In this week’s Macro Theme, we review our “Cry for Me Brazil” theme, which we unveiled in May, well before Brazilian equities entered crash mode. It’s been a couple of months since we talked Brazil, one of our older themes. Cry for Me Brazil is still very active.

It continues to present us with opportunities to bet against the equity market down there via the iShares MSCI Brazil ETF (EWZ).

Fundamental Gravity says what?

Two chief variables impact the risk and return of asset prices: economic conditions and how central banks respond to those conditions. Together, these variables drive what we call an economy’s Fundamental Gravity.

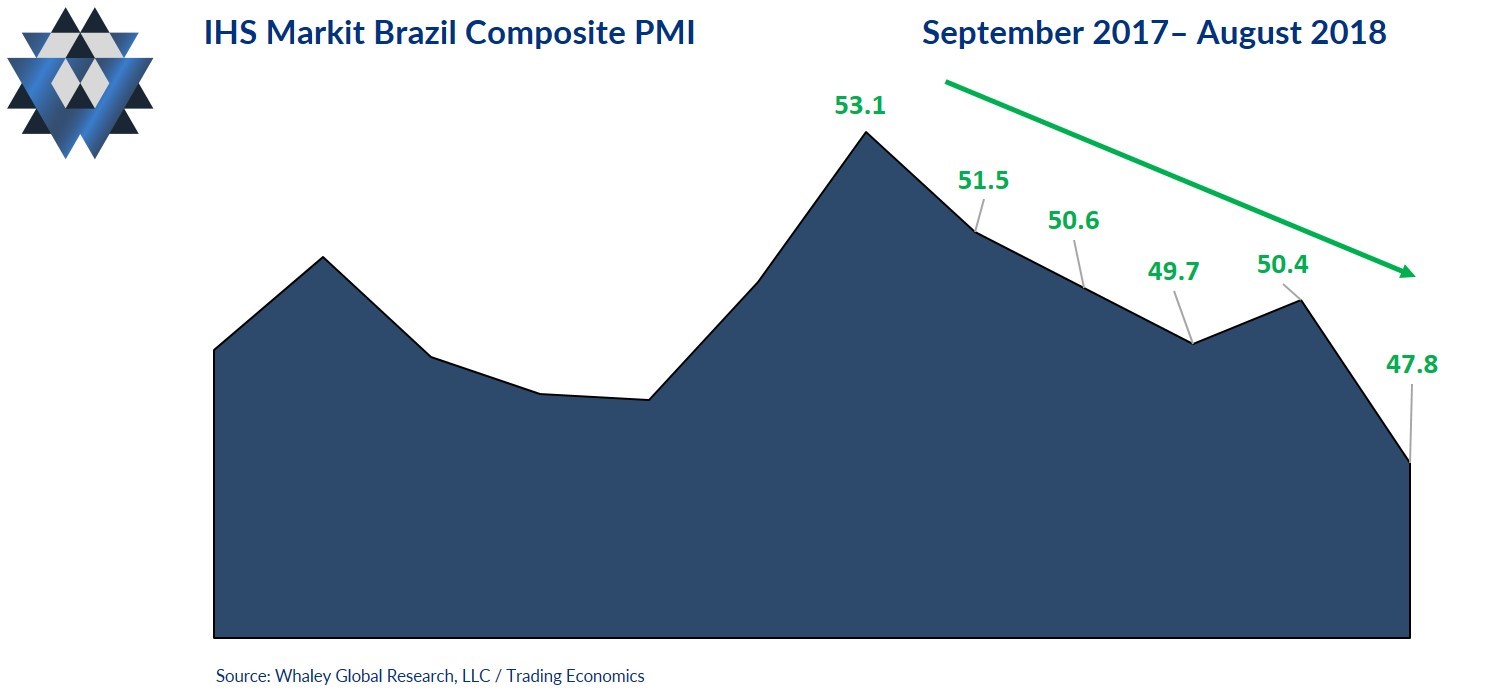

Let’s begin by looking at activity in Brazil’s service and manufacturing sectors. As of August, the IHS Markit Services PMI has slowed in five of the last six months and is currently sitting at the lowest level in over a year. The Manufacturing PMI slowed in three of the last five months and was in outright contraction during June.

Industrial production growth has slowed in three of the last five months and was also in outright contraction during June. The Brazilian consumer looks equally lackluster as retail sales growth has slowed in six of the last eight months and is currently sitting at a paltry +1.5%.

We aren’t cherry-picking here; most of the economic data down in Carnival land is deteriorating and remains solidly in bearish trends.

The reality is that with the Brazilian real getting the Salem witch treatment (declining -18.4% this year), foreign trade partners should be scrambling like Best Buy shoppers at 4 am on Black Friday to benefit from lower currency-adjusted prices, which would in turn give Brazilian exports a shot in the arm.

There’s just one little problem: the trucker strike in May (which required military intervention) has given the Brazilian logistics industry more than it can handle.

Exporters wanting to capitalize on the crashing real are booking shipping but can’t find trucks to deliver their goods to the shipping ports on time because of an ongoing dispute with drivers over freight prices.

It’s not just the economic side of the equation contributing to this bearish FG for equities, it’s the political environment as well.

We’ve discussed how the coming October presidential election is casting a bearish shadow, and that will last another month. In fact, just last week the right wing and leading presidential candidate Jair Bolsonaro was stabbed at a campaign event and lost 40% of his blood. Can you imagine how U.S. markets would react if a presidential candidate was stabbed?!

The Fundamental Gravity bottom line is that the combo platter of deteriorating economics and political uncertainty will continue to provide a bearish backdrop for Brazilian equities.

In Brazil’s current Fundamental Gravity, EWZ typically averages a -1.7% quarterly return, with an average quarterly drawdown of -17.5%. It posts negative three-month returns 53% of the time.

The Fundamental Gravity bottom line is that the combo platter of deteriorating economics and political uncertainty will continue to provide a bearish backdrop for Brazilian equities.

Cry For Me Brazil and shorting EWZ Part 2

This Friday, September 14, we will release part 2 of this commentary, which is where we will dig in to the other two critical forces, or gravities, that are currently impacting Brazilian equities: Quantitative and Behavioral. We will also provide a detailed game plan for trading EWZ.

If you can’t wait the 48 hours to get the complete picture for this macro theme and the accompanying trade details, please email us at ClientServices@WhaleyGlobalResearch.com with the subject line “Cry For Me Brazil.”

We will provide you with the complete macro theme breakdown as well as offer you the opportunity to participate in an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.