In this week’s Macro Theme, we review “Draghi’s Dilemma” and the opportunity it’s providing us on the short side of not only German equities, but French as well, writes Landon Whaley Wednesday. Join him at MoneyShow San Francisco August 24-25.

We rolled out this theme on March 19, but the rest of the world is just waking up to this Fundamental Gravity reality.

Fundamental Gravity says what?

Whenever we evaluate a market opportunity, we always begin with the Fundamental Gravity. The reason for this approach is because the two chief variables impacting the risk and return of asset prices are: economic conditions and how central banks respond to those conditions.

Together, these variables drive what we call an economy’s Fundamental Gravity.

We last updated our Draghi’s Dilemma theme on July 2, and since then there have been a number of bearish developments.

Let’s start at 30K feet with GDP growth.

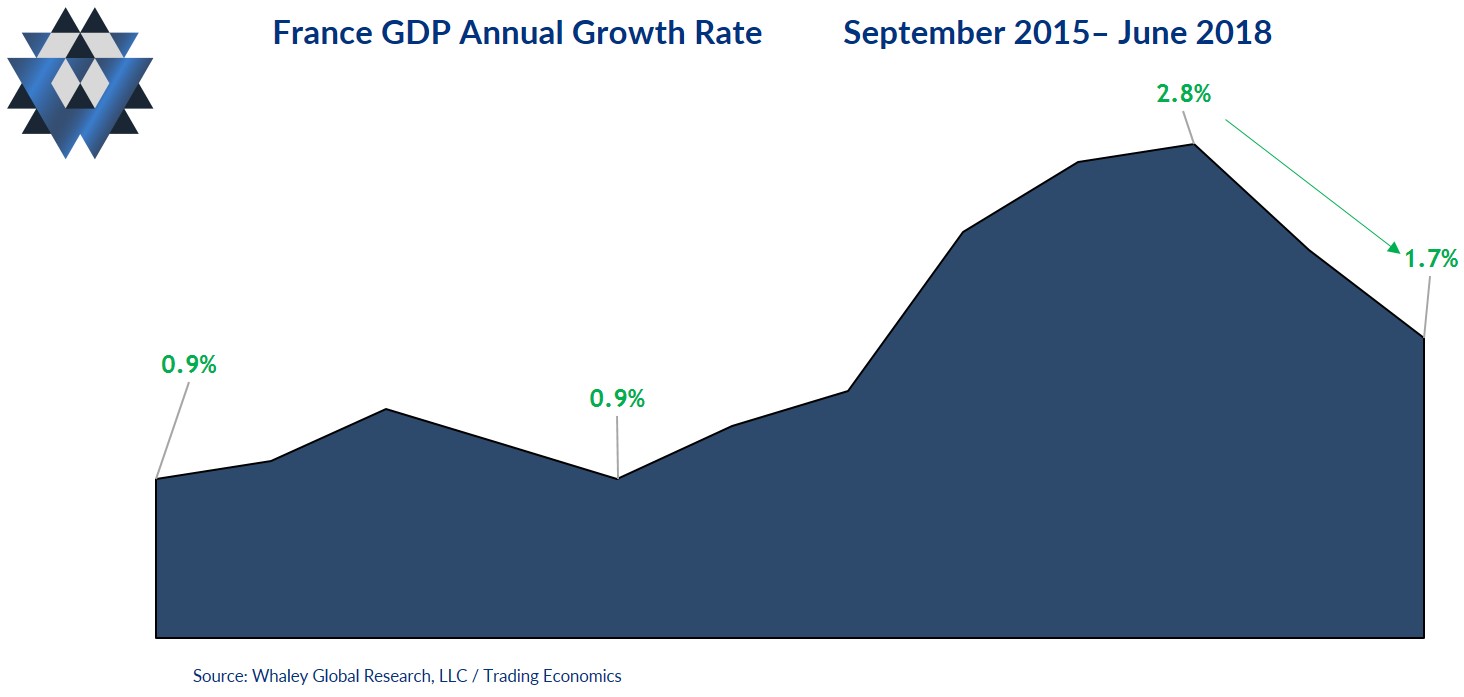

After four consecutive quarters of accelerating growth, France’s annual GDP growth slowed in the first two quarters of 2018.

INSERT FG CHART 1 HERE

If we look underneath the economic hood, it’s easy to see why growth has been slowing and why the most likely direction is for it to continue south.

France’s industrial production growth has been choppy for the two years, but has been on the growth side of the equator, at least until May. Then, for the first time in more than two years, industrial production growth contracted on an annual basis.

This slowdown in IP is confirmed by the latest Markit Manufacturing PMI reading, which shows that manufacturing activity in France has slowed markedly since peaking in December at over 58. July’s PMI reading is sitting at 53.3, which is the second lowest reading since 2016.

The slowing growth data is not isolated to the industrial side of the French economy: activity in the service sector is also deteriorating. The Service PMI slowed in five of the last eight months, which is why the composite PMI (a combo platter of the manufacturing and service sectors) also slowed in five of the last eight months.

Finally, on the consumer side of the ledger, retail sales declined rapidly in the first six months of the year. After peaking at 6.1% annual growth in November, retail sales have slowed in four of the last six months and are now growing at just 2.5%.

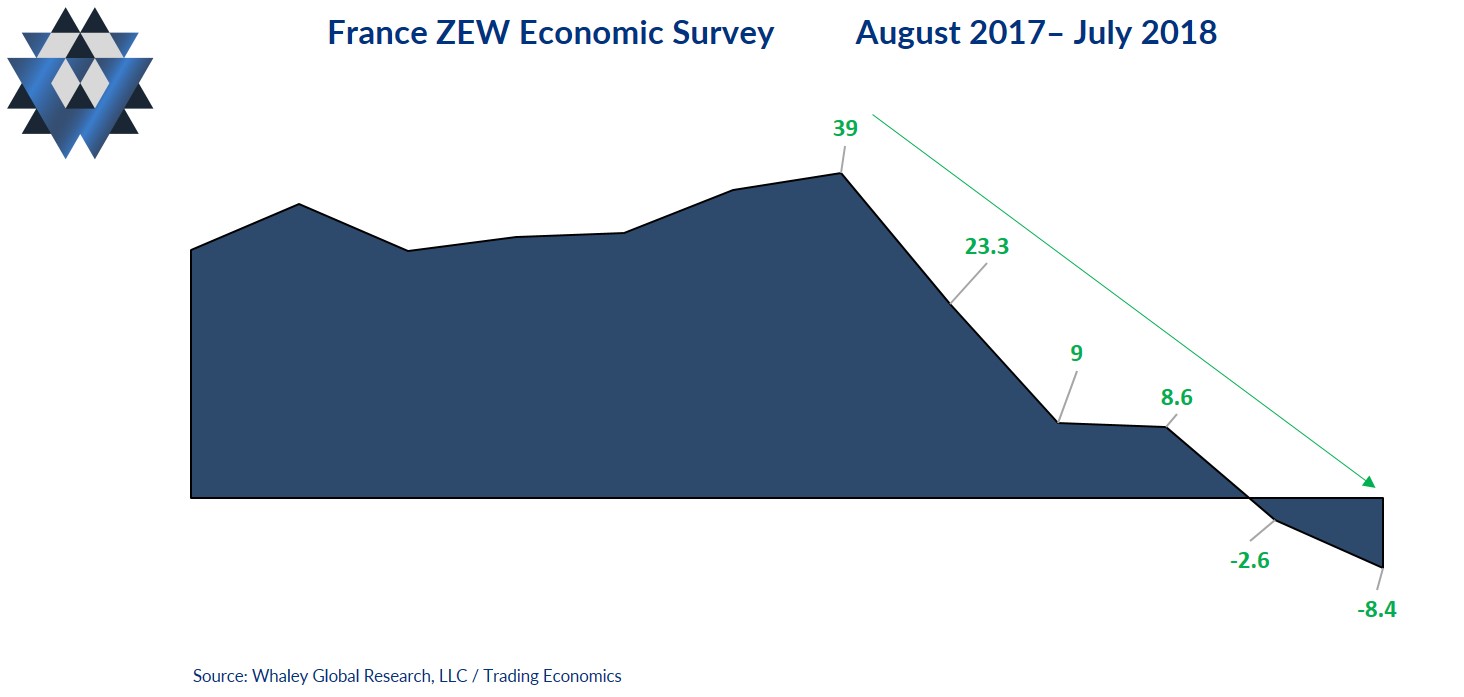

All of this deteriorating data confirms recent ZEW economic surveys. This survey asks 300 experts across France’s finance industry for their six-month expectations for the economy. France’s ZEW survey has declined for five consecutive months and has been negative for the last two. These negative readings are the first of their kind since 2016.

The current Fundamental Gravity is bearish for iShares MSCI France Index ETF (EWQ), as it averages a -0.07% quarterly return with an average drawdown of -11.1%. It posts positive three-month returns 52% of the time.

The Fundamental Gravity bottom line is that France’s economic growth has been slowing solidly for six months now, and the downside move across many economic data sets is just getting started.

This Friday, August 17, we will release part 2 of this commentary, which is where we will dig in to the other two critical forces, or gravities, that are currently impacting French equities: Quantitative and Behavioral. We will also provide a detailed game plan for trading EWQ.

If you can’t wait the 48 hours to get the complete picture for this macro theme and the accompanying trade details, please email us at ClientServices@WhaleyGlobalResearch.comwith the subject line “Draghi’s Dilemma.”

We will provide you with the complete macro theme breakdown as well as offer you the opportunity to participate in an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.