Nell Sloane of Capital Trading Group summarizes a dozen trading developments: Korean summit, Sprint-T-Mobile, EMF radiation, Deutsche Bank, yield curve, rising stock margin debt, betting on a U.S. rate rise, a stronger dollar, rates in Spain, meeting friends and more.

We must start out this week’s letter with what may be the most historic moment thus far in terms of Trump’s tenure as president. There is no doubt in our minds that the United States played a very key role in North Korea’s Kim Jong Un and South Korea’s Moon Jae-in’s meeting at the DMZ in Korea this week.

In what is an absolute historic moment, North Korea’s leader set foot over the demarcation line and onto the South Korean side for the very first time.

They are currently discussing the prospects of peace and denuclearization, which has probably taken the entire world by surprise. This is an absolute historic moment and we are hopeful that peace does indeed prevail. If the deal is successful we are confident that many will be clamoring for POTUS to win the Nobel Peace Prize.

**

Are rising debt levels in the United States and the corresponding rising interest rates part of the #MAGA policy or merely just a byproduct of it?

Many economists would consider rising rates a necessary adjustment to our rising levels of debt because rising debt levels are generally perceived as making one’s creditworthiness riskier. We suppose that theory does hold true, but we must also consider the fact that this comparison is done knowing full well that it will make U.S. Treasuries no longer the risk-free asset benchmark they once were.

Now we know that in economics or at least in the kind of economics whereby free central bank monetary spigots are not constantly left open that a higher debt level does often mean more risk.

This, however, doesn’t allow for much flexibility and we would rather assess things from a more comparative lens.

**

What do we mean? Well, is Spain at more risk of paying back its debt or is the U.S? Consider this, the Spanish 10-year rate is 1.28% compare that with a 2.96% U.S. rate.

You get our point. What this tells us is that there are very large bets being placed that U.S. rates continue to rise and maybe some of that is dollar-related, maybe investors need to be compensated for currency loss or dollar weakening.

We know the bets banking on higher rates is huge. And the contrarians we are think that a wash-out needs to occur before rates can continue their ascent. Seems too easy to just sell U.S. 10-year rates, is kinda what we are saying.

**

Stronger dollar? Going back to the #MAGA movement, maybe higher rates are all a part of making the dollar stronger again. Is it safe to assume that eventually the singularity exists by which investors will flock to U.S. debt or where risky assets just don’t make sense at a given level of 10-year yield?

We aren’t saying we know where that magic level is, rather that the Fed seems hell-bent on finding that out!

With short term rates up exponentially over the last year, we would suspect that 3-month T-bills are becoming increasingly the investment of choice and levels suggest that this term premium suggests short- term market risk is high!

So, to all our traders out there, if the equity market does plunge, we would suspect the yield curve to spike not flatten and spike considerably.

**

Speaking of yield curve spikes, last week Zerohedge noted that someone put on a massive $4.7 million DV01 futures trade, buying U.S. 5-year notes and selling U.S. 10-year notes (.638 ratio) and simultaneously selling German 5-year BOBL and German 10-year BUND futures (.446 ratio).

This trade is a bet that the U.S. yield curve will steepen and that the German 5-year will underperform the German 10-year.

**

The way we see it is this is a bet on BUBA (The ECB), that they finally remove QE and cause a spike in German short-term rates. We suspect the player expects that move not to transcend overseas into the U.S. yield curve market.

Either way it seems like a safer way to bet on continued higher rates globally as opposed to just the U.S.

**

Speaking of Germany, the ECB met last week and did absolutely nothing, same statement and everything. Way to work for your counterfeiting money!

**

Facebook (FB) reported a quarterly per share profit of $1.69 up from $1.04 a year ago and revenue rose 50% to $11.97 billion. Net income was up a huge 63% to $5 billion up from $3.06 a year ago (WSJ).

**

Sprint and T-Mobile finally announced an all-stock deal merger last week. WSJ reports that 9.75 Sprint shares will be exchanged for each T-Mobile (TMUS) share.

Until closing process from April 27, this deal values Sprint (S) at $59 million and a combined company enterprise value of $146 billion.

Deutsche Telecom will own 42% and SoftBank Group 27%. (DT is the parent of T-Mobile.).

We love all the talk of T-Mobile’s push for 5G and the benefit to the consumer.

**

What about radiation? What we don’t get is the nobody and we mean nobody is studying the radiation effects of all this EMF (Electromagnetic Frequency Radiation) that we are putting on every street corner, in every building, in all our schools. And nobody is concerned about the amount of radiation that is being emitted.

Everyone talks about cancer as such an epidemic, and we toss billions into organizations that raise money for its awareness.

When was the last time you donated to a nonprofit that studies the effects of radiation emission for wireless transmitters?

Yet, we are to believe the consumer is going to benefit—yeah right benefit alright by being slowly fried.

For those who think this isn’t a real concern, think cigarettes circa 1940 and how they and the companies that made and distributed them are viewed today!

**

In other more positive news, US GDP grew at 2.3% in Q1 higher than the expected 1.8%, to $17.4 trillion. This did give a boost to the U.S. dollar, which has run up off its lows.

Perhaps the higher rates are drawing some in, but we feel that it’s more a product of too many USD short bets.

BofA analysts are pushing a short euro trade, so that is helping the dollar as well.

**

Share repurchases up: It was also reported that share repurchases were up 43% compared to last year. So, if anyone was wondering what holds up the market, well, that should give you a little bit of a clue.

**

Funds flooding out: On the flipside of those buybacks, the Investment Company Institute reported last week that U.S.-based mutual funds and ETFs saw $2.4 billion in outflows for the week ending April 18. That follows a $41 billion record outflow in February which was the largest such move since Jan. 2008 (WSJ).

**

Twitter (TWTR) posts its second consecutive quarterly rise as revenue rose 21% YOY to $664.9 million which translated into $61 million in profits and 8 cents a share, WSJ reports.

**

Amazon posted huge numbers with net income rising 125% YOY to $1.63 billion, which amounted to a $3.27 per share number nearly 1.6x higher than the expected $1.27. Amazon (AMZN) operating income was up a whopping 92% YOY to $1.9 billion which was nearly double their guidance number.

AWS sales up 49% to $5.4 billion and subscription services were up 60% to $3.1 billion…All these great results, but the people should know that Amazon paid exactly ZERO income tax for 2017.

**

Sony Corp. reported its highest ever operating profit of $6.7 billion on the back of its video game business (PlayStation) both in console but even more so in subscription-based services. Sony (SNE) is also seeing increased sensor business related to the camera’s in smartphones. Sensors continue to offer huge potential and Sony is making great progress there.

**

Freddie Mac launches 3% down no income restriction mortgages, yes, we have truly learned nothing, we have seemingly come full circle from those 2007 highs. No really, you can read about it here.

**

Avengers: Infinity War broke the weekend box office record raking in $83 million on Saturday and a whopping $250 million weekend total.

**

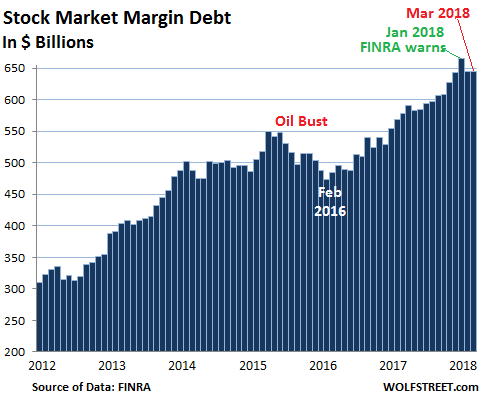

Stock margin debt: We saw a great chart on stock market margin debt, what were we thinking, you ask? Well, equities never fall so no worries, smooth sailing, right?

No, honestly, we were thinking it was a chart of sustainability, cough, cough, anyway you can see the trend:

Deutsche Bank measuring U.S. debt: We read a report from Deutsche Bank this week about the likelihood of the U.S. having a debt crisis.

Although we couldn’t disagree that much, they were highlighting investors to watch the auctions to see how foreign demand is, if it starts to fall off, rates may have to rise further to attract sufficient buyers.

**

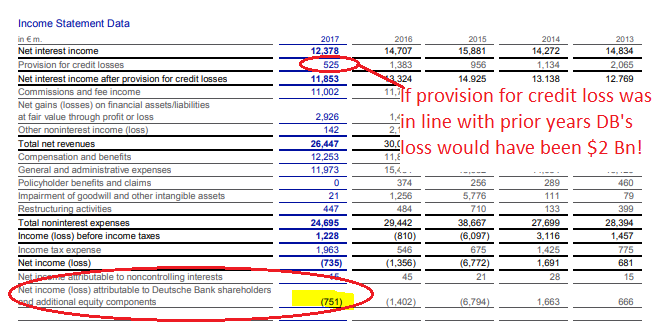

While we are on Deutsche Bank, (DB) we analyzed their income statement and we thought it odd that their provision for credit losses was lower than previous years.

We felt this was not consistent with the outlook, given the current economic expansion is already past historical norms, but what do we know?

Anyway, we figured their loss for 2017 would be over $2 billion if it just kept consistent with prior year’s loss provisions. Here is a chart for your referencing pleasure:

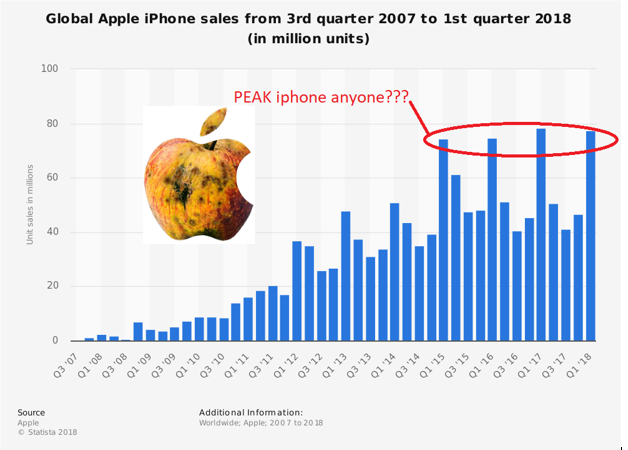

Apple hard cider: Another company we have been hard cider on is Apple (AAPL), but these charts are too telling.

And when you rely on one product, well, we hope you elaborate your offerings.

**

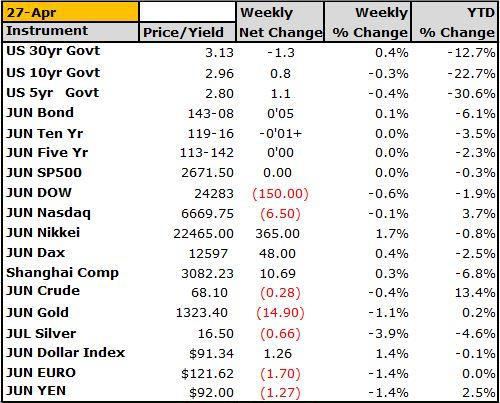

We leave you with the weekly settlement prices.

As you can see, Crude continues to be black gold and the U.S. rate complex the laggards by far.

**

OK, hope you enjoy the week, maybe here in Chicago we can finally bust out the shorts and short sleeves. It’s kind of funny around our neighborhood, it’s like everyone comes out from hibernation and you get people walking around the streets, playing outside, conversing, a constant reminder that no matter how much things go digital, nothing compares with having a drink outside with your friends, family or neighbors.

Somehow, we wish more time was spent enjoying others and their stories and attending to the basic human need of interaction, cheers.

Nell