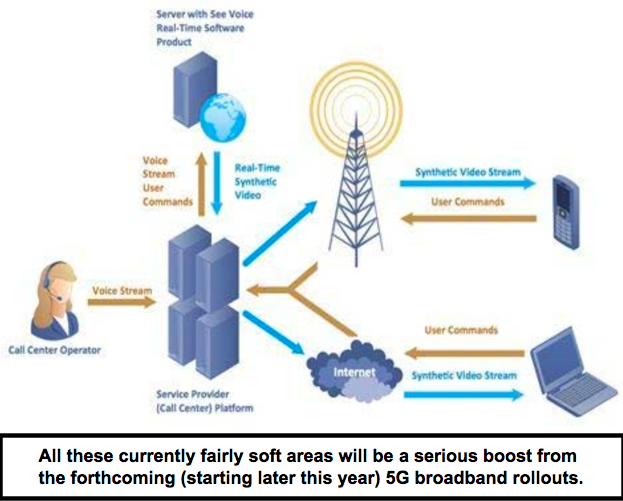

This is a special review of 5G and the sensors/optics sector. I suspect many investors (and consumers in general) do not appreciate the heavy impact this will have on telecom and even general data use in the years ahead, says Gene Inger of The Inger Letter Monday.

Estimates show growth to about 50 GB monthly per person vs. a typical use of under 10 GB these days.

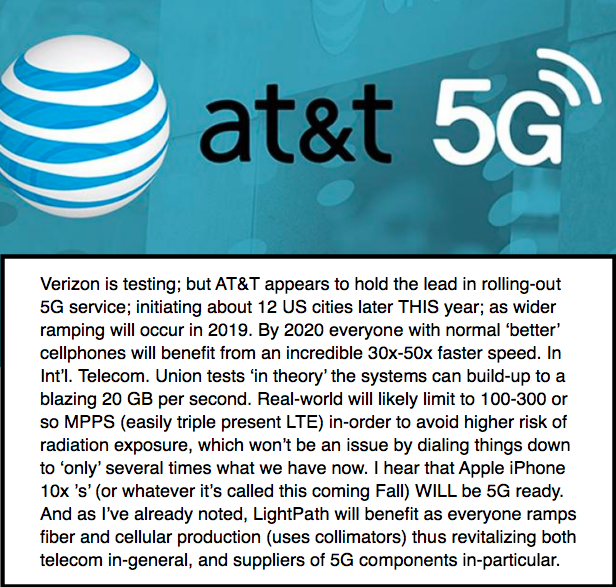

For instance, South Korea leads deployment so far, and their Minister of Engineering, Science and Technology estimates companies will spend over $300 billion in 5G infrastructure and technology over a decade to take 5G worldwide.

Because this will trigger fierce competition, and rush to roll-out, I’m thinking this becomes a big deal all-around and actually is why cellular manufacturers will experience better cell phone sales in 2019 and 2020 than most expect.

Mobile technology and cellular networks have evolved constantly for many years and it’s always been presumed that 3G would become 4G (there were interim variations that weren’t true 4G-LTE) and then 5G.

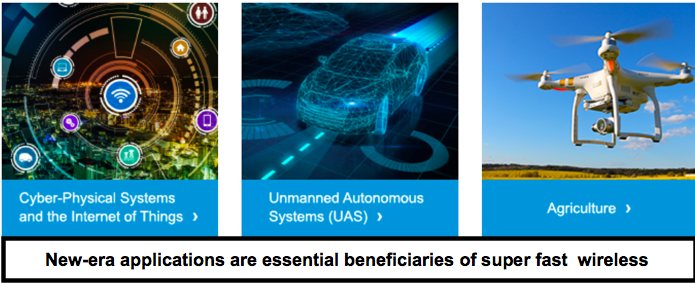

Most cellular users assumed another advance, but probably most don’t realize the serious demand for faster speeds as well as low-latency, primarily due to all the devices that will use the new 5G systems.

And there is speculation about wireless-to-the-home, which ultimately means all these wireless speakers and of course gaming platforms, will be reliant on the fast low-latency aspect.

It may be why Verizon (VZ) sold-off FIOS (fiber) systems to Frontier (FTR), or why Google/Alphabet (GOOGL) stopped expanding fiber high-speed systems itself. AT&T (T) does offer full-fiber in limited markets. If we get to a point that short-range (higher power) 5G is mounted on most existing cell towers (and even utility poles through dense areas in cities), you may initiate a new era that’s transformative for cellular/wireless.

If, for instance, T-Mobile, which lags AT&T and Verizon in roll-out plans, adopted full-speed 5G technology in the U.S., needed time to download a full 2-hour movie would decrease to a jaw-dropping few seconds.

That likely won’t happen much because of the radiation it would produce, but sure could when the systems reach home wireless. (To wit, consumers would be further away and definitely not have devices right next to their ears while using, already not recommended.) That’s sort of limiting the speeds on a smartphone to only 10x present speeds, while device use could be much faster. That’s beyond typical home internet the cable and telecom companies provide now, even with fiber connections.

Applications are broader. 5G networks will allow user internet access in motion at speeds of up to 400 miles per hour, double current capabilities seen for both military and civilian. (Most good airlines offer WiFi now from satellite, not ground-based broadband, hence it works over water.)

Think in terms of Apple CarPlay/Android Auto and particularly how this ties-in with forthcoming semi (and full) autonomous driving systems. Developing software for blockchain and vehicles, Microsoft is a buy on declines.

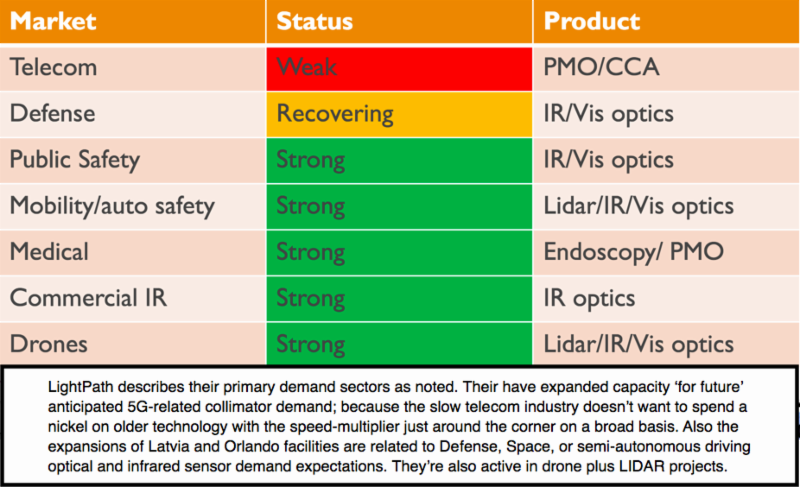

Those will make use of low-latency and high-speed for quick navigational predictive driving. In addition to low-latency required for optical and infrared sensor modules for modern proximity-related cruise control/collision avoidance systems and so on. (Those sensors, more so than even cellular, are a core competence of LightPath Technologies, and led their transformation over the past couple years to prepare for these multiple new business areas.)

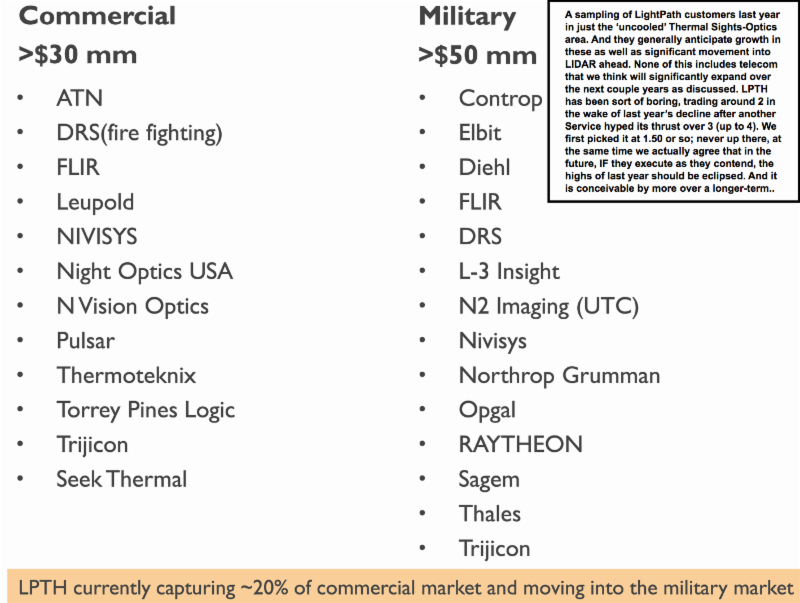

Not to focus excessively on LightPath Technologies (LPTH), but their CEO notes the estimated size of the sensor market as relates to autonomous or similar vehicle technology demands. He cites a research study of this growing to a $7 billion aggregate market (about 40% greater).

There’s competition but much of it is in China and LightPath does not do the sensor gear in China but only Florida, New York and Riga (NATO and EU country). They did a presentation Monday at Roth Capital in Laguna Niguel, California.

It’s stretching what's going on perhaps, but there may be a tendency for a slew of end-users to prefer American or European sources for sensors. I asked that question (because they related to military applications as well) and was told on a conference call that those are made in the USA or the Latvian facility of New York’s ISPOptics acquired over a year ago.

Optics and sensors are one of the hotter sectors and ironically they are highly competitive with varying performance among the sector players.

One of the common features is that many (actually most) end-product makers are customers of LightPath to some degree.

Knowing checkered pasts of fluctuations from low to high valuation; and the nature of technology, it has been our thinking (still is) that LPTH bumping-around 2 is low-risk as well as at a low PE (most say below 8 looking forward). Hence, I’ve been suggesting buying dips near 2 (for new members or those adding), with a belief that it will be a solid business regardless which end-user product becomes the leader in the sub-sets using optical and infrared sensors. It is telecom that’s been the slower contributor, which 5G should pick-up.

S&P 500 (SPX) pattern action evolves as outlined with a firm but then faltering out-of-the-box Monday rally, followed by a rebound (somewhat time with discussion of Larry Kudlow replacing Gary Cohn at the White House.

Perhaps on Monday the key depressant on a market we thought likely to be defensive was a San Francisco Fed paper that changed previous language regarding impacts of a sloping yield curve. Not a big deal, but if Washington believed that at face value, it would support not hiking rates yet.

Generally, the expectation is that the FOMC will move and that markets won’t be disheveled. Now what would be an eye-opener would be a 50 basis point hike, but that’s less likely (even more so with the SF paper).