All tech, all the time. That’s what most of the financial news coverage is about these days. Heck, even as I was writing this piece a CNBC segment called “The Next Big Tech Names” was running on television in the background, writes Mike Larson Wednesday.

I get it from a media standpoint. You want to talk about the “sexy” stocks because it boosts ratings. But from an investor standpoint, that’s myopic at best and dangerous at worst. Why? Because if you get swept up in the hype, you’ll miss out on the many, many more stocks that:

A) Offer much better dividend yields than the handful of tech/FAANG names we hear about 8,000 times a day ...

B) Operate in Steady Eddie businesses that are much less vulnerable to economic slumps, flattening yield curves, credit market crackups, explosions in volatility, or any of the other challenges thrown at us in the last several months ...

C) Aren’t the kind of stocks likely to suffer all-time record declines, wiping out $120 billion in investor capital in less than 24 hours (I’m looking at you Facebook (FB) ...

D) And most importantly, are actually outperforming the overhyped, overloved, overowned stocks the pundits and press can’t stop talking about!

I recently created a “Tech vs. DVD Plays” Screener using the advanced search and analysis tools available to Weiss Ratings Platinum subscribers. The idea was relatively simple: See how the tech sector benchmark ETF – the Technology Select Sector SPDR Fund (XLK) – stacks up against a range of higher-yielding ETFs that own stocks typically seen as more conservative and recession-resistant.

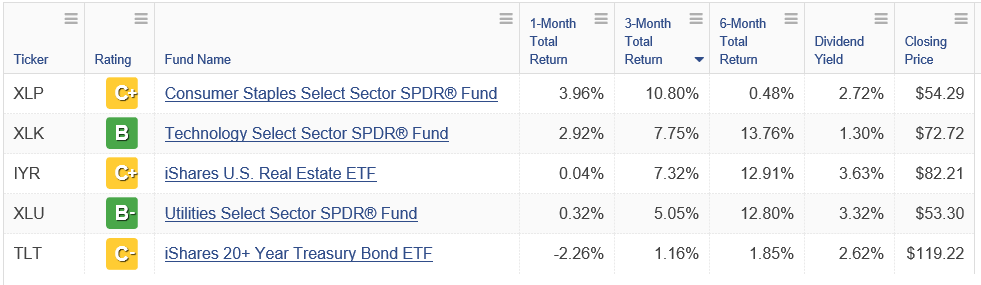

This is what things looked like when I sorted by 1-month total returns. As you can see, the Consumer Staples Select Sector SPDR Fund (XLP) ... an ETF full of “boring” names like Procter & Gamble (PG) and PepsiCo (PEP) ... returned just under 4% in that time period. The XLK that owns all the flashy names like Apple (AAPL), Microsoft (MSFT) and yes, Facebook, returned 2.9%. XLP also yields 2.7%, more than 2X the lousy 1.3% of the XLK.

Data Date: August 6, 2018

What about a slightly longer-term time frame? Well, see for yourself. This is a table showing how things stand over a three-month time horizon. On that basis, the XLP is up a hefty 10.8% ... while the XLK is up just 7.8%. The iShares U.S. Real Estate ETF (IYR) came in just a couple tenths of a percentage point behind the vaunted XLK at 7.3%. Plus, it spins off a yield of 3.6% - almost triple the XLK.

Data Date: August 6, 2018

On a six-month basis, XLK does pull ahead with a return of 13.8%. But guess what? The IYR is right behind at 12.9%, while the Utilities Select Sector SPDR Fund (XLU) is neck-and-neck at 12.8%. Yes, that means plain-ole, fuddy-duddy utility stocks are doing just about as well as their flashier counterparts in tech.

What’s the bottom line? You can invest most of your hard-earned dollars in highly volatile, high-risk tech names that have huge economic exposure and paltry dividend yields. Maybe you’ll catch the next Apple, and your stock will hit a $1 trillion market cap someday, too.

But what the TV guys don’t talk about is all the other tech stocks that can and are losing a fifth or more of their value in as little as a day. Facebook is the most glaring example. But I’ve shown you that plenty of other so-called “red hot” IPOs in tech and biotech have been collapsing lately, too.

At this stage in the economic and market cycle, don’t you think you’d be better off owning “Safe Money” stocks that offer a generous yield cushion? That operate in more stable industries? And that are either outperforming, or performing right in line with, the high-risk stuff?

It’s your choice, of course. But I know what I’m recommending to my Weiss Ratings’ Safe Money Report subscribers – and considering the returns many of those stocks are delivering for them, I’m confident they’re happy about it.

Until next time,

Mike Larson

Join me at the MoneyShow San Francisco August 23-25. You can see my speaking schedule, and get registered for free, by clicking here!

Check out Mike’s short video interview, Conservative Stock Picks for 2018 at MoneyShow Las Vegas here.

Duration: 3:33

Recorded: May 14, 2018

Check out Mike’s short video interview What Investors Are Doing Wrong and How to Fix It at MoneyShow Las Vegas here:

Duration: 2:22

Recorded: May 14, 2018.