Mixed takeaways should persist after Monday’s strong Dow (DJI) thrust. Why in the world was anyone surprised that Treasury Secretary Mnuchin said on Sunday’s FOX news talk, that trade war risk with China was on hold for now, asks Gene Inger.

Of course, it was. In fact, it was never more than negotiations. Or it may be that we were in the minority believing there was no such threat yet and that the sparring (including limited tariffs) was part of making a deal.

Reuters: Wall Street erases gains Tuesday on Trump's China trade talk comments.

Clearly the market needed an excuse to extend a market that was sloppy at the tail-end of last week. And no, it didn’t follow the pattern expected due to his Sunday comments; however, we did think it would try the upside.

Because it did so dramatically (and instantaneously) it’s not terribly strong now, and didn’t have much follow-through later in the day.

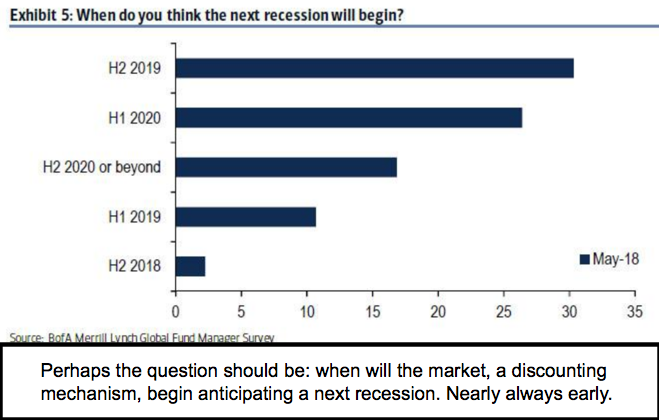

While the on-hold statement obviously provided impetus for essentially a higher rebound, it’s notable that most indicators varied little; and that the key stories of the day (or the conflicts) between high rate views and of course sluggish (or even recession) concerns, seemed incongruous.

In-sum: the contradictions actually are not.

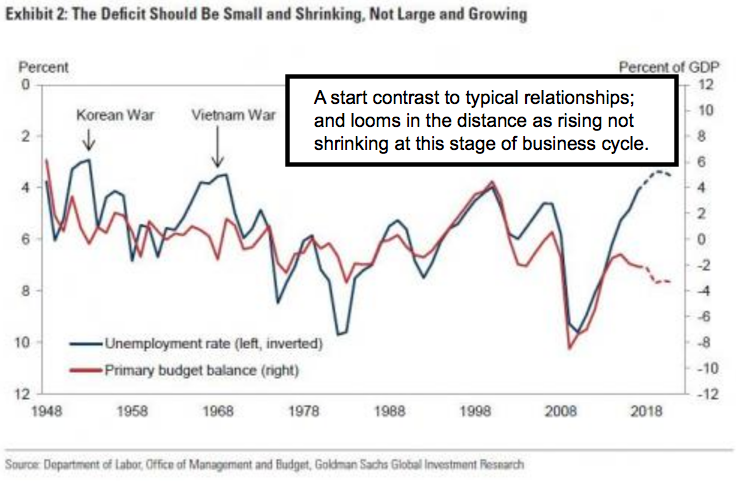

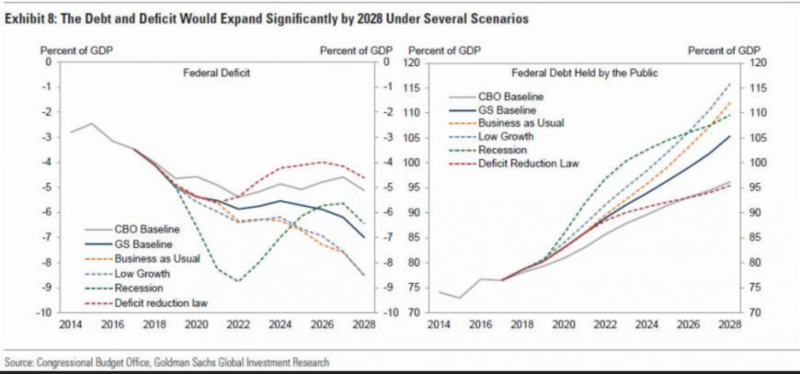

Either you have very rapid growth or a U.S. debt picture (and servicing that debt) becomes a serious challenge as higher rates have to be paid to attract money since the Fed is letting lots of holdings roll-off the balance sheet.

And if you have a real slowdown as a few indicators are alternatively suggesting, then valuations are beyond high. If you get a period of stagnant economic activity with higher rates to attract funds, well, you know where that leaves the markets.

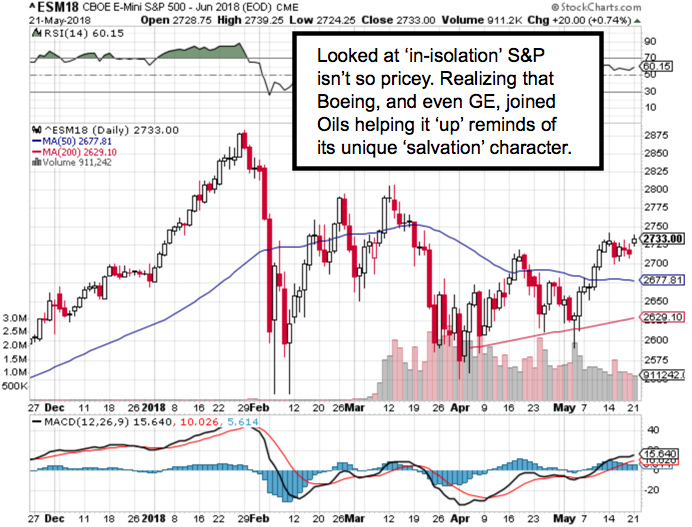

Technically, this market remains extended, but saved itself of necessity as I outlined over a week ago. (The break of the 200-day moving average had required a Hail Mary run-up try; and now they got more to hold onto, for the moment.)

So yes, you have plenty of cushion above that key support and yet you have a market that can surprise anytime.

Global stocks little changed Tuesday amid US profit taking, Europe rally, China moves: Reuters.

Bottom-line: the irony of this market is clear. The effort to divert investors’ focus on extreme valuation has contributed to not just a Fight the Fed mentality, but Greater Fool Theory too.

So now we’re in the midst of that battle. Stay tuned.