Turkey it seems lives on foreign borrowings. They have nothing with their radicalism the majority in Western Turkey disdain. And the United States is pushing back to Erdogan with his insults and aggressive action within his country, writes Gene Inger over the weekend.

Channeling the various arguments, I tended to be skeptical of conventional linear technical views that simply carry the S&P 500 (SPX) straight-line higher. To me that was non-thinking straight-edge optimism, oblivious to all actual facts.

I have always prided myself to include the actual corporate or economic goings-on, and not just charts, as useful of course as they were to me.

In the early days of financial TV, I emphasized charts because the dissemination of factual information was not as swift or readily available sometimes, so you looked for hints in what I’d termed price and pattern behavior. I still do that, but now sometimes facts appear before price reflects it.

Then there’s something else to contend with besides trade. Turkish idiots in Ankara encouraging converting Turkish lira (TRY) into Gold. Russians threatening economic warfare if new sanctions come forth from Washington. China playing hardball instead of using wisdom to sort out the situation. And now Trump pressuring Turkey a bit more, with the doubling of tariffs on Turkish steel & aluminum.

Bill Baruch: 3 tradable events this week: Turkey, Retail, Crude.

The United States is pushing back to Erdogan with his insults and aggressive action within his country to his own citizens, to foreign nationals and his interference in foreign elections overtly (remember how he cajoled Turks in Germany).

I might mention that Deutsche Bank (DB) is down yet again, because systemic risk in Turkey affects them as the primary EU bank doing business there. I am not ready to pile-in to buy Turkish lira even at the maximum pressure, although one play to play an eventual recovery might just be DB stock. To a degree Paris-based BNP Paribas (BNP) is also heavily involved in Turkey.

Currencies aren’t pegged these days, so you get dramatic consequences that allow a slower-motion evolution. But they still play-out big changes. In this case, civilized nations can only hope Erdogan somehow is replaced in a country where only the retrogressive Eastern citizens really back him.

To say I have sympathy for Western-oriented Turks who hoped to be partners in the EU, or who are educated, would be an understatement. Erdogan on the right is about as helpful to Turkey as (on the left) Maduro is to people suffering in Venezuela.

**

At the same time there are variables like trade & tariff resolution versus a continuation of the global insecurities and unknowns. And realize a trade deal with China indeed may allow prices to rip higher temporarily. But we’ve suspected that’s down the road (or out of the blue) after we get a more meaningful S&P correction, while rotation into the broader market, as I’ve speculated, will be insufficient to offset pressures on (mostly) FANGs.

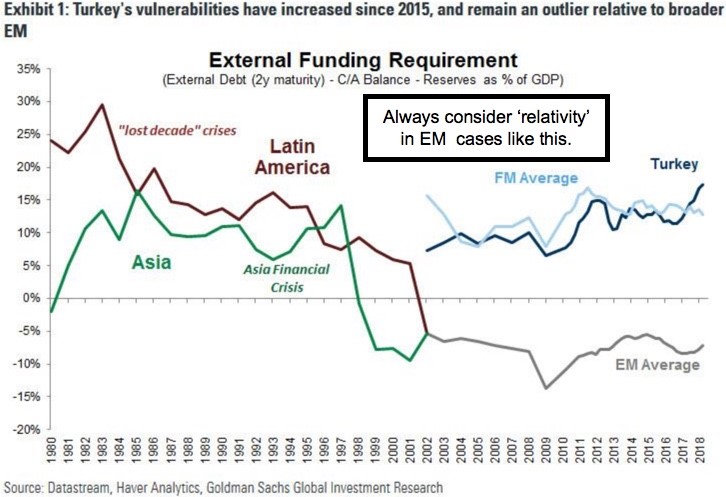

In-sum: Contagion in Turkey is just an example of what can happen. Who has noticed the mess that is the Russian stock market? And, of course, the huge declines in China and the Emerging Markets I’ve called submerging and warned to avoid all year long.

The instability overseas has shuffled a lot of funds into the USA. That is probably a part of what has restrained U.S. Treasuries from ramping higher sooner.

I think Turkey needs a policy shock by allowing a normalized central bank response; if the bankers aren't all in jail yet.

And in Turkey I have a prescription to turn things around: get rid of Erdogan or if not, get him to dramatically reverse his counterproductive policies by first of all dismissing all charges against normal people he persecuted.

But like Russia, that’s a non-starter unless it’s done very smartly. Otherwise he’s of course mostly fearful of being overthrown. (I suspected he engineered the phony coup a couple years ago and he is not at all smart like Putin.)