Tuesday was expected to be choppy upward consolidation, in the wake of Monday’s big break that recovered late and most of the rest in Tuesday’s Hail Mary rebound. The Amazon issue bolstered the S&P enough, writes Gene Inger Tuesday in The Inger Letter.

Midterm slump is the newest term thrown-around as an explanation not only for the declines already under belt; but what’s likely still on-tap as the year proceeds.

In reality there’s hesitancy ahead of typical midterm elections. But in this case, nothing is different now with respect to the upcoming midterm contest, than was the case weeks ago.

So why raise the topic? Because they know in their gut if not behavior of both momentum stocks and client disengagement that something more toxic is afoot.

But as money managers almost universally want to hold onto their control of funds, they need something to suggest any selling is just some sort of temporary impediment to rising prices.

I partially agree since we’ve suggested from January forward, that what we’re going to see will be more than a modest correction. We’ve now had two of those in the S&P, more than modest for several stocks. But less than a flat-out catastrophe, barring war or some horror, big bears suggest.

Algorithmic Maginot Line

However, with slight dismissal for the moment of Tuesday’s action, we do view this market as poised for a nasty period ahead. And it’s not just a midterm slump but rather extreme equity valuations in a narrow sector or universe of stocks (just a handful of FANG and so on). All alone these constitute a set of financial risks separate from any political variables, or for that matter, even monetary policy shifts by the Federal Reserve.

As to Tuesday, it was generally akin to an expected upward consolidation pattern, but just a bit more fierce, due to a phony report saying that Trump backed off any planned attacks against Amazon. Coming late in the session after his earlier tirade, it seemed believable, since now it’s common knowledge that he sticks a firm stake in the ground and then he plans to negotiate around it. Except he didn’t do that, at least not yet.

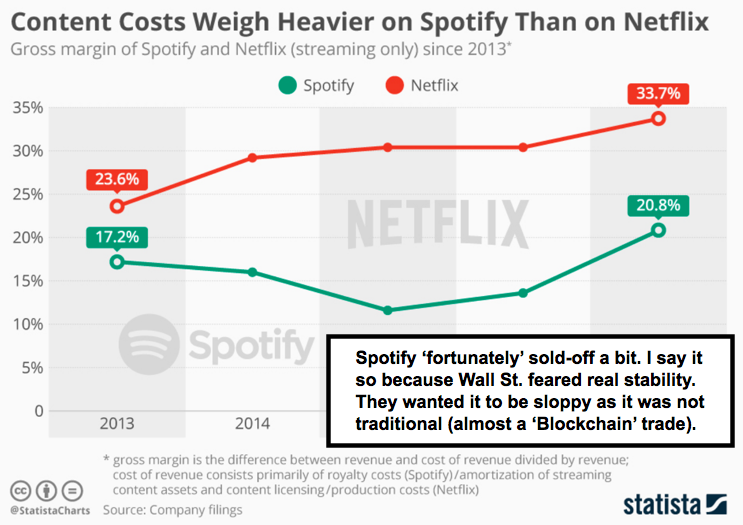

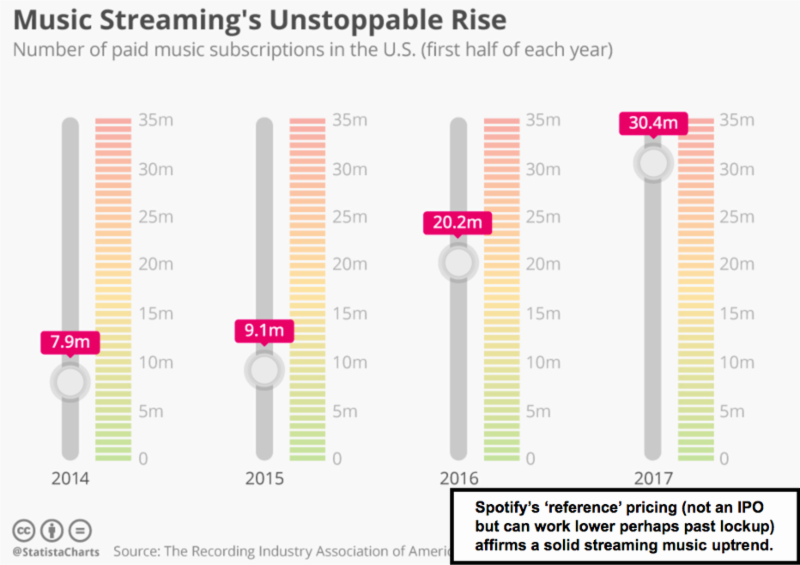

Bloomberg: Spotify's cautious analysts start to emerge, shares stumble.

So it wasn’t exactly fake news as it was a press briefing statement of a week ago that was already known and reiterated. Released as it was real new news, by Bloomberg, just when the S&P 500 (SPX) was weakening after the 2 o’clock balloon. How convenient.

I’m not saying it was other than a pure accidental interpretation although it’s suspicious because not only did it bailout Amazon (AMZN), but the entire market.

Then, about a half hour later, the story was corrected by the competition (CNBC) to indicate that it was an old story and nothing new was going on regarding Amazon past the president’s earlier remark about the US Postal Service pricing for Amazon shipments and so on. But it was late in the day and the bulls had a lock on the move, so late fades were minimal.

Bottom line: This was expected to be a choppy upward consolidation, in the wake of Monday’s big break that recovered a third late in that day and most of the rest in Tuesday’s Hail Mary rebound. The Amazon issue (or fake denial) was sufficient to bolster the S&P enough, that in theory if they can gain a bit more Wednesday morning they an argue total recovery.