With Chinese tightening moderate, and China experiencing export and domestic demand growth, now is not the time to fear China. Alibaba (BABA) and Tencent (TCEHY) are again beginning to look attractive, says Monty Guild, editor of Guild Investment Management.

Back in November, we wrote:

“The skeptics and haters of the current bull market have spent the last eight years finding reasons and justifications for their skepticism. One of the favorite reasons for pessimism has been China.

“Sometimes China has been a geopolitical boogeyman, with journalists fretting about China’s rise on the world stage and its potential to surpass the U.S. in military or economic power. We have thought those fears to be baseless and have said so for years. China has a long, long way to go before it will be able to challenge the hegemony of the U.S. either militarily or economically, even in its own back yard.

“Sometimes, conversely, it has been China’s weakness rather than its potential strength that has spooked western observers. The fear here is that China’s decades-long boom has been a powerful stimulus to the global economy, and if that boom falters, it would drag the global economy into recession. A related fear is that China’s boom has been built on unsustainable financial leverage -- on a domestic debt bubble that will result in a severe financial crisis.

“Since China’s financial system remains almost completely separate from the global financial system, it is irrational to worry that such a crisis would be directly contagious to the banking systems of the developed world, as we have often pointed out. But put these two fears together, and you get a Chinese slowdown caused by a domestic financial crisis. However, the global growth picture has brightened considerably over the past year and a half, so there has been less of a feeling that the global rally is so dependent on Chinese growth remaining strong.”

Over the past few months, China has been in the news and on investors’ minds again, for a variety of reasons. Before the current escalation of trade tensions, the topic was President Xi Jinping’s actions to cement his own power for the indefinite future, and his approach to Mao-like status and acclaim in the public mythology of the Communist Party.

The leader shows the way forward, and looks a bit like Mao.

Since March, markets have been unnerved by trade tensions as the Trump administration moves to address what it views as longstanding unfair Chinese trade practices -- including intellectual property theft, forced technology transfers, the dumping of state subsidized products, and other abuses. Throughout this period of uncertainty we have believed that the odds greatly favor a favorable resolution without the outbreak of a full blown trade conflict.

We continue to believe this first, because of our evaluation of President Trump’s negotiating style (start aggressively, then moderate), and second, because of our assessment of the risk-reward ratio for China.

The Communist Party is still existentially dependent on robust economic growth to keep the people happy by continuing to raise its poor citizens into its middle class, and it needs trade with the United States to achieve that goal. We believe that a settlement will be reached that is amenable to both sides, addresses the most pressing U.S. demands, and ensures that trade between the world’s economic giants continues to flow freely.

Now another China fear is coming back: the fear of tightening in the Chinese financial system.

It’s a fear that’s deeply rooted in investors’ experience during much of the past five or six years. The central banks of the developed world were not the only ones using extraordinary measures to create liquidity in the aftermath of the 2008 financial crisis, and they are not the only ones now navigating the inevitable and delicate process of reversing those policies.

The Chinese also went on a debt spree. In the developed world, the key driver was quantitative easing and the radical expansion of central banks’ balance sheets. In China, the “leveraging up” was more complex -- basically the unleashing of a “wild west” financial landscape through local government debt and a host of complex, off-balance-sheet operations by banks.

For several years after 2012, the ebb and flow of China’s credit impulse was a very important leading indicator to watch for international observers wanting clues about the direction of Chinese and global growth, emerging-market exports, and commodity prices. With demand and economic growth tepid in the U.S., Europe, and Japan, China’s credit expansion pulled a lot of weight in keeping the global economy on track.

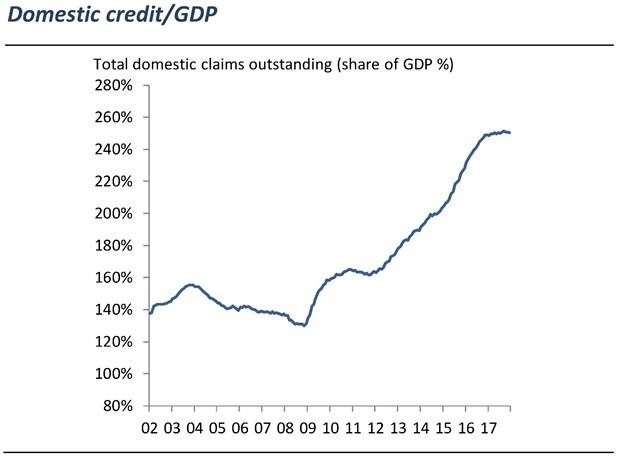

The chart below from Jonathan Anderson of Emerging Advisors Group shows all domestic Chinese credit as a proportion of GDP.

Source: Emerging Advisors Group

As you can see, after an initial impulse up in 2009, China’s financial system leverage levelled off until 2012, when it began a rapid and lengthy expansion that lasted through 2016. Then it levelled off again, as the Chinese government began to take regulatory actions to rein in credit growth in the face of the inevitable risk of financial instability that such growth would create if it continued indefinitely.

Global observers fretted that the end of growing Chinese leverage would put a stake in the heart of the global recovery -- or even that a Chinese “hard landing” (a Chinese recession caused by financial tightening) would tip the world into a global recession.

For three reasons, though, we do not believe that the end of China’s huge post-crisis credit impulse spells imminent trouble for global markets.

First, the tightening is gradual. In a way, the existential requirement to handle the deleveraging process is greater for the managers of China’s economy than it is for western politicians and central bankers. In the latter case, the fortunes of individuals or political parties may be at stake. In China, the fate of the ruling party and the stability of the country is at stake, because the grand bargain made by the Communists is that the people will tolerate an illiberal regime in exchange for rapid economic growth. In the face of this reality, the Chinese policy approach to deleveraging is gradual and flexible.

This does not mean that they will inevitably manage it successfully, of course. But so far, they are demonstrating flexibility and sensitivity. For example, take recent cuts to banks’ reserve ratio requirement (RRR). (RRRs help determine how much credit banks can extend, with lower reserve requirements meaning a greater capacity to make loans.)

The general trend of tightening regulations since 2016, in an effort to rein in excessive leverage and speculation, is leading to higher funding costs, disproportionately for smaller banks. Loosening the RRR will ease pressure for them, and therefore also ease pressure on small businesses, who have usually had limited access to regular bank loans and have relied on the shadow banking funding that will now be drying up.

In addition, regulators have eased off on the path of regulatory change which is shrinking the shadow banking sector, at the end of April issuing a final version of relevant regulations which allows a significantly extended timeline for compliance. So they are watching and adjusting the regulatory path as needed.

Second, during China’s last period of tightening, the government was pushing in the same direction as the economy (that is, the tightening was “pro-cyclical”), which was experiencing a period of weak export growth in the face of sluggish developed-market demand. This time, the tightening is going against the cycle (“counter-cyclical”), with strong export growth and domestic consumption offsetting the effect of tightening on the Chinese economy. (Recently, March exports were announced, and rebounded to 12.9% year-on-year growth from a 2.7% contraction in February.)

And finally, the global economy itself turned a corner in 2016 into a period of growth more robust than the recovery had seen so far. This means that other economic engines are now supporting the global economy. Whether or not “peak growth” has passed as current market worries suggest, China is no longer the main game in town. So Chinese tightening -- gradual, for now -- can, we believe, be well tolerated by a global economy with more diverse areas of strength. Chinese growth will certainly continue to slow gradually, but for the rest of 2018, should continue at a 6.5–6.8% pace.

Investment implications: With Chinese tightening moderate, and China experiencing export and domestic demand growth, now is not the time to fear China. We notice that technically, some Chinese stocks that were in favor last year, such as Alibaba (BABA) and Tencent (TCEHY), are again beginning to look attractive.

With the Chinese macro situation stable and favorable, some Chinese stocks and regional Asian exporters could continue to do well. In China, we like technology and e-commerce disruptors. Among Asian manufacturing exporters, we favor Vietnam.

Disclosure: Please note that principals of Guild Investment Management, Inc. and/or Guild’s clients may at any time own any of the stocks mentioned in this article, and may sell them at any time. Currently, Guild’s principals and clients own TCEHY.