A tech-reset prospect is finally being debated by pundits and money managers. Well, they are really so heavily invested in all of them and not just Facebook (FB).

They hardly are in a position to overtly warn investors of increased risks, lest they infringe on their own ability to lighten-up, should that be their ongoing challenge.

This calls for readjusting to not necessarily a permanent situation, but near-term risks. I have consistently been pointing to recently in FANG and fellow-travelers, that this is not simply a rolling correction.

MarketWatch: Stocks slump Friday as results from bellwethers overshadow Amazon’s record earnings.

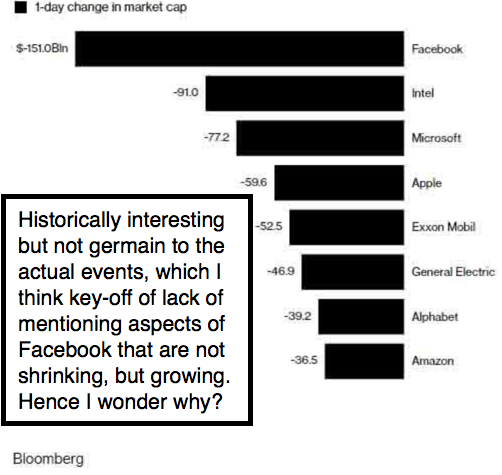

It’s a rolling bear market, and it precedes the bombshell of Facebook, which was so obvious in recent months, that it’s hard to comprehend why anyone is surprised.

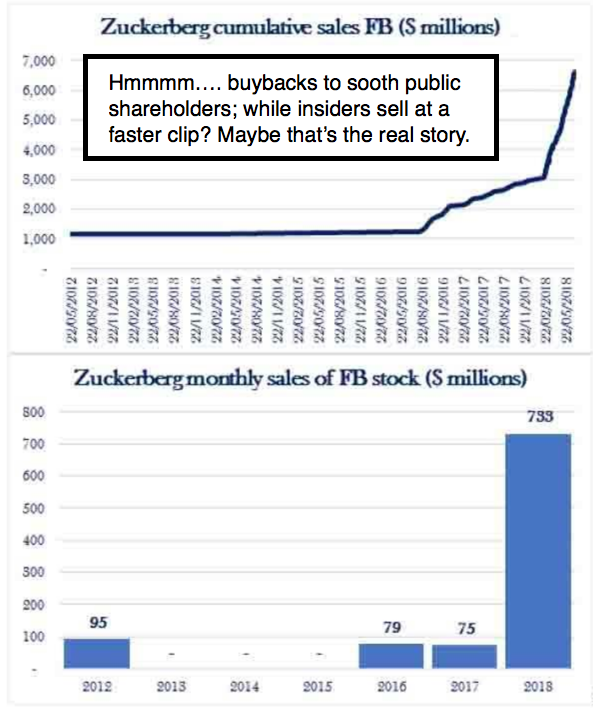

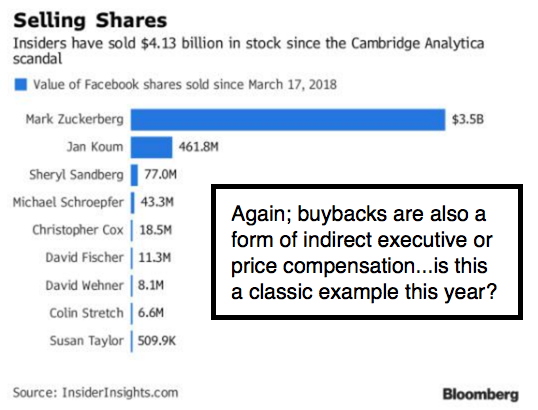

The Facebook privacy and advertising changes alone accounted for our warnings; It’s a deliberate systemic program of insider selling (over 4 billion in just recent months) should have rung alarm bells. Peter Thiel’s big 70% sale earlier this year that I clearly pointed out as affirming my concern.

Of course, there’s another issue: changes to the business model to avoid a degree of pressure from U.S. government.

And that story last week I shared of Hexagon (Harvard related) disconnect from Facebook, who expressed surprise (oh sure) that they accumulated the largest database of text, tweets, and social media posts in history.

Harvard Crimson: Facebook suspends Harvard prof's analytics company over user privacy concerns.

(That is lots more information that any government agency has on the broad masses: a concern I’ve had for a long time for what I called a private-sector NSA.)

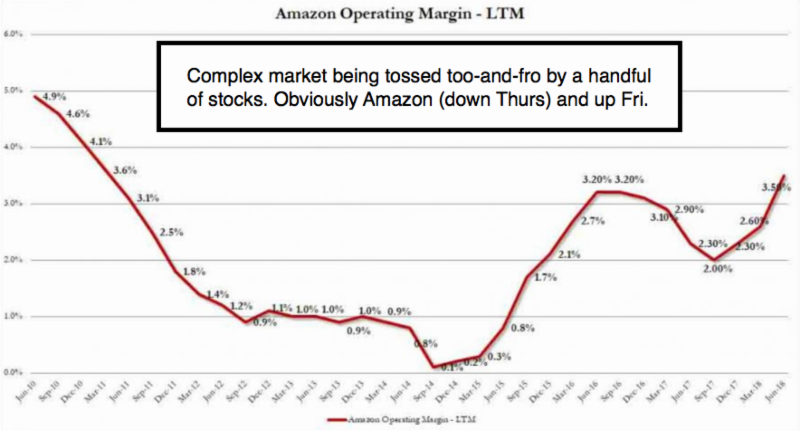

In a sense this has been a diabolical market that has fooled lots of people as well as contributed to hedge fund concentrations (via ETFs often). It is a too concentrated focus into the handful of stocks loosely called FANG but in-reality is slightly broader than that.

As far as a stock like Facebook: it has very little potential (rebound or not), for another simple reason: China kept them out and they’ve got everybody else aboard that has an interest in being on social media with them. That’s to say that aside from opening China in the future, they have lots of work to do if they hope to milk more advertising or other revenue from FB users.

So, as many analysts talk about video growing, sure I agree. But they’re trying to appeal to the same user-base, and thus it’s still a crowded segment.

Elsewhere, this is a heads-up for those trend-followers denying the excess. And maybe Facebook makes it sound worse than it is to keep US government probes at bay somewhat (as in poor Facebook..hardly).

The market says financial conditions are tightening; FANGS are overblown and multiples at this point are excessive broadly.

In-sum: sectors can blow-up; others have rotated down for months since our warning during the parabolic thrust back in January.

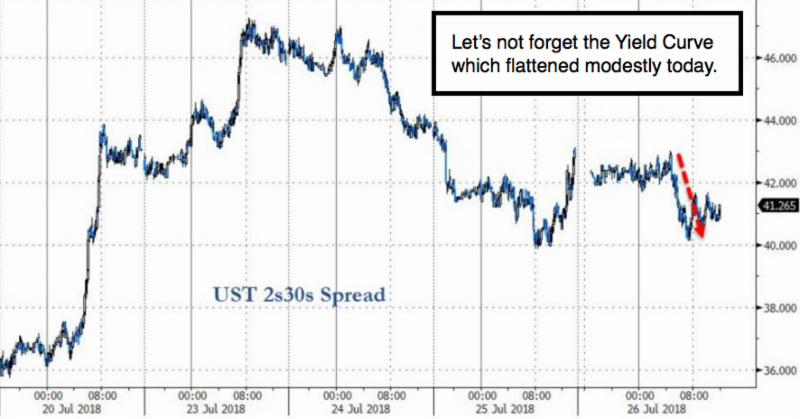

Plus, you have the Fed gradually snugging-up as we move from Quantitative Easing to what’s essentially Quantitative Tightening, whether the ECB chimes-in or stays on the easy side until year-end, as the ECB’s Draghi hinted Thursday.

The liquidity concerns alone are a threat over the next couple months. So the only advantageous investments are low multiple, high-dividend, or very special under-the-radar situations. Generally, it is time to consolidate.

**

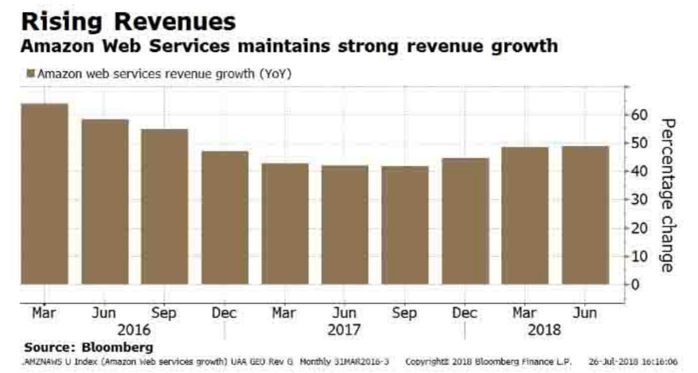

After the Thursday close, the EPS from Amazon (AMZN) seemed incredible (although notice revenue actually contracted a bit).

So, you took a 55-point session decline to nearly an 80-point rally (net up 25 or so) in a flash on the news. This is so crucial. Because if AMZN had disappointed, it would be the end of what’s called FANG supremacy. And the market would have more difficulties with its effort to overlook tax advantages, competitive service (yes vs. AWS for that matter) and at some point that compresses profit margins.

**

Also Intel (INTC) beat numbers both on revenue and earnings. It dropped 2 on the news. More important to me: if a story I’ve mentioned before proves valid, it will help Intel in the 3rd and 4th quarters. That’s the shift by Apple (AAPL) away from Qualcomm (QCOM) for cellular modems to Intel. (Production is ongoing now and sales at retail starting in late September.)

Sources suggest Intel’s newest 7580 modem will be both GSM & CDMA capable. (It means that a single device works for AT&T (T), T-Mobile (TMUS) or Verizon (VZ), for instance).

Sure, that’s easier inventory control for Apple. It responds to a protracted litigation with Qualcomm's royalty demands. (Although that may shift it to Intel to fight Qualcomm royalties on what is a standard these days, so nobody seems to think they deserve payments.)

And one more thing. Contrary to reports that the Intel modem is slower than Snapdragon; no, that is not what I hear. And the Intel cell-chip will support dual SIMs

The new Intel is faster and supports Gigabit LTE by the way and will be paired with a new MIMO (multiple-in/multiple-out) antenna, to deliver faster up-and-down speeds.

However, Qualcomm may support 5G before this Intel modem does, and that doesn’t mean much in the USA yet, but China is going full-speed on 5G and might help it sell there. (Not the iPhone, which has low penetration in China, but for the dominant Android systems that are easier for hackers and government agencies in China. a constant bit of a battle which Apple fought but surrendered iCloud access to China for their resident iPhone users.)

Long-term, Intel is not the only game in town for servers either with AMD on their heels. And in mobile, Apple is designing their own cellular chips in expectation of in-house production ultimately. This is not unlike plans to build their own primary CPU processors based on the licensed ARM design. That could also negatively impact Intel if they switch to that in MacBooks (but not MacBook Pros) depending on performance benchmarks.