A vertical integration model: Most-interesting Wednesday was AT&T Chairman/CEO Randall Stephenson in an interview on Recode. Gene Inger says it may need a higher multiple, rather than a floor determined by dividends.

He made a lot of the points we have about OTT (over-the-top) broadcasting; a shift away from cable and satellite to streaming; and needing bandwidth to deliver it. (Hence the fiber expansion as well as forthcoming 5G service in a few areas initially and broadly later.)

And he discussed the linkage of databases gathered both by Turner and Time Warner (TWX) and AT&T (T) customer relations base that can provide opportunity if combined.

And if the merger is not approved, it’s still a good plan as it is with bringing greater content into AT&T mobile and broadband. That has a tendency to increase the value of customers to AT&T, rather than merely providing a pipe.

This is an example of ideal vertical integration, and that is why I’m thinking that ultimately it deserves a higher multiple at that time, rather than it’s a floor being determined mostly by its dividend. (That is if they merge and integrate and then make money, in that space too, over the next year or two.)

**

Reuters: Wall Street slips Thursday as Trump tariffs spark trade war worries.

**

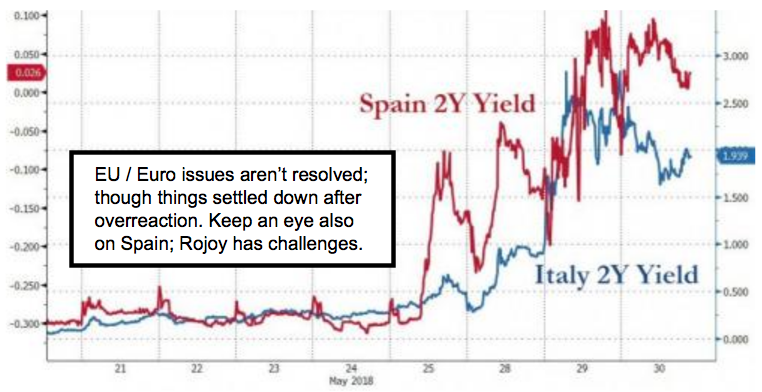

Europe is not doomed and though liquidity and currency statuses are not great, the focus on Italy was an overreaction.

**

China levers: Similarly, the press focus on threatened $50 billion of tariffs on China was reported in a matter-of-fact understated manner. It’s probably leverage for Chinese assistance in coming-to-terms on trade, but if implemented it does matter.

Small-cap Russell 2000 (RUT) made a record high again Wednesday, which isn’t just a rebound in Oil though that was the general leadership of the market. It’s a reflection of shifting into less-overvalued stocks than the FANGs or such.

**

The Fed Beige (Tan) Book as well as the agencies proposed easing of the Volcker Rule did not budge the S&P 500 (SPX) much, which continued trading at Wednesday’s highs, during both the report and the proposal. Basically, the implications are of a Fed that can move rates higher eventually, but at a slower pace. And the Volcker Rule inhibited some banking and institutional trading that might not be in the customers’ interests, hence possible concern there.

I am not thrilled to see the rules-easing approach, but it’s not a short-term concern. Of course, once markets break a lot of these regulatory retreats, in-hindsight, they will be trotted out as explanations for excessive returns to not all, but some, of the policies that built up to the last financial risk. That’s of course a reason (with the debt growth too) that we really need to see fast growth of the economy not only persist, but not become as sluggish as it’s a maturing normal business cycle. An infrastructure bill would help.

Personal note: I’ll spend most of Thursday at LightPath (LPTH) Orlando HQ for a factory tour, and investment briefing about the small growing optics and sensor company. Later I will reflect on it briefly. Of course, I don’t expect any revelations, but do welcome the chance to see their expanding facilities first-hand.

Recorded at MoneyShow Las Vegas May 14, 2018

Duration: 4:10.