Surprisingly little has changed at least as far as the roiling market. It’s a short-squeeze, a rebound in Facebook (FB) the continued stronger Oil and a softer tone by the Chinese president, sounding much calmer than ours, writes Gene Inger in IngerLetter.com.

Seriously, the market backdrop isn’t that much different. The S&P 500 (SPX) may briefly move over the declining-tops pattern. We genuinely have a better tone coming from China, although Xi’s speech was reminiscent of the one he gave last fall, with few changes in promises of openness.

Of course, the market was relieved. And that’s why Trump said, “we’ll see,” as the White House chose (properly) not to overdo last week’s talk failure.

Stocks mixed Wednesday as Mideast tension upstages Fed.

The overall range-bound nature of the S&P prevails, even as a beleaguered investment crowd was able to mount a solid intraweek rally. (That is not unusual on a Tuesday.) This time it was basically just a huge short-squeeze, combined with genuine sighs of relief on trade (for now).

Bloomberg: Oil options traders are most bullish Wednesday since crude was over $100.

We have never believed an actual trade war was coming. We’ve shared lots of problems it leads to, as well as reasons why it would be defeating, in a sense, both for China and the U.S.

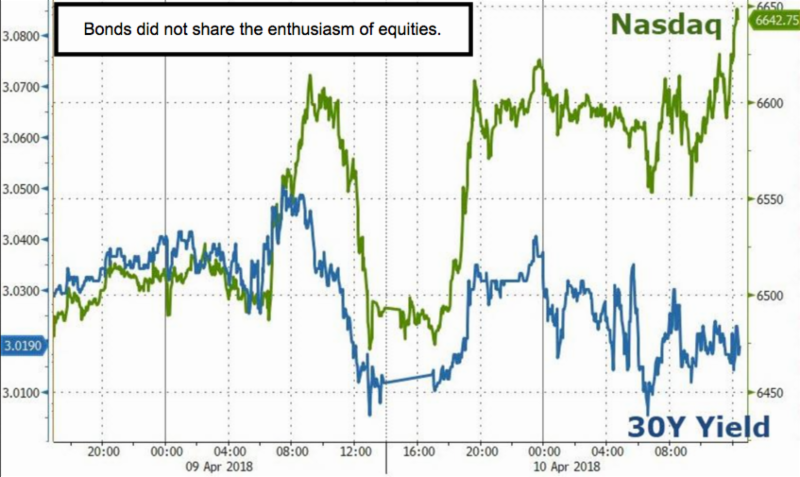

But should we be wrong about it not happening, you’ll know where some of the pitfalls are, or how that would impact interest rates, and diminish potential buybacks so many analysts are counting on to help levitate the market going forward.