It may be a good time to go with the flow and consider adding new money to low risk cash investments and leaving it there with one goal in mind, to make money by earning interest while waiting for a better buying opportunity in the future, writes Dr. Joe Duarte Sunday.

Classic rocker and Dallas native Steve Miller penned a hit in the 1970s titled, “Your Cash Ain’t Nothin’ but Trash.” And while this lesser known song about a down-on-his-luck loser and his misadventures by Miller is a bit off the beaten path for radio programmers these days, its title was quite on point during the zero-interest rate period following the subprime mortgage crash and the ensuing so called “Great Recession.”

Indeed, during this extraordinary period of time investors in money market funds had nearly zero gains for nearly a decade.

But the times are clearly changing, gauging by the Fed’s action on June 13 and their warning to investors of as many as two more interest rate increases in what’s left of 2018.

By the back of my napkin calculations, if those two rate cuts do occur, we may have a Fed Funds rate in the 2.25 to 2.5, a yield which should be taken seriously in comparison to zero or even one percent.

Furthermore, there is now some emerging evidence that the possibility of even higher rates may already be having a meaningful effect on the markets. Of course, the big concern for investors is the fact higher interest rates will eventually lead to a decrease in stock prices – think 1987, 1990 and as I noted above, the post 2008 subprime mortgage debacle.

Arguably we may not quite yet be at the point where cash is so attractive that a stock market crash follows, but as I will show below the train has left the station.

Specifically, there are now increasingly clear signs that risk-averse investors are quietly plowing money into cash, a development which seems to account for the falling volume and the general sluggishness of the stock market that I have noted over the last few weeks.

What’s my point? At some point investors recognize that making more money with less risk, such as what is available in the relative safety of treasury bills, money market funds and so on is not so bad, especially in a market that is so heavily dependent on weird trading by headline reading robot algorithms. More important, and this is the take home message, there will be a point at which enough people will make the move to cash, which will in turn lead to fewer and slower price advances in stocks, even in the face of good news.

Trends turns sluggish after Fed rate hike

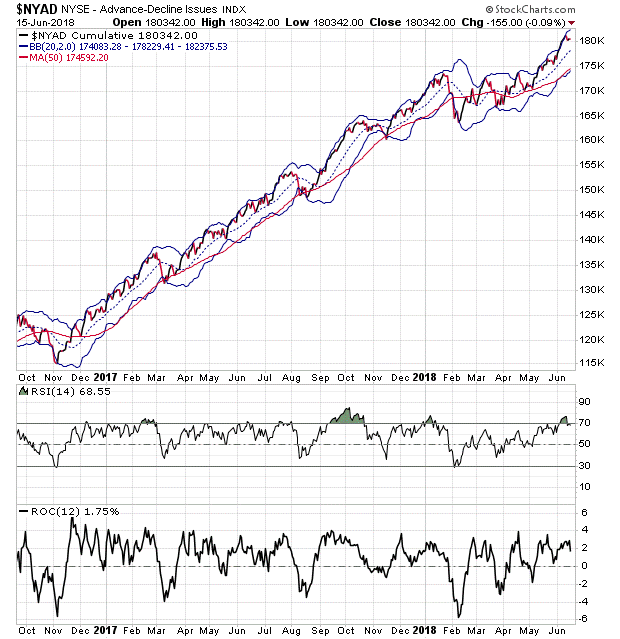

We may be getting close to the inflection point where cash beckons and stocks either slow their rate of advance or decline. After last week’s increase in the Fed Funds rate the highly accurate since November 2016 New York Stock Exchange Advance Decline line (NYAD) slowed its pace of advance and could be forecasting a change in the stock market’s trend.

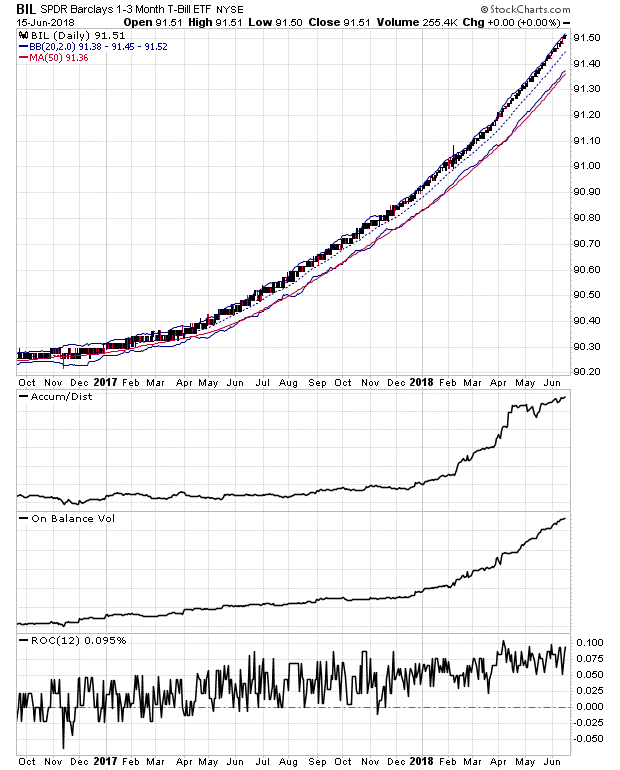

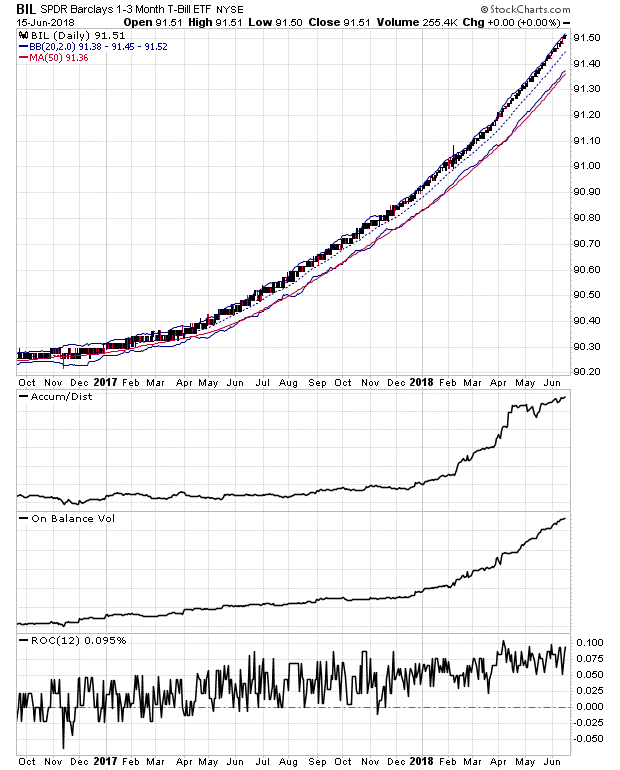

Note the non-confirmation of the most recent high in NYAD by the ROC momentum gauge at the same time the RSI is signaling the uptrend is over extended. Most interesting is the relationship of NYAD to the rising price of the SPDR 1-3 Year U.S. T-Bill ETF (BIL)

Aside from the fact that the BIL chart is heading nearly straight up, note the aggressive uptrend in the Accumulation Distribution (ADI) and On Balance Volume (OBV) indicators for this ETF. This is a clear sign of two things, as I will further detail below. One is that money is either not moving into stocks, moving out of stocks, or both.

SPX stalls as NDX flirts with resistance

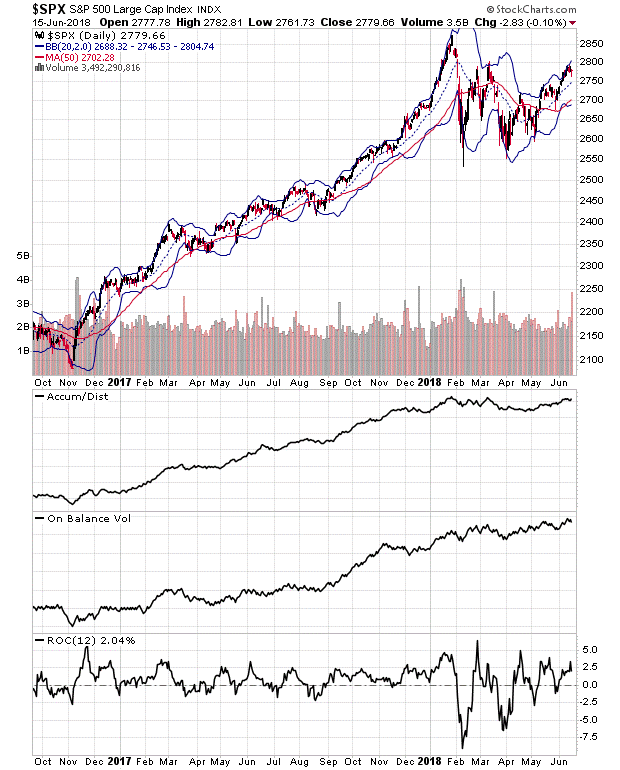

Over the past few weeks I’ve been concerned about the sluggish money flow into stocks painted by flat On Balance Volume, equally uninspired Accumulation Distribution metrics, and the general trends in raw volume in the stock market. Specifically, I’ve been concerned about the trend toward higher trading volume on down days compared to up days in the major indexes. Moreover, little changed last week with regard to the general trends displayed by those key indicators; a sign that sellers seem to be more motivated than buyers.

Specifically look at the still flat ADI and OBV on the S&P 500 (SPX) chart. Coupled with what seems to be a stall in momentum as measured by ROC, this is not an encouraging picture.

The technical signs for NDX are somewhat better, although the raw volume trends are similar, albeit less pronounced. Furthermore, ROC is still rising which is a positive sign, while ADI and OBV look a bit more comforting than their counterparts for SPX. Finally, NDX is still near its recent highs - a sign of relative strength.

Finally, note the following converging indicators:

- NDX and SPX entered a trading range in January 2018

- The NYAD confirmed the trading range in the major indexes at the same time

- Money flows into BIL, as measured by a rising price and confirmed by rising OBV, and ADI.

Managing risk with higher cash levels

The stock market appears to be losing some of its upward momentum as investors seem to be quietly putting their money into low risk, cash related investments.

In previous articles I’ve suggested various techniques of risk management such as trading in small positions, sticking with stocks whose technical and fundamental character is positive, hedging with inverse ETFs, and using options for income via spreads and buy-write strategies. I continue to make those recommendations, especially when viewed in the context of the positive money flows into cash that I have reviewed above.

Moreover, even though this article is about the return on cash deposits, I’m not advocating moving out of stocks into cash en masse. In fact, I think stock prices could still move higher, albeit at a slower and more protracted price pattern over the next six to twelve months.

Still at the end of the day it’s clear that investors are increasingly electing for lowering their risk as short-term interest rates rise. Thus, it may be a good time to go with the flow and consider adding new money to low risk cash investments and leaving it there with one goal in mind, to make money now just by earning interest while waiting for a better buying opportunity in the future.

Cash ain’t no longer trash.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.