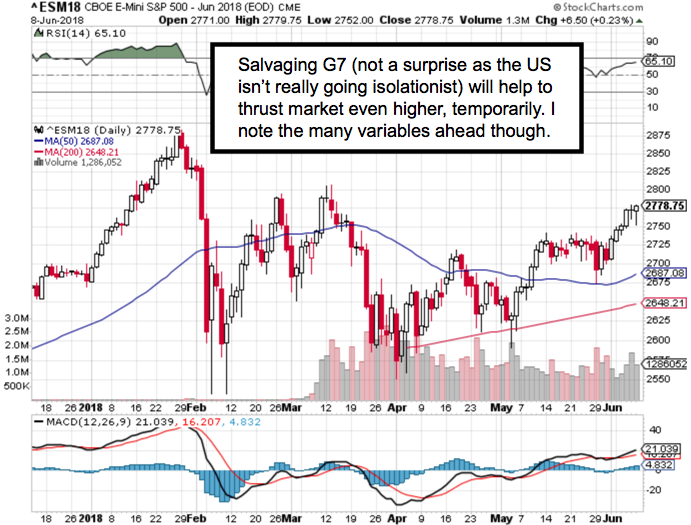

Traders have more room to maneuver before they'll worry. It’s a function of being able to pull-away from the 200-day and then the 50-day moving averages, a couple weeks back when the battle was really fought, writes Gene Inger.

Precarious technical factors are not exactly lined up but gleaned just off-stage waiting for the right time to make their presence known. Since we gave the Bulls some room to lasso-back market control above key levels a trader would monitor, we’ve felt it would rebuild into an overbought status, one more time.

We’re working into that but not so jammed that it can’t extend a bit more. That changes little with respect to investing (valuations generally too high), but more importantly argued recent against shorting or fading too strongly, as it didn’t (and still doesn't) have quite the feel we had in late January.

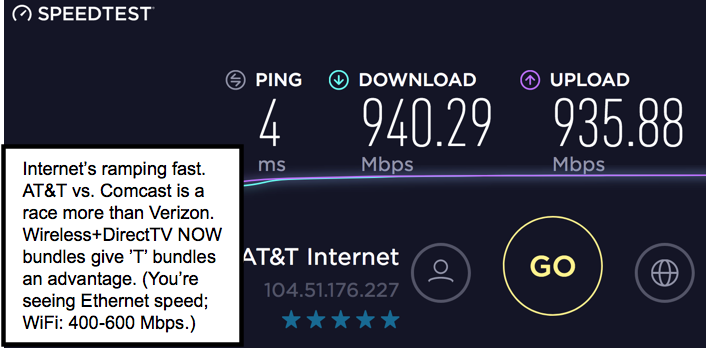

I say stay tuned for that, as the sense remains a volatile time forthcoming. In the interim everyone is flailing opinions around regarding everything one can contemplate, from success or failure in Quebec, to the Fed meeting, to the Singapore summit. And even to whether the AT&T (T) Time Warner (TWX) merger gets blocked Tuesday by the efforts of a vehement antitrust U.S. Attorney.

None of this has fazed the stock market, and that's exactly where we have wanted it, ahead of all of these issues for the week ahead. Essentially this is the week where things can go all the market’s way, all against, or mixed.

In-sum: It’s a yin and yang week ahead.

Speaking of that, you now have Quants rationalizing the proportions Apple (AAPL) or other FANG stocks are to the total market capitalization, which worries me a bit more. Actually, they remain extreme influences as you know; and so the primary reason you would hear such explanations to minimize their S&P influence, might be by those trying to forestall a grasping of risk.

Bottom-line: As G-7 leaders frantically salvage some sort of consensus, I suspect we emerge OK in this and the U.S. is still in the driver's seat, even if some partners don't like their diminished preferential trade treatment.

I’ve patiently awaited fiber here in the Orlando area and just wanted to share the achieved speed... now I’ll be spoiled anywhere other than at my desk…works great.

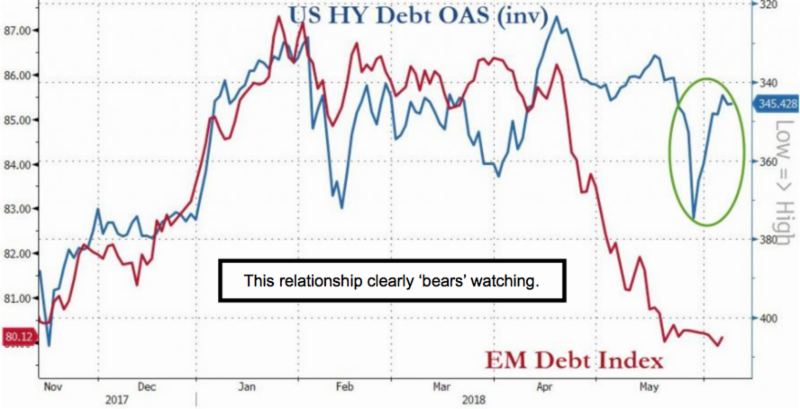

Daily action continues to see stocks shrug-off Emerging Market worries as well as the upcoming central bank meetings not to mention G-7 or the high yield credit flutters. And of course, no worries it seems for Singapore.

Treasury yields rise Monday before Fed meeting; solid demand at auctions: Reuters.

Reality is this continues until it doesn’t, although the upside extension has within its core the seeds of the next declining phase of the market. While few want to say so, the higher an overvalued market again becomes, the greater the risk is for an ensuing (even out-sized) decline.

Recorded at MoneyShow Las Vegas May 14, 2018

Duration: 4:10.