The Ides of March arebest known for marking the notorious date that Julius Caesar was assassinated. It was actually notable as a date for all Romans to settle their debts each year, says Gene Inger of The Inger Letter.

Perhaps the IRS here in the U.S. embraced that date for the same purpose (presuming validity of income taxes) until it moved to mid-April. For us it’s an S&P 500 (SPX) inflection zone.

Also significantly the Ides of March marked a turning point in the saga of Roman history. And perhaps we’re near having one in our markets, as it also roughly coincides with another of the Roman annual celebrations of the era. That was the Feast of Anna Perenna a festival that concluded ceremoniously with picnics, drinking and revelry.

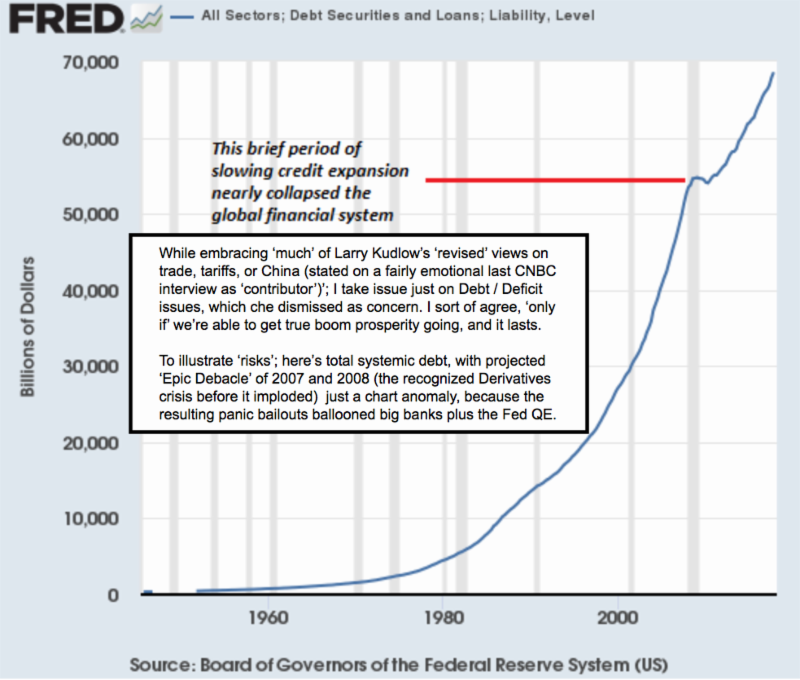

Sort of like optimism in the area of a market top? Back before our Epic Debacle 2007-2008 call it was common to see reveling traders leasing Ferraris and summer homes out in the Hamptons, and over-impressing their associates (or just impressing potential mates). Times are a bit tamer now, but a bit of Great Gatsby conspicuous spending returned.

Of course, part of it is that nagging sensibility that February wasn’t just a fat-finger or one-off short-vol breakdown, not to mention a hangover.

Remember, it was millenials’ parents wounded by being swept-up in the housing and then market frenzies I warned of 10 years ago. (It was February 2007 that I warned about stocks, a year after a warning to get-out of real estate. And in May 2007 I escalated credit crunch warnings to the Epic Debacle call, based on derivatives issues.

I’m well aware that few would listen, including economists or others at a couple major firms including Bear Stearns and AIG and certain anchors at a financial network.

A few icons survived and perhaps have seriously sobered-up since their experiences then. It is probably a modern version of a Depression mentality that set-in, with lessons learned. However, if so, why did the Senate vote Wednesday to pass a bill loosening or eliminating many of the major bank reforms/rules passed in the wake of that?

Traders and investors (or at least the exponents of upward for all times) have been intoxicated by visions of inconceivable near-term advances in equity prices for some time.

We believed that January’s parabolic thrust actually was the finale of the move, with the prospect of nominally higher highs in the Spring. But we believed more ragged markets or less clear than an unsustainable parabola we identified in January (and the ensuing forecast break).

I’m not claiming to be a soothsayer nor indicating how long the mourning is going to be for the cycle that internally topped a couple months ago.

We have been flexible with respect to the automatic rally we got off the low and allowed this to fight a bit before. When Caesar arrived at the theater in Pompeii he passed the soothsayer, and joked that the Ides of March indeed had come and laughed.

The soothsayer responded, they say: ah, but the Ides have not yet gone.

**

The market remains open-ended to vulnerabilities and desperate efforts (such as the Hail Mary rally I called for Tuesday night after the day’s first liquidation or selling wave).

These efforts will be erratically sensitive to developments.

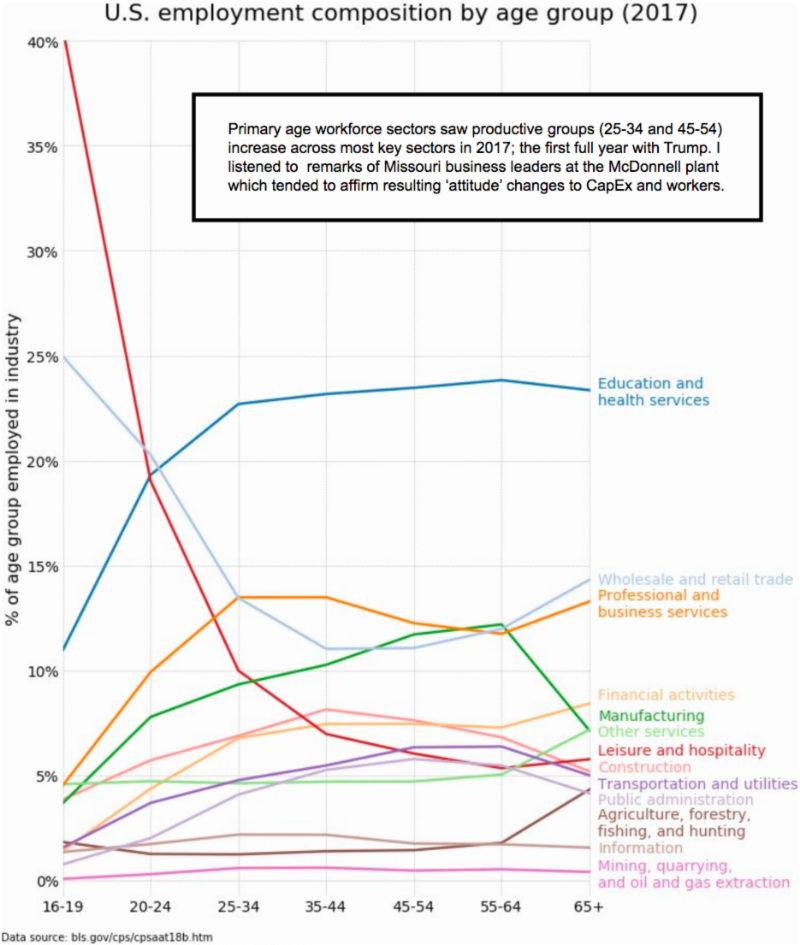

Consider as a for-instance, if Larry Kudlow can temper Trump's protectionism plans, the market might like that temporarily, whether favorable or not in the longer-term. Trump is ultimately pro-free-trade and I can imagine great amusement (though serious) of arguments between Larry Kudlow and Peter Navarro in the White House. And that’s probably exactly what Trump is looking forward too.

Reality financial television in the Oval Office, with implications for how trade agreements are renegotiated.