Thursday I was at LightPath (LPTH) headquarters in Orlando for a tour and investment briefing about the small growing optics and sensor company. I am viewing LightPath as a continuing Strong Hold for the future, writes Gene Inger Thursday.

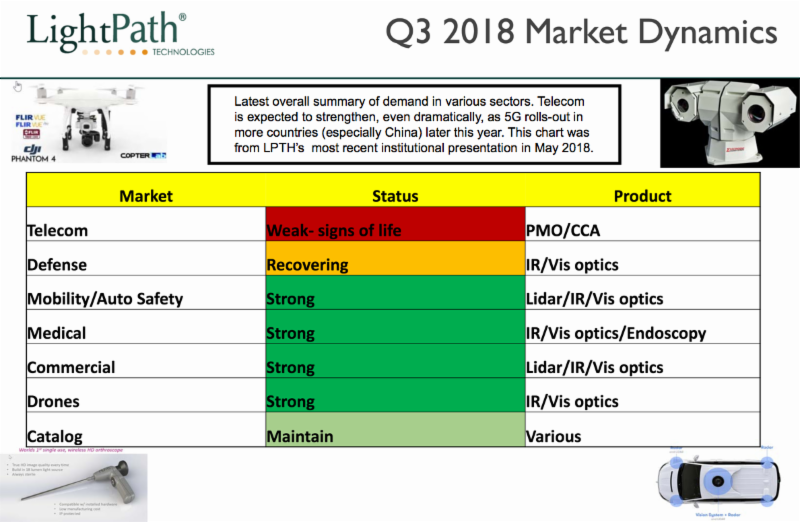

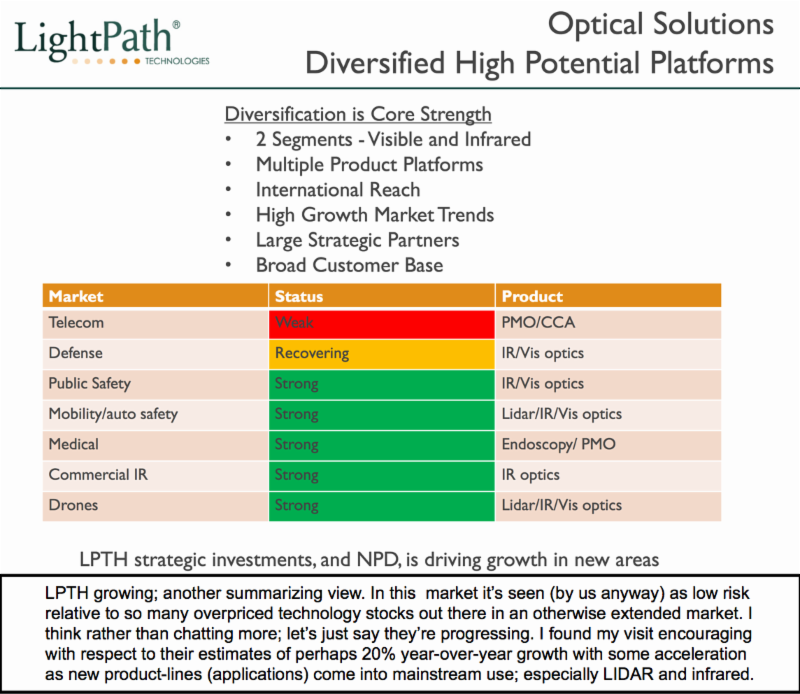

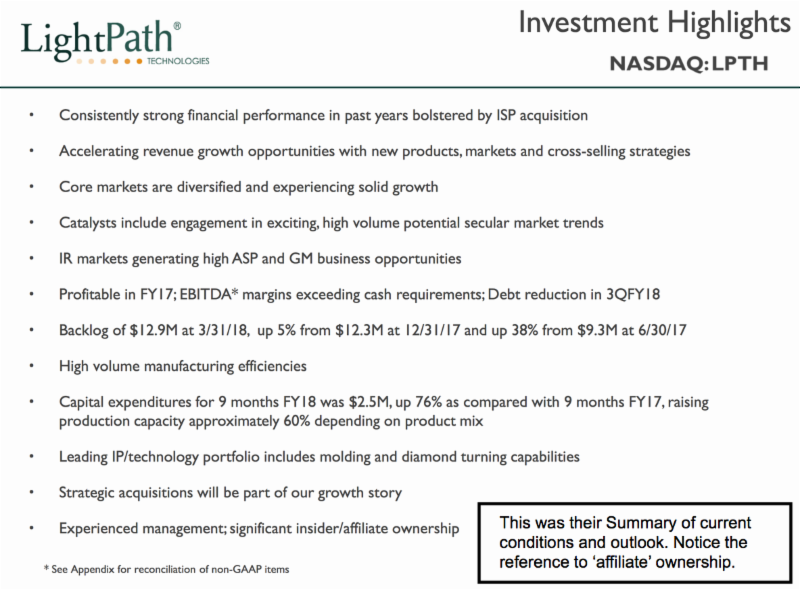

Their presentation charts look familiar but are updated to this month from prior presentations.

I really think LPTH remains under-the-radar.

I saw nothing Thursday to reduce enthusiasm and in fact was quite encouraged by the mood that seemed to prevail not only in management, but among the few production staff I encountered.

LightPath does really complex optical work.

And I get the point about lower unit prices and newer techniques (included a patented process) allowing it to capture more markets at competitive prices and still make a decent profit.

Maybe now I’m not so doubting my optician when he tells me good lenses cost at least a bit more. (However I know the eyeglass business is another story).

Lighting the path for markets this week, we’ve pointed out Tuesday’s breakdown was an overreaction to the Italian crisis and would rebound.

But then we saw Wednesday’s rebound as likely not at all sustainable, because of the likely imposition of EU tariffs coming Thursday. Got all that; and right back down.

Hence you know we are suspicious of rallies, as well as suspect nobody believes the tariffs will stick, which is also why the Dow Jones Industrials (DJI) was only down 300 or so Thursday, and not declining at a faster clip.

Regardless the big-caps are really extended.

Bottom-line: the market is skittish as it has been and remains vulnerable.

Recorded at MoneyShow Las Vegas May 14, 2018

Duration: 4:10.