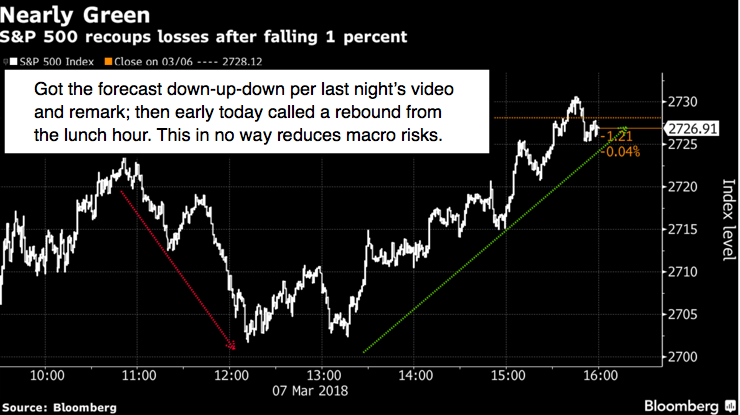

When in doubt stay out of this oscillating tug of war that’s dominated a couple weeks of market action. Most money managers can address fundamentals or technical conditions, but are at a loss when short-run S&P outcomes hinge on trade, says Gene Inger of The Inger Letter.

Blind spots across the board compel traders to follow technicals lots more than usual, which often gets them whipsawed if they respond to all the alternating rallies or declines--as basically none have staying power.

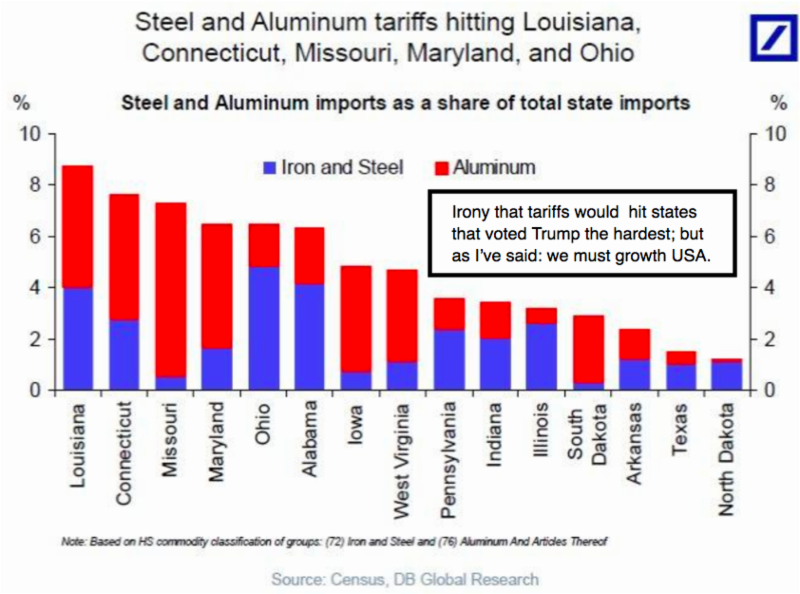

Of course, a primary focus for now is on probable tariff announcements Thursday. If they do or don’t, certainly that increased market angst, trader hesitancy as well, and ironically a suspected rebound into the 2 o’clock balloon.

Regardless of these daily moves, there are other issues out there. Sure, now everyone expects a Fed rate hike this month, so perhaps that’s an easily-absorbed influence. But again this is a pricey market, and that’s a viewpoint we have regardless of the periodic ability to mount the frantic short-covering rallies, that are unsustainable because there’s little true investing money behind the moves.

Geopolitically, you have everything from a curious cooperative attitude (or seemingly so) from North Korea, whether it’s due to Kim blinking or not at President Trump’s bigger button (which Trump shouldn’t belabor, even if that instigated the change in Little Rocket Man’s tone). Then, further apace, you have more stories linking North Korea with chemical weapons (or components) sent to Syria, which seems quite believable, even though Pyongyang has denied it supplied such materials to Syria.

Even further afield, but the market may care, you have Turkey’s Erdoganthumbing his nose at the United Nations Ceasefire Resolution 2401, that I was so proud of my cousin's work on, at the Security Council. Turkey should pay attention, as even Russia sided with the U.S., France and a slew of other UN members, chiding Ankara and insisting the ceasefire intends to include all of Syria(including northern areas where Erdogan is trying to smash the Kurds) and not just the conflict zone near Damascus.

If Qatar is really involved with this (they tend to play both sides), that's of course where markets can be impacted. Not just oil prices, but shipping, as they’re near a choke-point in the Persian Gulf and the world’s largest LNG (gas) exporter. And of course, we have a big Air Base there. Given the short attention span of markets, one would think it forgot all of this.

Now analysts had something to go with, so of course, rallied the market more, and eviscerated shorts, as we’d forewarned anyway. The primary reason is that the market is expensive; everyone overlooks the robust Beige Book Report (higher wages hourly might appear Friday and get some attention) and all sorts of geopolitical concerns.

Bottom line: it's not out of the question that we see a a favorable trade announcement (somewhat protectionist but not totally nationalistic). And then see implied-inflationary numbers Friday, taking the chatter back to square one, which happens to be rates and FOMC policy decisions.