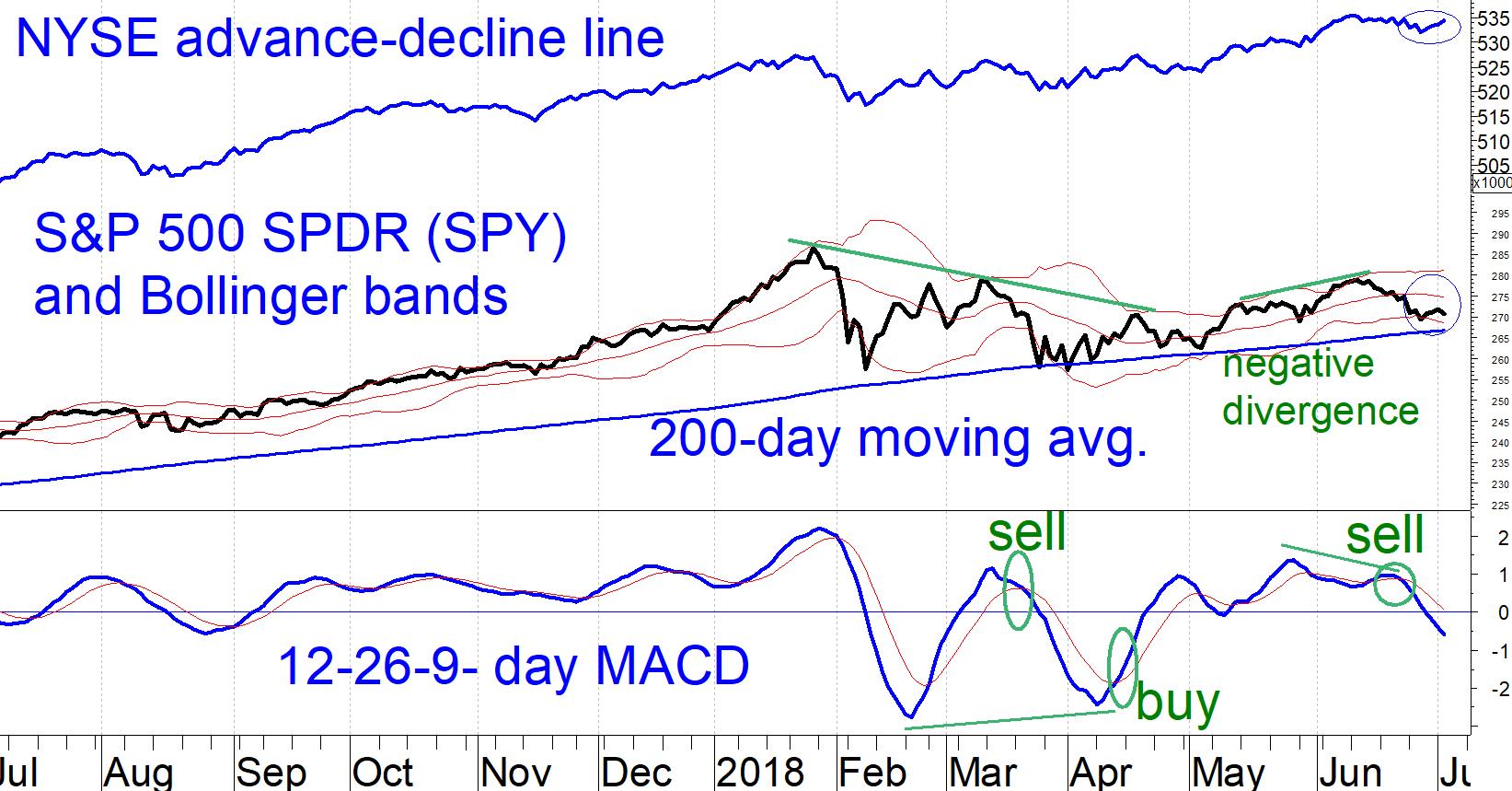

State of the market—Stocks have pulled back over the last two weeks, but the S&P 500 Index (SPX) is holding its ground, never having significantly violated important support areas such as the lower Bollinger Bands or the 200-day moving average, writes Dr. Marvin Appel.

Market breadth is actually stronger than the S&P 500 Index, with the NYSE advance-decline line near its all-time high even as the S&P 500 Index remains noticeably below its January peak.

So far, so good as we await second-quarter earnings reports, which are expected overall to show strong growth.

Preliminary data suggest that the employment report will show the labor market remains healthy, allowing the Fed to continue on its course of gradual rate hikes.

Our models remain on a Hold, suggesting profitable market conditions but with potentially significant market volatility.

Chart: Even as the S&P 500 Index remains near its lower Bollinger Band (near-term mildly oversold), the advance-decline line is close to its recent all-time high (blue circles).

The S&P 500 Index has formed a negative divergence with its MACD. This is potentially bearish over the next month or two but is contradicted by our longer-term models.

My overall interpretation is that the stock market will continue to move sideways or slowly higher over the rest of the summer, even though volatility will likely pop up from time to time.

Note however, that the Dow Jones Transportation Average (DJT) has flashed a long-term sell signal that we do not formally incorporate in our timing models.

—Marvin Appel

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.

Watch Dr. Marvin Appel share ideas on MACD during interviews at TradersExpo New York:

I find a weekly MACD is most effective for bonds.

Duration: 3:41

Recorded: Feb. 25, 2018.

Duration: 2:57

Recorded: Feb. 25, 2018.