Evading radar warnings is precisely what HFT traders piloting this market were expected to do Thursday with mixed levels of success. That is what we got. Combined with dubious bank behavior and end-of-quarter action, it mitigates resolution Friday, writes Gene Inger.

Nevertheless, this market has been flying-into headwinds for weeks; while a majority of analysts tend to talk about rotation, as opposed to overall risk factors.

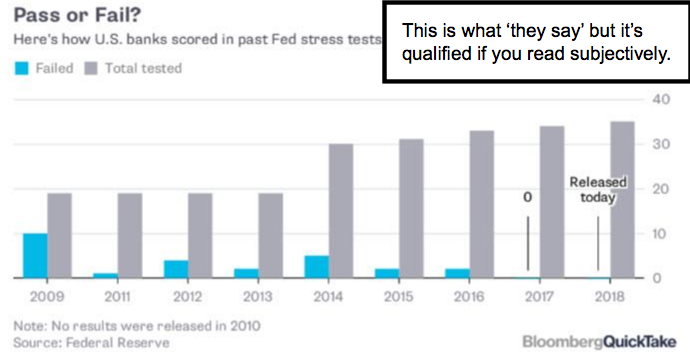

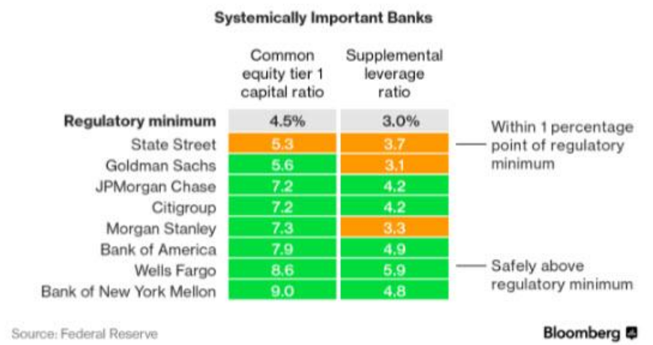

Stress test results should be a further wake-up call that’s not going to ensure continuation of the Financial Select Sector SPDR Fund (XLF) for instance.

It’s a weak sector that we’ve been opposed to investing in all year long. But it is going to sober some thinking about the condition of bloated banks.

Reuters: Nike, financials push Wall Street higher Friday mid-day.

So sure, a couple of the major banks announced modest buybacks and/or unwarranted dividend increases, primarily to try abating investors focusing on what’s really underlying their weakness.

With such persistent decline for months, now reducing risk and taking banks generally closer to values compared to the past, we will now move to a neutral view on Financials.

I emphasize that doesn’t mean they’re particularly attractive; it just means buybacks may artificially hold them a big higher than they otherwise would be. (As many other sectors.)

New York Times: Why have bank stocks had such a bad two weeks? A flattening yield curve.

I’ve warned for some time that Fed policy was at-odds with rate realities in Treasuries; and I’ve contended the (bullish) bank analysts talk of higher profits from lending was generally premature.

In fact, the rate pattern can argue a drop in the 10-year from here. Now I wouldn’t bank on that; but should it do so this Summer, those stocks won’t be making more money. And there might be a bit of a respite for bonds, which could play havoc with equities, which regardless should be fairly unstable (at best) during this Summer.

In-sum: with so many classic warnings signs in the markets for months; it is worthy of again noting the problem arising from the passive investing structure of ownership, especially as the market tries to stabilize at crucial technical levels in the S&P 500 (SPX).