Markets are digesting a slew of confrontational perspectives. Not just Canada, but the EU saying it will have retaliatory tariffs ready to go July 1 and sublimely just proceed. If these tensions crystallize into action, it might not be so calm. Most just believe negotiations will ameliorate these issues in time. We shall see.

Meanwhile, the Super Bears constantly proclaim a correction from which a recovery won't occur soon. And we have disputed that prospect all year as you know, believing that the predicted February break would precede what was a ragged Winter and Spring, but not a catastrophic hit like the really bearish crowd has constantly suggested forthcoming.

This of course matters. It is unexciting to say stick with all core positions, while trimming super-expensive stocks to build liquidity for what we suspect is inevitably volatile periods of market action ahead. It has maintained the idea of not shorting this market, other than an occasional daily fade, and that’s saved investors from not just loss of position, but from losses if they shorted or played for a major break.

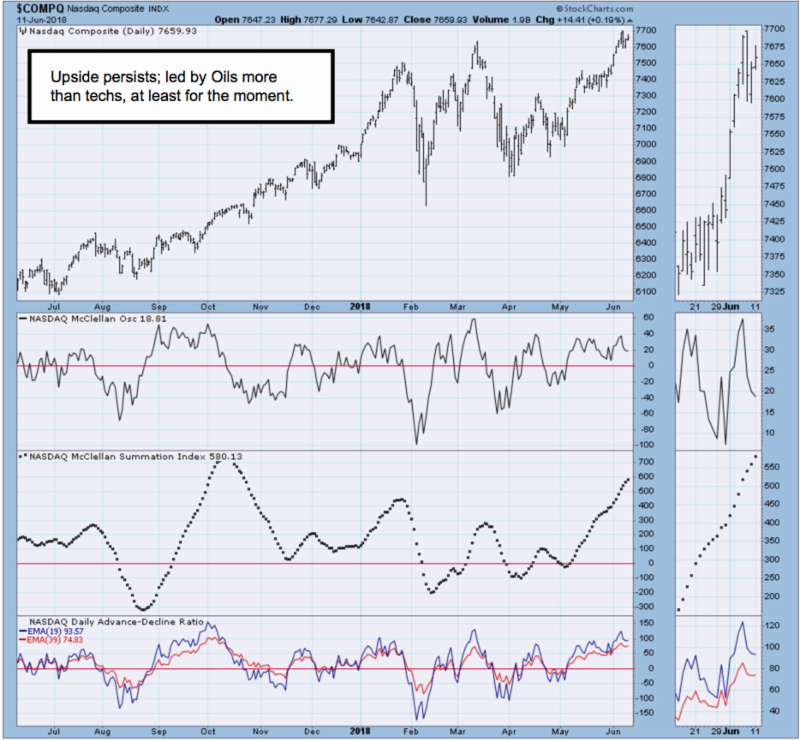

Now, as Summer approaches, we are edging into what can become a rockier time in our market but again, not a catastrophic one. I say that partially because the Bulls have maneuvering room to work with, given the clearance cushion above 50-day moving average and 200-day moving averages. At the same time, I wouldn’t get complacent, as this remains a stretched and unusual market, with credit market conflicts, and overbought technicals.

In-sum: The market has been on hold ahead of the summit and might be setting-up a buy-the-rumor, sell-the-news scenario on accomplishments of a favorable nature, and obviously a break should there be a failure.

At the same time markets are minimizing the trade issues, net neutrality rules withdrawn (which likely helped telecoms) and ignoring pressures on OPEC’s upcoming meeting to offset Iranian oil sales that won’t export to the EU.

OPEC cautious on oil outlook despite end of global glut: Reuters Tuesday.

Then there is Turkey’s Erdogan and his threats against Austria that are truly off-the-wall, and inaccurate as how he portrayed Vienna’s decision.

Meanwhile, markets are ignoring the net neutrality shift, the threats by the dictator Erdogan against Austria, or the global credit markets. I think it’s normal to focus on Singapore Monday night.

Bottom line: In an overbought condition the market leaders especially are more vulnerable to surprise shocks. A tech-wreck would spread sufficiently to break the S&P 500 (SPX), because they constitute so much of the rally efforts seen really over the past year and a half.

Hence odds of volatility do increase, unless you have some dramatic breakthrough that reprices such stocks to higher levels. That’s unlikely unless for instance China would finally allow Facebook (FB) to operate there, relenting on restrictions. I think something like that would have wider implications than Facebook but with so many other tense issues for now I’d not hold my breath for that.

There is really no change yet in our belief that this market is stretched, but not at a significant breaking point. However, that can change instantly, because you have senior indexes at high levels and excess valuations.

Recorded at MoneyShow Las Vegas May 14, 2018

Duration: 4:10.