It is called the last mile, and it’s crucial to the future of all commerce. Yet most investors have never heard of it. There lies an opportunity. In self-driving vehicles, logistic technology and robots, writes Jon Markman. He’s presenting at MoneyShow August 24-25.

Bloomberg ran a story August 7 about a startup called Zume that uses robots to make pizza. Softbank, the Japanese investment behemoth, is in talks to invest up to $750 million.

But the real story is not the robots. It is the trucks.

One of the great success stories of the past decade is Domino’s Pizza (DPZ). The genius of the Michigan fast food chain was thinking about the category in a completely new way.

Getting the crust and recipes consistent was important. However, the game-changer was understanding something called abstraction. Domino’s managers insightfully removed all of the friction from ordering pizza.

The company became the Uber of takeout pizza, before there was an Uber. This was no small accomplishment, and shareholders have been rewarded ever since.

Zume wants to make pizza with robots. It has a bunch of them in its Silicon Valley pizza factory.

One, affectionately nicknamed Marta, plops marinara sauce onto flattened circles of dough then spreads it around. Another, named Bruno, removes the pie from the conveyor belt and gently places it into an 850-degree, double-decker oven for pre-baking.

The remainder of the cooking process takes place on the truck, equipped with 56 pizza-sized ovens.

This is where the real innovation happens …

Zume CEO Alex Gardner says cooking the product on the way to the customer will ensure the freshest and tastiest product on the market, delivered in about 15 minutes.

The financial end of the business is even more compelling. Gardner, a former president of Zynga Studios, the online game company behind Farmville and Words with Friends, says it is like Domino’s without labor costs.

Undoubtedly, that angle attracted Softbank.

In addition to a 15% stake in Uber, its Vision Fund has equity positions in Didi Chuxing, Ola and Grab, a who’s who of Asian ride-hailing firms. Recently, the fund led a $535 million funding round for DoorDash, a meal delivery startup that competes with UberEats.

These businesses aim to solve the same problems: They are experimenting with robots to remove friction and cut labor costs out of last-mile delivery logistics.

In the future, customers snap their fingers, and food will appear “automagically.”

3 companies set to profit from the last mile logistics trend

You won’t find Zume outside California, must less on a major stock exchange, in the near future. But that could all change soon enough.

In the meantime, Domino’s is the leading pizza player, not just at the last mile but also well before it. (Just ask my Power Elite subscribers how they like this stock. They are sitting on a tidy near-70% gain since I recommended it last year.)

But there are plenty of other stocks that are one step ahead when it comes to the last mile logistics trend …

Walmart (WMT) recently announced it was partnering with Alert Innovation, a startup that develops autonomous robots. Its Alphabots will help fulfill online orders, then deliver items from the warehouse to associates in the front of the store. When customers order online and drive to the store, an associate will deliver the packages to their car.

It is an idea that is driving the future of commerce.

In May, Kroger (KR) made a $248 million equity investment in Ocado Group, a British online grocer known for its best-in-class robotics fulfillment infrastructure.

The companies plan to build 20 state-of-the-art distribution hubs in the United States. And Kroger continues to work with Nuro, a Silicon Valley startup, on autonomous delivery vehicles.

In fast food, no restaurant company has embraced technology move aggressively than Domino’s. It has a self-driving car partnership with Ford (F), its Michigan neighbor, that will eventually remove all friction from takeout pizza.

It will be at least two years before Zume has a functional business model. Even then, there is no guarantee that consumers will prefer Marta and Bruno to actual humans — regardless of how quickly the pizza arrives.

It is why investors should forgo picking application winners … and focus instead on the companies that are facilitating the inevitable robot revolution.

The first name to consider in last-mile technology

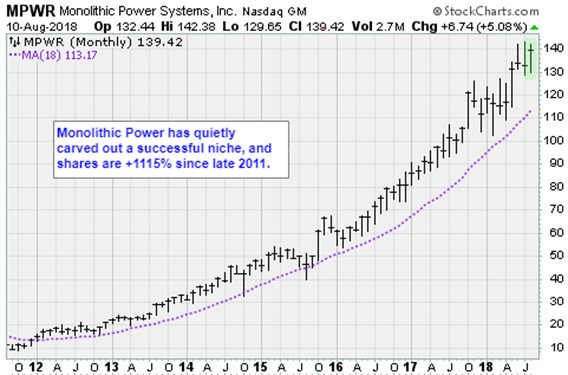

Monolithic Power Systems (MPWR) makes integrated circuits for the power systems used in consumer electronics, cloud computing, telecom, automotive and industrial applications.

It is a fast-growing, low-cost, high-volume business. One that Monolithic dominates with 55% gross margins. In fiscal 2017, sales grew 21.2% to $470.9 million, year-over-year.

However, the most exciting part of its business is the opportunity to grow as the industrial world moves toward networked robots loaded with sensors.

In 2017, Monolithic developed an integrated circuit that was 30% more efficient than those used in traditional electric motors. It generates less heat, more torque, and it is cheaper. It is also the perfect solution for a growing list of drones and industrial robots.

Gardner dreams of a time when those robots will be able to deliver a warm picnic basket of crispy roast chicken and a nice Chianti anywhere, moments after ordering the items online.

It’s a nice dream. It is all about the last mile.

Best wishes,

Jon D. Markman

P.S. Domino’s is eating all the other pizza chains’ lunches with its high-tech approach to building its business. And investors are paying attention to its “Paving for Pizza” initiative, which smooths over the potholes — literally — that hot pies encounter during the “last mile.”

DPZ shares have surged almost 70% since I recommended the stock last year. To get my next piping-hot profit play delivered to your inbox, and to get full access to all my freshest picks, click here.

I’ll be speaking at the San Francisco Money Show August 24-25. It will be a great show, with all sorts of experts sharing their insights. You can find more about that incredible conference by clicking here. I hope to see you there!

Subscribe to Jon Markman’s Power Elite newsletter here

Subscribe to Jon Markman’s Tech Trend Trader here

Subscribe to Jon Markman’s Strategic Advantage here