For those who wish to trade, the plausible choice is to expect the unexpected and be as prepared as possible. Often this means we get caught in the wash, rinse, repeat as we wait for the next headline, the ensuing market move and consequences, writes Dr. Joe Duarte.

Sometimes this market makes me feel like a dirty shirt in the wash, rinse, repeat cycle. But I don’t want to be right. I just want to make money.

So, I’m getting used to living in a new world, a world where what I see on my trading screen and what is really happening may not be coherent. And I’ve come to the conclusion that it doesn’t really matter what I think about the world or the markets. What I do know is that there are still ways to make money if you can adjust to the new rules of engagement and change along with them, as often as events call for such maneuvers.

All things considered, I want to be bearish but I can’t bring myself to fully committing to the negative side of the trade. I also want to be bullish, but I can’t sleep without thinking that something isn’t quite right and that the market might crash at any moment. So, I own stocks, I hedge, and I keep waiting for the other shoe to drop. But more than anything, I stay in the moment.

Point for the bulls - breadth hits home run

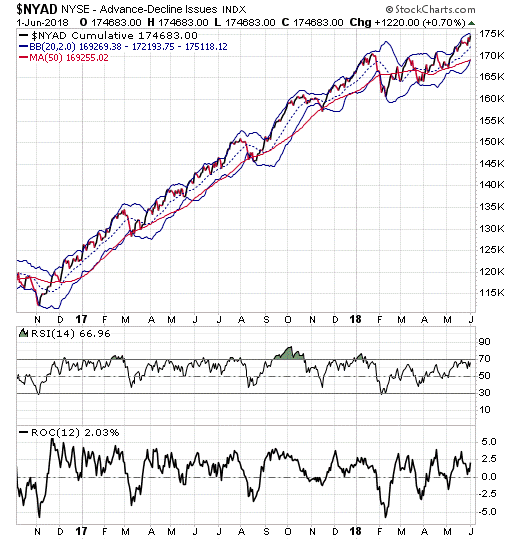

The New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the stock market’s trend since the 2016 presidential election made a new high last week. Usually, especially in the last year and three quarters this type of technical events means the trend for stocks is up. So, based on that one very reliable indicator I’m bullish.

Furthermore, in an information vacuum it’s hard to fight the image of a breakout in NYAD. Moreover, things get better when you note the ROC and the RSI are both documenting that some strength was present in the market last week and that stocks are far from being overbought.

Point for the bears - man does not live by price alone

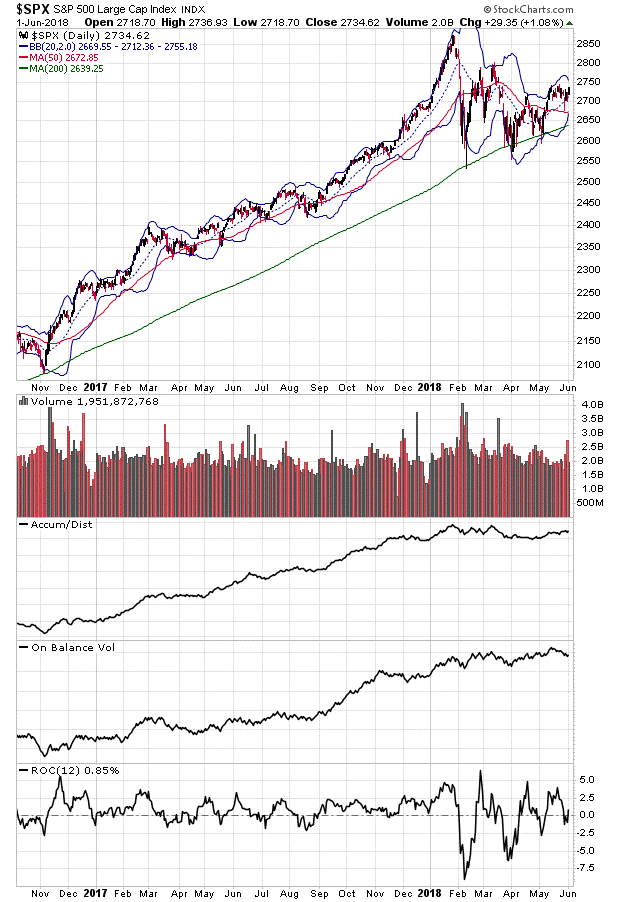

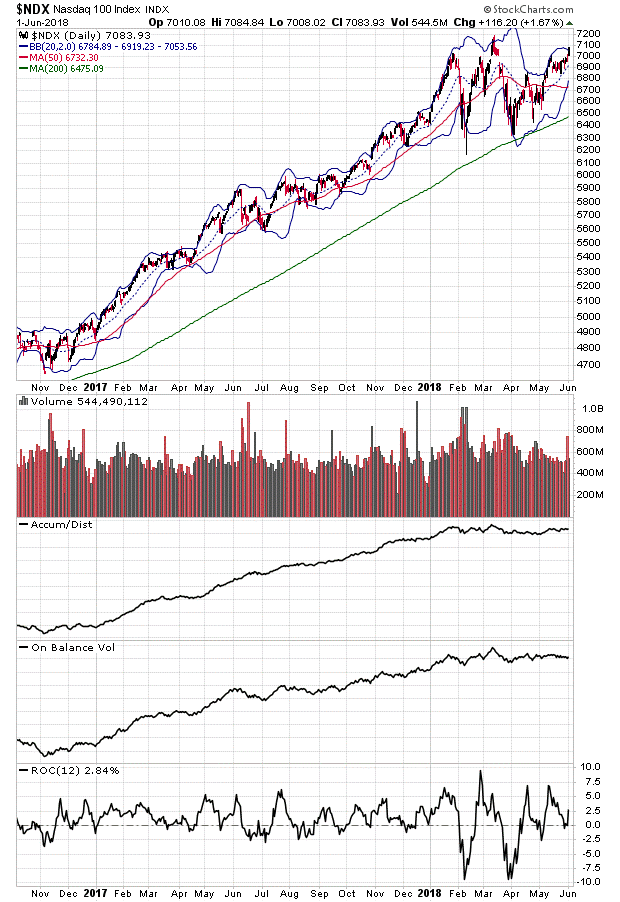

Regardless of whether you are a bull or a bear, you must agree with the notion that bullish market breadth is a requirement for healthy intermediate and long-term price advances in the stock market. Indeed, bullish breadth combined with rising prices is as pure a definition of a bull market as there is. And if we were in the proverbial information vacuum we would see nothing but bullish action in the current breadth and price movements of the S&P 500 (SPX) and the Nasdaq 100 indexes (NDX).

Still, as anyone who’s seen what happens in sci-fi movies when space-walking astronauts open the visors on their EVA suits--think terrible death--trading in information vacuums is not advisable. Moreover, technical analysis requires confirmation from price and momentum oscillators, especially those indicators that are derived from raw volume. And that’s precisely where things get a little bit uncomfortable in the current market.

If you look only at the price panel of the NDX and SPX charts, you see bullish price action. Specifically, NDX has delivered a minor breakout while SPX seems ready to follow. Furthermore, the Bollinger Bands (elastic bands around prices) are closing in on the price bars. This is an indication that a big move in prices is nearing. So far so good, right? We have bullish price action and a big move is likely on the way.

MoneyShow video interview with John Bollinger: How to use Bollinger Bands.

But, and this is a big asterisk, volume is not bullish as the rally after the positive employment report had very anemic volume while trading volume was up on days in which the market closed lower last week.

In addition, things get more concerning when we note that the Accumulation Distribution (ADI) and On Balance Volume (OBV) indicators for both NDX and SPX are flat for the former and slightly negative for the latter. So, although prices and breadth are bullish, the oscillators are saying that there is no real momentum in this market, which ultimately means that sellers are more active than buyers.

Stay in the moment and follow the money

Traders are facing a dilemma. Low volume markets are vulnerable to news and this market is no exception. Making life a bit harder these days, there is higher trading volume present when robot traders perceive the news to be negative, such as what we saw on May 29 when the headlines suggested a financial crisis was about to swallow Italy. By contrast when the U.S. delivered what robots perceived as good news on June 1 upon the release of the U.S. employment data, prices rallied, but they did so on lower volume than on the prior day. Meanwhile price charts are turning increasingly bullish, which means that if volume trends don’t change there could be a meaningful decline in the next few weeks.

The problem is if you’re trading for a living or investing as part of a savings plan there isn’t much of an alternative to the stock market at the moment unless you have very deep pockets and low debt levels. So, in order to make the best of the current situation it helps to keep a few things in mind.

1) Stay in the moment. Expect intraday volatility with wild point swings in the indexes as the news cycle churns and the algorithms react.

2) Stay small and stick with what’s working--own small positions in stocks with positive price patterns and sound fundamentals in order to minimize heartache and acid reflux.

3) Hedge all bets via inverse ETFs and higher than normal cash levels while looking to reduce risk with options and income producing option strategies.

4) Accept the drag on your portfolio from inverse bets. When the market falls you’ll be glad you had them in place.

5) Don’t try to beat the market. Instead focus on gaining ground slowly and take what they give you.

6) Be humble. Expect to be wrong and to pay the price but be thankful if your hedges reduced your losses on a bad day or if you made it through the trading day with more money than what you had when you turned on your screen.

Hang in there--this is a new world. And for those of us who wish to trade, the only plausible choice is to expect the unexpected and to be as prepared as possible. Often this means we get caught in the wash, rinse, repeat cycle as we wait for the next headline, the ensuing market move and the consequences.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.