Upheaval of the status-quo is really what the current angst, aside the monetary policy concern (and daily relief) is all about, writes Gene Inger, Wednesday, in The Inger Letter.

Issues range from the tariff and trade issue or an under-reported threat by China against Taiwan or Turkey’s incursion into Syria (purportedly to attack Kurdish groups; but overly focused on larger oil field facilities, hence related to higher oil prices and newer geopolitical concerns.

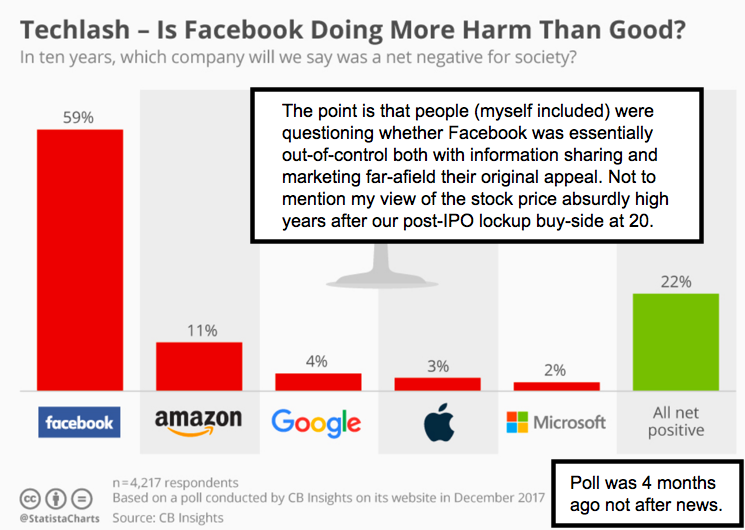

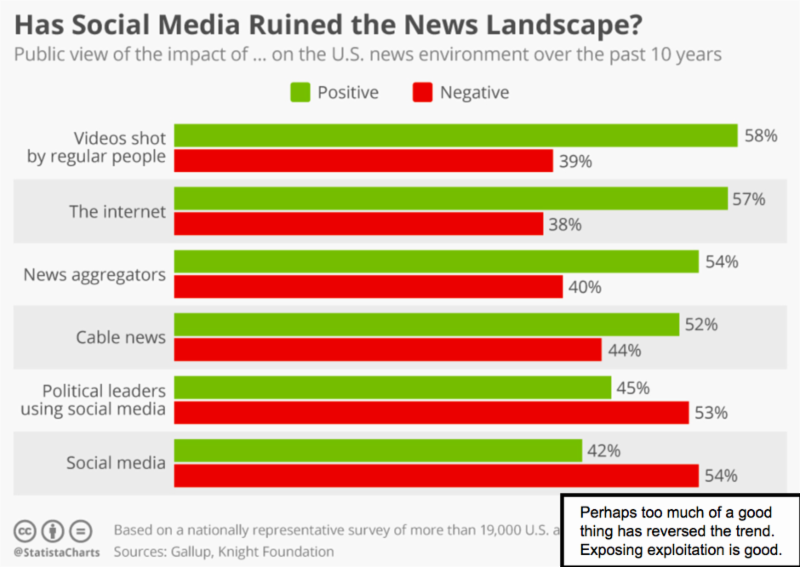

Or the potential EU-led tax trends on internet sales. This confirms that the era of the golden goose'Teflon ability of digital marketing or revenue to shun taxation is basically history. And not to mention how the social media duress can work down the food chain suppressing more than Facebook (FB).

Aside all of this and more the markets are on tenterhooks.

Values remain extended.

And the market dances around shy of the S&P 500 (SPX) inflection zone, identified around the June S&P 2750 area.

Wednesday’s reaction to the Fed's nominal rate hike, and straight-forward news conference also conformed to the pattern. (Up if they moved a little, then selling, then a bounce and then a renewed fade.) There was little if any surprise in Chairman Powell’s remarks; and it was refreshing that he was too the point, not arcane with respect to what’s called Fedspeak.