Here at IFA in Berlin, in the panel on 5G they talked of rolling out the self-driving technology 10 years from now. What they meant was the technology starts now, writes our roving Trader Gene Inger from Berlin.

But by 10 years from now sensors will then be embedded in major roadways and true full autonomy will be feasible, experts say at IFA, one of the largest gatherings of the global technology industry.

I learned today that Level 2 of autonomous driving is now "available" on the 2019 Audi Q8. For sure this level will broaden-out to other models, and I speak for other manufacturers.

Audi is testing Level 3 autonomous systems currently as this technology advances using infrared and other sensors, including night vision. It's a hint of the direction that autonomous driving is going, even if fully autonomous driving is years away.

**

The downgrade on Tesla (TSLA) by Goldman Sachs basically affirmed everything I’ve said since $100 or more higher. Although I liked test-driving the Model S, competition is coming.

Paul Dykewicz: What Tesla traders should know about self-driving traffic jam ahead.

I’ve pointed this out for months and slowly but surely you see it coming.

Turbulent trade talks end to contribute to tension on the tape. However, that would be ongoing anyway, both from a global concern that I believe to a degree was enhanced when President Trump rebuked an EU interesting proposal to eliminate all tariffs on international products including autos.

Watch Canada as we resume negotiations Wednesday. Most consider Trump’s tweets as a negotiating ploy as the U.S. certainly will not be better off without a Canada deal.

NAFTA has been around for 25 years and we are intertwined. Plus, I have noted it’s more the currency issue with Canada, not labor rates.

Yes, they do need to balance some tariffs they impose on us (because this is a rare case where U.S. goods are cheaper when bought in another country).

That’s essentially the biggest obstacle to a deal. I believe that can be addressed two ways: either the trade talks. or firming the Looney (CAD).

**

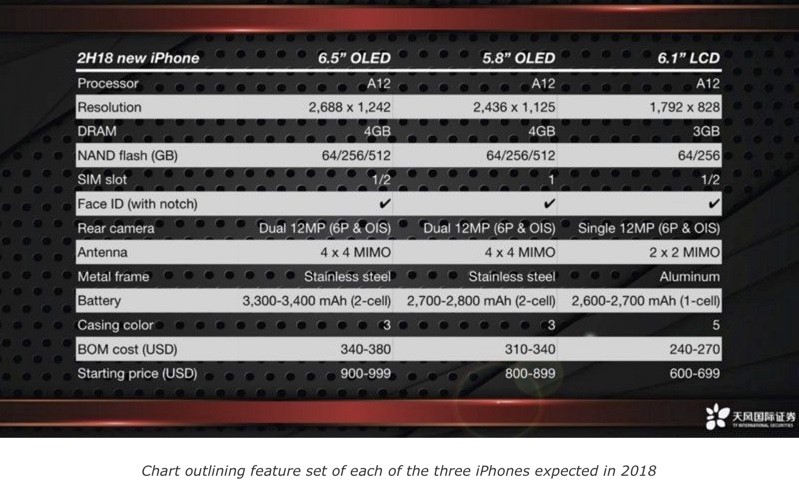

Tuesday morning protests against the Supreme Court Kavanaugh nominee, or the chatter about how many iPhones will sell in pre-release orders are of course noise in a market this high.

The market is really overextended, and failed to continue an early August shakeout because of false trade hopes.

Meanwhile, Wednesday you have gold and silver moving higher. I'm less pessimistic on them.

**

More scrutiny on social media is also an issue this week. And candidly it’s not going to help matters two months ahead of midterms to see the focus for most media shift from trade and rates to Bob Woodword’s new book that includes internal White House conflicts as well as what amounts to staff in the administration believing Trump has gone off the rails, regardless of an issues merit.

Any rallies this shortened four-day trading week are expected to be contained and controlled, aside a brief spike should a Canadian/U.S. breakthrough occur in trade. Stay nimble and don’t trust upside proclamations.