These days headline risks, like reality TV, come in many forms. writes Landon Whaley. Join him at MoneyShow San Francisco August 24-25.

One risk is when the biased perspective of a market grows so entrenched that it’s the only perspective you hear anyone discussing by people not normally attuned to financial markets.

An example of this is when your Meemaw asks you if she should buy this new thing called “Bitcoin” after it’s rallied 1600% in under a year.

Of course, the right answer if you care about your Meemaw and her eighteen cats is, “No! Don’t let your humanness force you to do the exact wrong thing at the exact wrong time.”

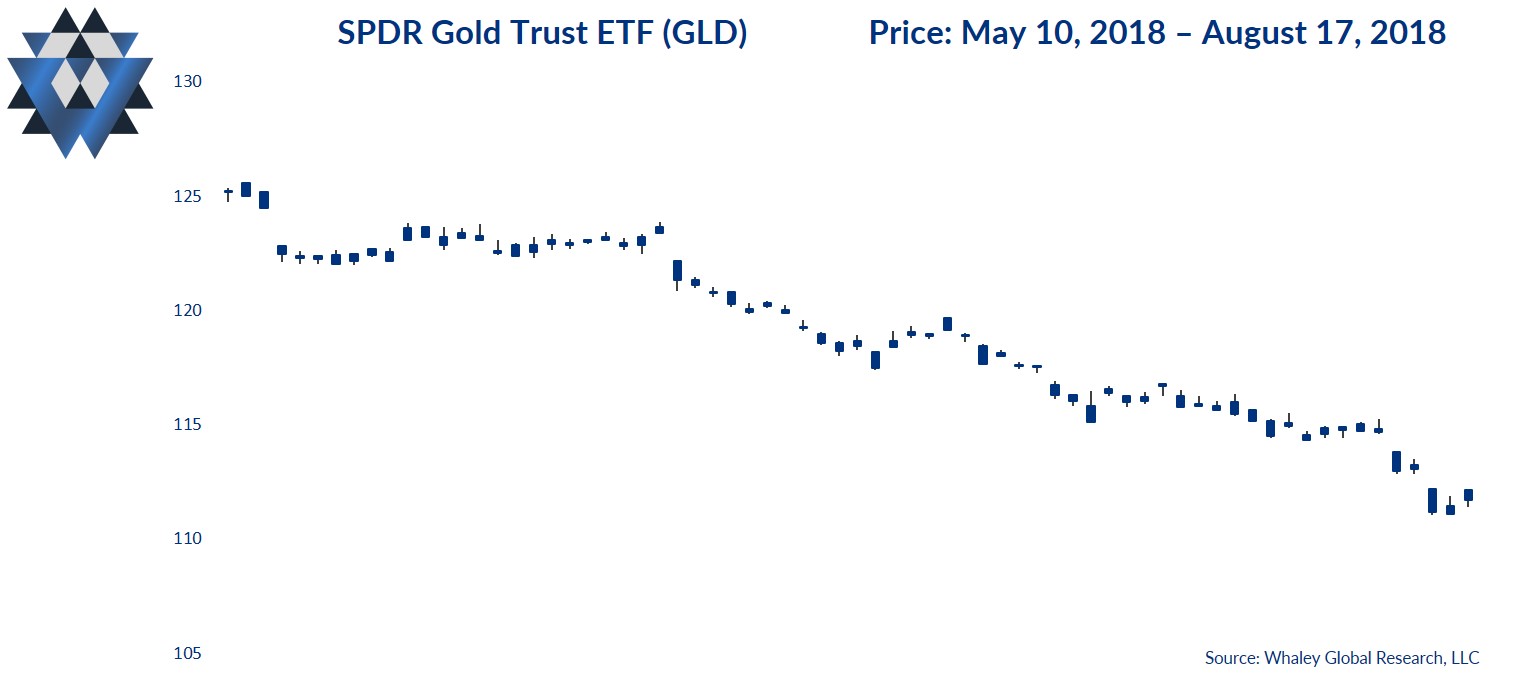

Well, we are seeing this exact same headline risk right now in gold.

Investors are as bearish on gold as Yogi and Boo-Boo. Perusing the latest Commitment of Traders report, which tracks the positioning of large and small investors in the gold futures markets, we can see that the trailing 1-year and 3-year Z-score of the current positioning is -2.5.

This level of Z-score indicates that investors are more than two times more bearish right now than they’ve been at any point over the last three years. More importantly, this bearishly skewed positioning is closing in on becoming the most bearish it’s ever been, which was at the end of 2015.

The timing of the last historically bearish positioning is extremely important. The end of 2015, specifically December 4, marked the bottom of a brutal bear market in gold, which had lasted over four years and taken 45% off the price of the barbarous relic.

In the ensuing seven months, gold bounced from a low of $1,045 an ounce to $1,370 by early July 2016. Can we interest you in a 30% gain in seven months?

We aren’t saying you should run out, get a second mortgage and load the hopper with gold. But, as we will reveal in a later commentary, the conditions in December 2015 that catalyzed that 30% rally almost exactly mirror the conditions we believe we will experience this December.

Bottom line, we are closer to a floor in gold than most believe.

And if you need one more sign that the bottom is probably in for everyone’s favorite “crisis hedge,” look no further than Wall Street. These guys are consistently the poster child for humanness in financial markets, doing the exact wrong thing at the exact wrong time.

Remember all the “internet” based mutual funds that launched in Q1 2000, after the Nasdaq had rallied 272% in the previous 24 months? Classic Wall Street.

This time around it’s not Wall Street, but Vanguard chasing where the market’s already been. They are moving their main precious metal fund’s focus away from gold: they recently announced they’re changing the name of their $2.3B Vanguard Precious Metals and Mining Fund (VGPMX) to the Vanguard Global Capital Cycles Fund. The name change is not merely cosmetic; the restructuring will allow them to widen the fund’s mandate beyond metals and mining, and to venture out to include cyclical companies as well.

This crowd-following move gives us the all-clear signal to buy gold. (For the record, the name change isn’t the only thing Vanguard is screwing up here. The worst equity sector on Earth to be invested in when there is an economic backdrop of growth slowing, inflation peaking—and eventually turning south—and lower yields, is cyclicals.)

We will alert you when it’s time to pounce on the bear and ride the new bull market in gold, but how will you know when it’s time to get out?

That’s easy: get out when your Mom calls you saying that she’s been hearing a lot about gold lately, and do you think she should melt down all of your deceased Aunt Edna’s jewelry before the price goes down?

Gold alert: Please email us at ClientServices@WhaleyGlobalResearch.com if you’d like to receive an email alert when we get long gold and to participate in a an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.