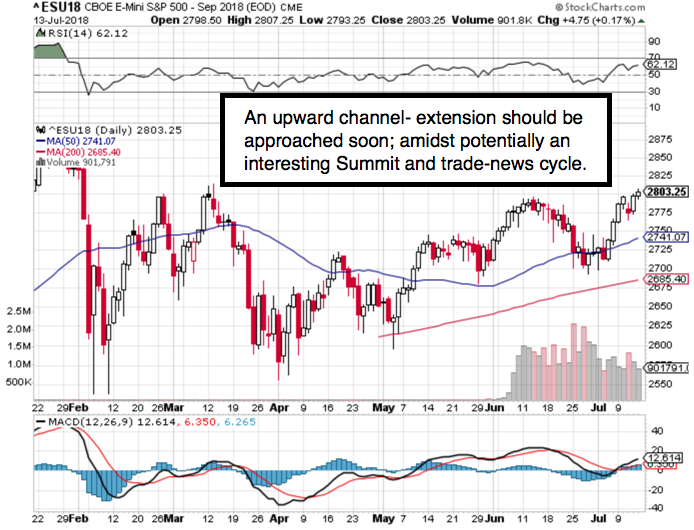

Overall, market conditions are little changed. I’d be thrilled if we got trade deals (but I’m not ignoring Mexico’s discussions right now); and then the markets (SPX) were to spike higher, providing a lower-risk opportunity to fade strength, writes Gene Inger.

For now, it’s unclear as to whether this exhausts itself or simply persists. Either way slightly higher levels seem probable for the moment at least, barring new bombshells.

Reuters: Wall Street flat Monday as oil slump offset banks earnings optmism.

The biggest story Friday isn’t broadly grasped yet, although it’s still just a possibility.

And it’s Amazon (AMZN) becoming competitive in networking. They are addressing networking switches, which would undercut current prices by competitors and companies like Cisco (CSCO).

Amazon Web Services already is, but the competitive landscape changes if they really forge ahead.

TheStreet: Cisco investors shouldn't panic about competition from Amazon for now.

That move (leveraging their existing cannibalization of other industries) at some point if they do it, is a more valid invitation for antitrust exploration than the perhaps absurd appellate effort by the DOJ against AT&T (T). (And on that keep in mind that our buy area of AT&T was $29-31 after the merger. And even before we were generally bearish from $40 on down.)

So, in our view the shares had their 20%+ decline. All the chatter about it combines with the reallocation awareness; hence the idea of scaling-into AT&T (for those who want) between $29-31 and then in the Fall, either at higher or lower prices as may prevail in months ahead.

In-sum: the risk of heavy tariffs includes cost-push inflationresulting from sluggish economic activity amidst higher prices on goods.

Opening salvos show a serious will, while we see the legal step of investigating Chinese practices and while we believe staff level discussions on a path to calm all these waters are quietly going on.

It’s tricky however and a hint is provided by China’s soft responses this week to the latest round of explicit tariffs.