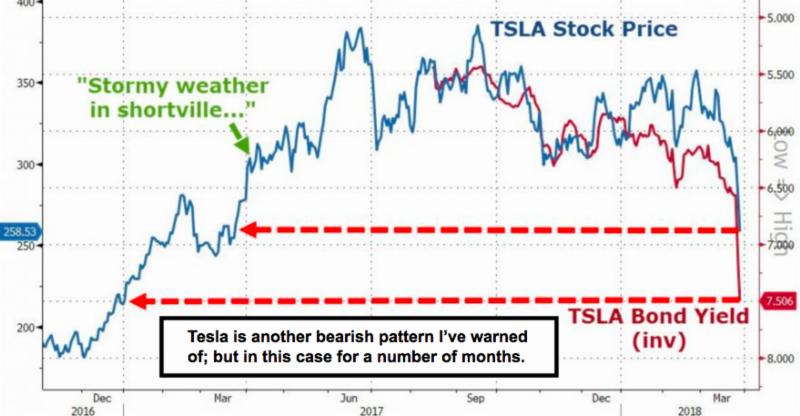

Without the support of technology, no matter how high they go in the very long run, the near-term remains vulnerable. It isn’t possible for the rotation into other sectors to absorb further selling in the FANG or related issues, writes Gene Inger in The Inger Letter.

A clinging session may be a good way to describe Thursday's chop which was not controversial, and very easily understood technically.

I’ve got no idea why pundits continued to describe the week’s more dramatic oscillations, and Wednesday’s comparatively milder choppiness, as just an impossible to comprehend forest of uncertainty.

It’s not. The behavior all week is quite clear and beyond simply an effort to hold the line around (slightly above or below) June S&P 2600 levels.

I note that it also coincides with the 200-day moving average, hence very specifically this is an effort to make this bouncing affair a secondary test of the indicated February double-bottom, also right at the 200-day moving average.

Bloomberg: White House whiplash on Amazon adds to sky-high tech volatility.

You may recall I thought it was a last ditch stance and right at that level, not only because it was the 200-DMA, but also as it was peak-to-trough right at a 10% decline for the S&P 500 (SPX). Get more than that and the leveraged crowd would be hard-pressed to recovery.

That’s why I called for an automatic rally at the time, but only for trading, not for investing.

Why? Because I thought there was nothing attractive in terms of forward prospects to justify more than trading moves into Spring at-best, and then we'd see new troubles.

We did abort the move roughly as outlined (rough because even that fought for several weeks around or shy of S&P 2800, the cap we thought any up-move would have). And for the most part it oscillated around S&P 2750, which I termed as inflection.

Then we got the more recent break as I described with a symmetrical or similar pattern breakdown (followed by false rebounds). And now we’re at the secondary test lows, which in theory are not holding together well.

Bottom line: There is no change in our overall assessment. Whether we get a breakdown Thursday (last day of the quarter and most leave early for both Passover and Easter holiday observations), or they drag it out a bit longer, we suspect the risk is increasingly significant for a break to a lower level.

Probably some algorithmic after-the-fact signals would also be generated by such a move. (And as the lateral low of 2550 or so comes out later-on.) Hence, one has to be prepared for at least the possibility of more drama.

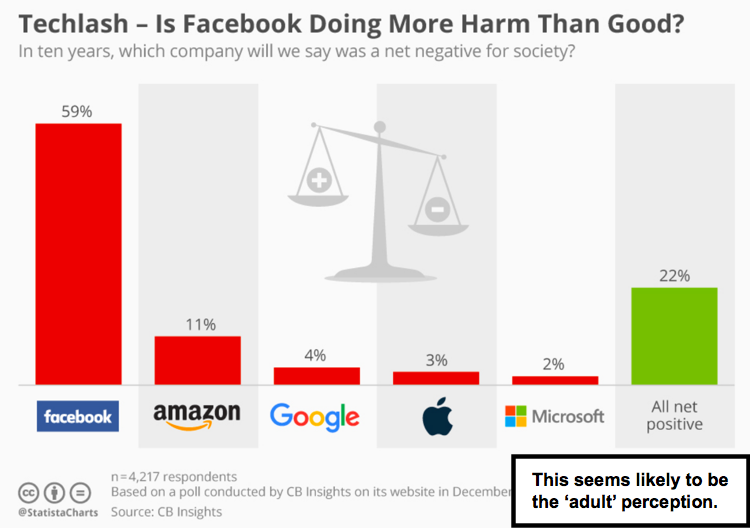

Given the backdrop and even ABC News reported about Facebook (FB), with the display or thousands of pages of data printed just from their producer’s Facebook capture, people will be alarmed.

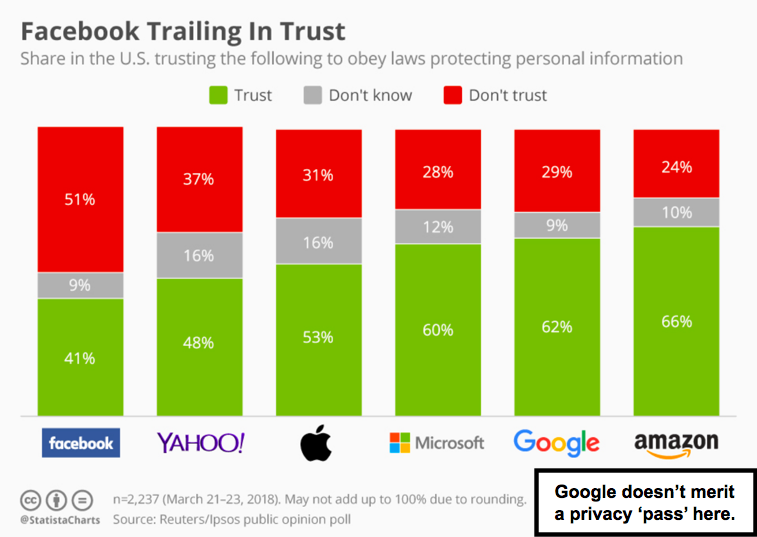

Of course, it’s after the fact too, as is selling weakness on the stock. But we warned of this and I still suspect fallout will weigh on associated stocks, as well as increased scrutiny of others that do data-mining; like Alphabet/Google (GOOGL).

Facebook treated their users as the product. Tim Cook of Apple (AAPL) said he would never be in a situation like Zuckerberg. Cook pointed out the very same thing: that the product must be what the users want, not what the app (or similar) wants.

New York Times: Facebook introduces central page for privacy and security settings.

Just making the point that this isn’t over. Managers quietly are shying from an assortment of technology stocks, not merely social media.