Bill Baruch, president and founder of Blue Line Futures, previews E-mini S&P, Gold, Crude, and Treasury markets and today’s economic report calendar. Follow his reports Monday-Friday on MoneyShow.com and short Midday Markets video.

Bill Baruch’s Midday Market Minute short video for Sept. 14 here.

Stocks slide on tariff talk Friday.

E-mini S&P (September)

Thursday’s close: Settled at 2905.25, up 16.75.

Fundamentals: We have said this before and we will say it again, the Federal Reserve is in the driver’s seat. Major U.S benchmarks notched terrific sessions Thursday with the NQ gaining more than 1% after the pace of CPI growth for the month of August softened from July.

We have been sounding the horn all week on how critical this read was coming on the heels of last Friday’s wage growth beat. What’s important to know is that the Fed is expected to hike in September and barring an unforeseen circumstance December is also a forgone conclusion.

What would an unforeseen circumstance be? Well, a complete fallout on the international trade front. And this is why we have said for months that the trade dispute has actually been a supportive factor for equity markets at times.

However, this third wave worth $200 billion in tariffs on Chinese goods is concerning as we believe it to be the official start of a trade war. Ultimately, after the Fed hikes twice more this year, they are expected to hike two or three times next year as their hiking cycle peaks.

On the other end of unforeseen circumstances is if inflation runs hot. This would force the Fed to move at a faster pace, hypothetically, to hike in January. For this reason, inflation data was ever-critical coming on the heels of wage growth poking its head above +0.3% for the first time since December.

Therefore, traders, as we expected, used Thursday’s soft CPI data as a reason to buy. Furthermore, a tweet from President Trump that implied no rush to make a deal with China was only a minor hurdle on the session

Technicals: Price action is now out above 2897.50-2900.50, a level we said Thursday that would lead to the next bull-leg higher. This is playing out with the S&P 500 (SPX) above the 2906.25 level, an area that has continuously exhausted rally attempts. Our near-term momentum indicators are rising this morning to ...

Today’s economic calendar

Today, Retail and Food Services August sales. In July, earnings, confidence and Retail Sales showed that the consumer is alive and well.

Advance estimates of U.S. retail and food services sales for August 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $509.0 billion, an increase of 0.1% (±0.4 percent) from the previous month, and 6.6 percent (±0.5%) above August 2017.

Today’s read along with a fresh look at September University of Michigan Consumer Confidence Survey will go a long way in continuing to confirm such; beats should open the door for higher price action and a test to 2924.50 today.

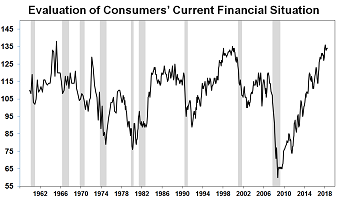

Consumer sentiment posted a robust rise in early September, reaching 100.8, the second highest level since 2004-only behind the March 2018 reading of 101.4. The gains were widespread across all major socioeconomic subgroups. The Expectations Index reached its highest level since July 2004, largely due to more favorable prospects for jobs and incomes.

Crude Oil (October)

Thursday’s close: Settled at 68.59, down 1.78.

Fundamentals: Crude Oil came back in Thursday. The selling below the $70 mark began to hit the tape just about the same time Hurricane Florence was downgraded to a Category 2. Ironic? Maybe.

The selling also came as fears of two other storms heading towards the Gulf began to dissipate.

However, Crude Oil often takes on a premium at the onset of a storm which is the height of uncertainty. Let’s not forget though that Wednesday’s EIA inventory report was actually bearish with a composite read being of a larger build than expected.

Furthermore, a strong technical band of resistance near $71 rejected the rally attempt.

For now, Crude Oil is in price discovery mode and while we remain long-term bullish the near-term swings fundamentally and technically will be tougher to predict.

Technicals: Price action is stabilizing above our major three-star support and this will be key heading into the weekend. However, as we discussed here Thursday, Crude Oil has overshot support each time it pulls back due to the overcrowded long trade. For this reason, traders and buyers must be prepared to see a move near ...

Gold (December)

Thursday’s close: Settled at 1208.2, down 2.7.

Fundamentals: Gold traded to a high of 1218, the highest since August 28. A soft read on CPI and a strong euro (EUR) following the ECB meeting was exactly what Gold needed. However, a tweet from President Trump saying that the U.S has no need to rush to make a deal with China, reversed gains on the session. While this did not send the Dollar Index (DXY) higher, it stopped did stop its bleeding, the effects were seen more so in the weakening of the Chinese yuan (CNY). The yuan remains a critical part the Gold trade and Gold cannot extend gains until the yuan is on the same page.

Today, we look to Retail Sales and the freshest of data points, the first look at September Michigan Consumer Sentiment. Data last month showed that the consumer is alive and well, any faltering today would subdue the dollar (USD) and act as a tailwind for Gold (barring negative news on trade, of course).

Technicals: The constructive consolidation continues as Gold tested and failed to hold ground near major three-star resistance at ...

View a short video: Bill Baruch: Trading Futures. Gold, USD, yuan.

Recorded: TradersExpo Chicago July 24, 2018.

Duration: 4:34.