Is it kinda cool to be around the day a company hits a $1T market cap for the first time in history? Maybe, except Petro China was actually the first company back on November 5, 2007. Does it make good clickbait? Of course, writes Landon Whaley Tuesday.

Should it be a sign that the technology sector is still humming along with a bullish Fundamental Gravity at its back, and that it’s time to BTFD in your favorite tech-related company? Absolutely not!

This latest push by the Nasdaq 100 (NDX) and tech shares to a brand new all-time high on July 25 was nothing more than a siren meant to draw unsuspecting investors close to the rocks. After hitting that high, the Nasdaq 100 immediately declined 4.9% over the following three trading days.

Our Quantitative Gravity for both the Nasdaq 100 ETF (QQQ) and the Technology Select Sector SPDR ETF (XLK) hit a bullish peak on June 8. Both have become less bullish ever since, though at the time of writing they hadn’t actually turned bearish.

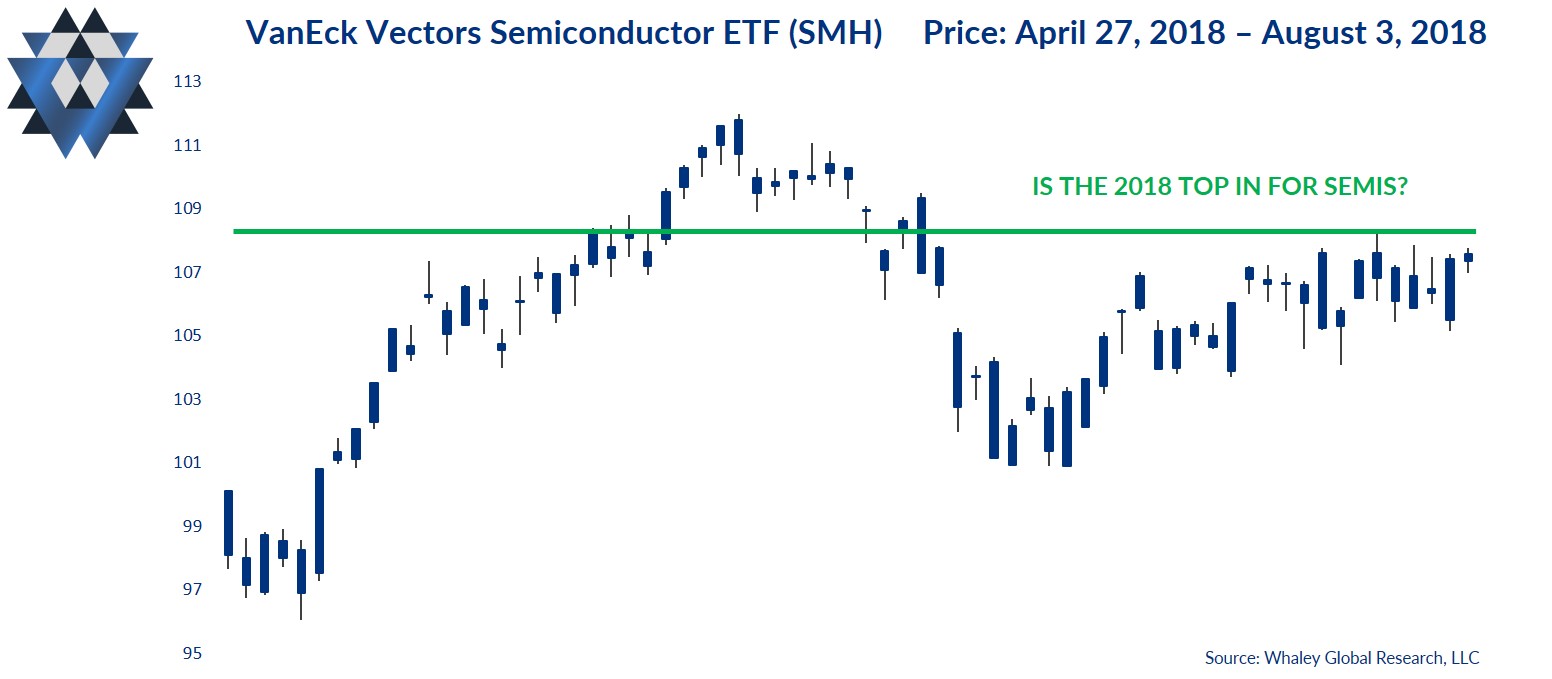

The story is the same with our favored way to short the coming downtrend in tech stocks, VanEck Vectors Semiconductor ETF (SMH). Semiconductors had a nice rally during July, but it resulted in nothing more than a lower high. In addition, its Quantitative Gravity framework began deteriorating on June 7, not confirming SMH’s July rally.

More importantly, the Fundamental Gravity backdrop for semiconductors is becoming more bearish. The annual growth rate of global semiconductor billings has been slowing since December and is now sitting at 12-month lows. Couple this fact with both the deterioration in South Korea’s economic profile and the transition of the U.S. economy to a growth-slowing environment, and you have all the makings of a bear market in the U.S. semiconductor industry.

For the last two years, the SMH ETF has been on an absolute tear. Since U.S. economic growth bottomed in June 2016, SMH has gained a whopping 90.7%! The risk and return stats of SMH differ drastically depending on whether growth is accelerating or slowing.

In high growth environments, SMH averages a 3.2% quarterly return, with an average drawdown of just 10.1%. However, when the U.S. economy begins to cool, SMH typically averages a -3.4% quarterly return and a peak-to-trough drawdown of 18.3%.

The headline risk bottom line is this: don’t be lured by headlines of trillion-dollar companies just as the Fundamental Gravity backdrop is about to make for a hostile work environment for technology stocks.

In addition to providing detailed analysis and trade ideas like this commentary on a weekly basis, we also provide real-time email alerts whenever we add, or close, a position in our Asset Allocation model or Gravitational 15 stock portfolio inside our Gravitational Edge report.

Please email us at ClientServices@WhaleyGlobalResearch.com if you’d like to participate in a an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.