We are about to finish Q2, but the final revision for Q1 GDP was released Friday. The headline number missed estimates as it came in at 2% which was below the consensus for 2.2%, writes Don Kaufman.

This means the final result was 0.3% below the initial result which is significant since the rate started out low compared to where Q2 is about to come in at.

The final two quarters of the year will likely see growth in between Q1 and Q2.

The real consumer spending growth was lowered from 1% to 0.9% which was 0.1 below estimates. The GDP price index was raised from 1.9% to 2.2%. This increase in the price index is what drove real GDP lower. However, core GDP growth was still 2.6%.

Q1 was great for businesses as non-residential fixed investment was up 10.4%. The weak consumer drove growth down. The reason growth is expected to accelerate in Q2 is consumer spending is expected to grow between 3% and 5%.

Trade deficit shrinks sharply in May

The trade deficit has become a hotly politicized topic ever since President Trump made it his main campaign message and started issuing tariffs. However, this data point is important for economists and investors as well since it is a key cog in the GDP report. The deficit shrunk sharply in May as it fell from $67.3 billion to $64.8 billion. Also, the April result was revised $900 million lower, so it was also a good report.

If you’re rooting for a good GDP number, you want exports to grow quicker than imports. Of course, imports should grow as well because historically they have been correlated with the strength of the consumer. The May deficit beat the consensus for $4 billion and beat the best estimate by $200 million. April’s exports were revised to grow 0.2% instead of fall 0.5%. Imports fell 0.4% instead of 0.5%. This change helps GDP. In May, exports grew 2.1% and imports grew 0.2%. This also helps GDP growth.

Specifically, exports were helped by 12.8% growth in food and feeds and a 3.7% increase in capital goods. There was a 3.2% increase in consumer goods exports and a 3.1% decline in industrial supplies.

Auto imports fell 1.2% and consumer imports fell 1%. We don’t want to see consumer imports falling unless most of the new purchases are from domestic suppliers which could happen if Trump’s tariffs are high enough. However, if Trump’s tariffs catalyze domestic buying, the consumer will get less bang for his buck since prices per unit are higher in America.

If prices were lower, people would buy domestic goods without tariffs. The other parts of this equation are regulations, taxes and employment costs. They all play a role in how expensive domestic production is.

Finally, industrial supplies imports fell 0.7% and capital goods imports were up 3.4%.

Strong Kansas City Fed survey

The past three manufacturing surveys have been strong after the first two were weak. The most recent strong regional Fed survey was the Kansas City Fed report from Thursday.

The headline index was 28 which was 1 point below the survey from May. In previous reports from the other regional surveys, there have been signs of too much demand and not enough supply. This report showed decent strength without that problem because the backlog index fell from 27 to 10 and new orders fell from 38 to 27.

Just like the other regional Fed reports, this one showed increasing prices, but at a slower rate. Input prices were down 6 points to 47 and selling prices were 22 which was flat.

Jobless claims, consumer confidence and corporate profits

In this section I’ll review the rest of the economic data that was released on Thursday. Jobless claims were up 9,000 to 227,000. That was worse than the consensus which expected 220,000 jobs. The four-week moving average increased 1,000 to 222,000. This report means another good employment number will be released next week. The bad news is it further supports the narrative that the jobless claims can’t fall any lower than where they are now.

Once the rate of change becomes flat, the next step is rising claims.

The Bloomberg Consumer Confidence report from last week increased from 56.5 to 57.3. It’s good to see that the negative headlines from the tariffs haven’t hurt sentiment. I wouldn’t be surprised to see a drop next week because of the weakness in the stock market this week.

With the tax cuts and the strong economy helping after tax corporate profits, I was shocked to see growth in Q1 was only 0.1. The latest revision to 2.7% growth makes sense. There was a big revision to pre-tax profits which helped the results. Pre-tax profits were up $51 billion to $2.191 trillion. Q1 annualized after tax profits were at $1.859 trillion.

The annualized income tax paid was $332.1 billion which was sharply down from $445.6 billion in Q4. This new rate is the lowest of the expansion.

The tax cuts have been a boom to corporations.

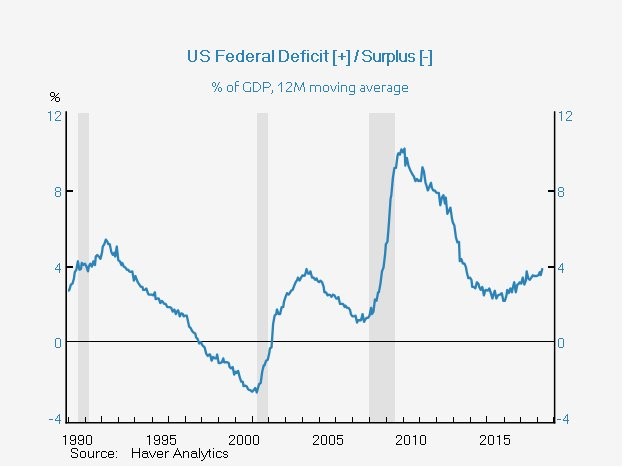

Deficit is increasing

This section is about the budget deficit, not the trade deficit.

Unlike the trade deficit, the budget deficit widened. The year to date fiscal deficit is running at $385 billion which is 12% higher than the same period last year. There has been a 5.2% rise in government spending and a 4%increase in tax receipts.

It’s a bad situation to see spending increasing so much in an expansion.

In the next few years, it’s unlikely that corporate profits will keep hitting records and the labor market will stay at such high employment.

As you can tell, I’m hinting at the fact that a recession could really blow up the deficit given the increase it is seeing in a good economy. The chart below shows the deficit as a percentage of GDP. In January 2016, the debt to GDP was 2.2% and in May 2018 it was 3.9%.

Subscribe to TheoTrade here...

View a brief video interview with Don Kaufman on volatility for traders and investors here

Recorded at TradersExpo New York Feb. 25, 2018

Duration: 2:34.