Apple enthusiasts line up to buy the latest modestly-enhanced iPhones at 3 am, as all models are available, including SIM-free ones. It sounds like ample supply. Why not, especially for the XS, asks Gene Inger Friday.

The XS is basically the same phone as last year’s with the only big difference being it works far better for T-Mobile (TMUS) as it supports their newer 600 MHZ band that the prior cellular chip did not.

All other carriers will simply see faster throughput due to better LTE but it’s all minor.

Others are waiting for the iPad Pro re-do (perhaps next month). I do predict the base Apple Watch 4 will be a huge seller. That is due to both built in ECG capability and a help me I’m falling automatic sensor too. (It’s notable that Apple is designing for more than just joggers with these devices.)

AP: How the Apple Watch is inching toward becoming a medical device.

**

Meanwhile, the market performance has been anemic, but recovered Friday a bit from the morning shakeout on trade news.

Reuters: Wall Street flat Friday as Trump gives go ahead on China tariffs.

**

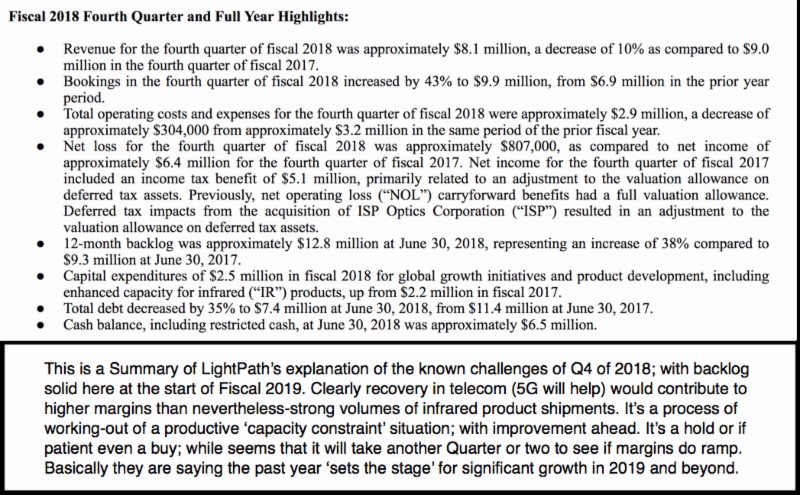

Also falling slightly was LightPath Technologies (LPTH) whose audited earnings were a tad shy of the preliminary numbers Thursday.

CEO James Gaynor (suffering from a respiratory bug) explained the transition and efforts, pretty much as we had surmised most likely. Edited transcript of LPTH earnings conference call Sept. 13, Thomson Reuters.

The shares might dip and find buyers if so.

Since while not perfectly clear from the conference call, it seems like they expect a turnaround (of course they should) in telecom due to 5G rolling-out.

And better margins in the infrared product line, where they actually had capacity constraints that will be eased as new equipment is installed or consolidated from New York. (That is a move I actually asked about when visiting LightPath several months ago in Orlando.)

At this point Gaynor indicated that although Chinese commodity prices of course rose (the reason for their new glass) there is no tariff impact at all.

**

Bottom line: it’s easy to get frustrated with this market or complacent, at one’s peril I suspect.

There’s almost zero upside enthusiasm in the market Thursday and if not for Apple alone, the market would have hardly advanced as it did. Risks are not diminished.

**

Friday morning the market is grudgingly snapping back (essentially running-in shorts) after the logical statement of tariff implementation by the White House. The implication is that China has not yet accepted an invitation to renew negotiations.

We should see a bit more S&P improvement even if we fade again later in the day.

The quick hit the S&P 500 (SPX) just took relates to Trump still wanting $200 billion in China tariffs implemented.

There really is no surprising news in this, and those shorting weakness will probably see rebounds.

However, there is no change in our view of the market as vulnerable and rather defensive this afternoon.

Market upside is limited and would not be surprised to see some slippage later.

Meanwhile, little LightPath absorbed the selling on their audited report and is actually firming Friday.

**

We continue to have re-balancing ongoing in several ETFs, including the shift we forewarned about involving the Technology Select Sector SPDR Fund (XLK) and the newer NYSE Arca Computer Technology Index (XCI).

That has been more beneficial to Verizon (VZ) and AT&T (T) than to Facebook (FB) and for Google (GOOG), both of which likely are trimmed by managers using those funds.