A concentration of active interest in a narrow handful of FANGs (or similar tech stocks) dominated the market as you know, and now is at risk of having oxygen sucked out of the marathon soon, writes our roving Trader Gene Inger Thursday from Malta, enroute to IFA Berlin.

In fact, a SalesForce.com (CRM) shortfall announced after Wednesday’s close may hint at analysts having raised earnings expectations about realistic goals in efforts to justify not only valuation concerns that so many think irrelevant, at least this Summer). It’s in order to keep the upside game going.

However, in the short-run, the progress toward a deal with Canada, perhaps by the self-imposed Friday deadline, not only earlier helped the upside, but may largely already be priced-into share prices.

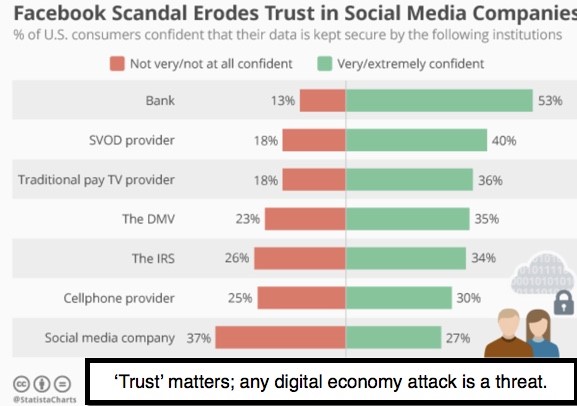

Of course, there’s nominal response to the latest social media bias concerns that well hear lots more about next week.

Google (GOOG) Thursday morning made it clear that they did not omit the president’s speech he claimed they did. At the same time they did not focus on a non-State-of-the-Union talk. This is a bit disingenuous since most media (and internet is media now) cover any and all presidential speeches and even off-the-cuff remarks... if they feel them newsworthy. That too begs the question about omitting any sort of formal presentation by any president.

Plausible deniability?

One reason getting some press relates to the Congressional testimonyto which Google is sending less than top people next week. And number 2 at Facebook (FB). And of course, its in the growing swirl that transcends President Trump’s vitriolic warning to a small number of the companies.

The New York Times has made this pretty clear, with an article based on a discussion with a Facebook engineer who sort of spilled the beans, about which I suspect financial media covered, as it does suggest bias even if as usual the president didn’t articulate it in a particularly articulate way.

Later, as Google will probably acknowledge a technical but unintentional bias to search, I suspect they will try to blame the bots which constantly are out there harvesting data and measuring which sites (or posts) get the largest number of hits.

Look for Google and Facebook to shift the focus at Congress, inferring that the issue isn’t internal bias (although the NYT’s candid Facebook engineer story largely contradicts that), but simply what is trending at a given time or has (as the term says) gone viral. And not that management adjusted bots or algorithms to have a tilt towards the Left, or of mitigating conservative or more Right-leaning posts or stories.

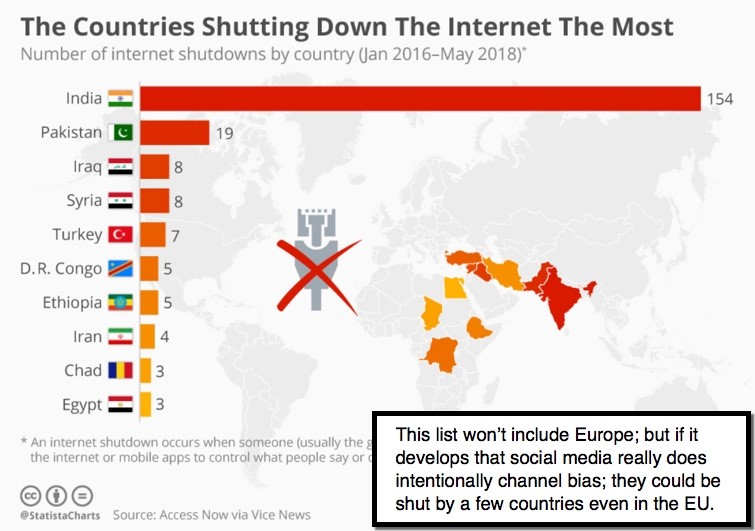

I suspect their explanation to Congress will both be a plausible deniability effort. And also slightly disingenuous as it’s clearly an aspect of editing that sites like Facebook, and especially Yahoo can shift to a better-balance, if they chose to do so. This matters here in Europe too.

So, if that happens to hammer Google, it will likely spread sector-wide. and be an excuse for some sort of shakeout.

You also are near the deadline for money managers to finish adjusting portfolios for the shifts of Google and Facebook from an IT ETF to the relatively new Communications ETF (both managed by State Street).

We suspected this could impact Google and Facebook (the other transferee).

The XLC is a much smaller ETF in regard to size, but this should increase over time.

**

I’m writing from Malta. Friday we disembark and fly to Berlin and then immediately begin IFA, the technology show through the weekend. It’s chilly and raining in Berlin, opposite of Italy-Greece by far of course. Ironically, I need a vacation from this so-called vacation already, but I’m afraid that will have to await returning to Florida.