The satellite industry is heading towards consolidation, but one of the companies that should be a part of its future is EchoStar Corporation (SATS), a technology leader that has been falling in price with its sector, writes Paul Dykewicz, editor of Stock Investor.

The company stands out for offering broadband services profitably, while other satellite operators have struggled to do so. EchoStar also has more than $33 billion in cash to make acquisitions that would position the company for further growth under the leadership of its Chairman Charlie Ergen, a self-made billionaire.

With just $389 million in net debt at the end of 2017, EchoStar is rated an Outperform technology stock by Raymond James & Associates, which recently raised its price target on the stock by $1 to $74. The company’s key assets are its Hughes Network Systems broadband unit, its EchoStar Satellite Services video distribution business, its stake in pay-television venture DISH Mexico and newly deployed satellites that include the recently launched EchoStar 21.

Ric Prentiss, the analyst who tracks the stock for Raymond James, wrote in a Feb. 23 research note after EchoStar held its fourth-quarter and year-end 2018 earnings call that the company’s underlying business is outperforming expectations and its balance sheet is “extremely healthy.” Headquartered in Englewood, Colorado, EchoStar operates 20-plus geosynchronous satellites that orbit 26,236 miles above the earth to provide broadband, video and related services.

I covered the satellite and space industries as a beat earlier in my career, interviewed Charlie Ergen several times and spoke to him conversationally when he was much more accessible than he is now as chairman of EchoStar and chairman and CEO of satellite TV operator DISH Network (DISH). Years ago, Ergen told me the only business in which he ever lost money was in providing broadband, and that he was determined to make money in it one day.

Ergen has done so through EchoStar, which acquired satellite broadband provider Hughes and its debt for about $2 billion in 2011. The transaction gave EchoStar a technological advantage in pursuing both consumer and business broadband customers. Those pursuits have proven to be profitable.

I spoke with Hughes Network Systems Executive Vice President Mike Cook at the Satellite 2018 conference in Washington, D.C., and he told me Ergen is “making money with us,” attends board meetings and engages actively in strategic decisions.

Investors worried about the March 19 sell-off in the market and the hit taken by technology companies should avoid overreacting due to high-profile controversy involving Facebook (FB), which reportedly provided personnel data from 50 million of the social media website’s users to Cambridge Analytica. The market rose the following day, even though technology stocks in general pulled back a bit further.

The Federal Trade Commission is expected to investigate whether Facebook violated a 2011 consent decree with the U.S. government. U.K. officials also are investigating Facebook, so that company’s shares could fall further in the days and weeks ahead, depending on the ultimate findings.

Meanwhile, technology stocks other than Facebook still offer value for investors who believed the sector looked promising before the selloff.

Bryan Perry, who writes the Hi-Tech Trader advisory service, said he regards the selloff week as the “storm before the calm.”

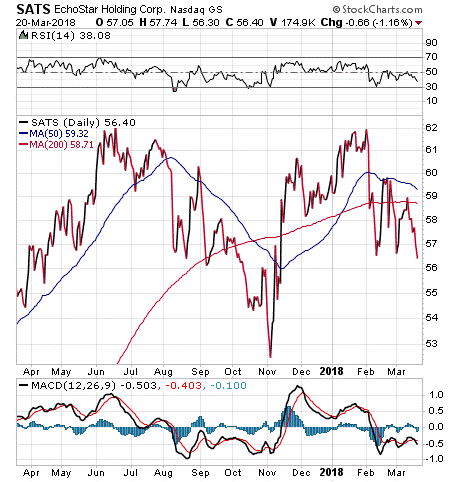

With EchoStar Tuesday afternoon (April 10) at $55.18 it is well below the $74 a share price target set by Raymond James. After the technology sector’s pullback recently, EchoStar could be a stock worth watching for possible investment.