First of all, we would like to take a minute to remember all those that lost their lives some 17 years ago Sept. 11, 2001. We will remember that day for quite some time, writes Nell Sloane recently.

In fact it was on this day, a sunny crisp Tuesday morning that our phone lines went down to our trading partners inside One World Trade Center at Cantor Fitzgerald.

We knew right there and then that something was up, and we watched it unfold right before our eyes. Being on the floor of the CBOT, we evacuated and left the city for fear that we might be targeted next.

We will never forget those and their families who were so tragically affected that fateful day. We will acknowledge their memorial this time every year for as long as we can.

**

There’s a lot to get to.

First we would like to thank Anthony Crudele and the crew at Futures Radio Show for allowing us the opportunity to talk about our views on the markets and trading. The link to the show can be found HERE

**

We also want to thank Greg Winterton at AlphaWeek for the great article they put out this week. He is the founder of AlphaWeek an informative and vast resource for every investor. The link to the article about Magnelibra and the Blue Dragon Program can be found HERE.

**

So, the obvious news two weeks was the non-farms payroll report which put in a respectable +201k which beat expectations mildly, however both June and July were revised down a combined total of 50k jobs. The larger and more inflationary issue arose as the YoY growth in avg. hourly earnings hit 2.9%.

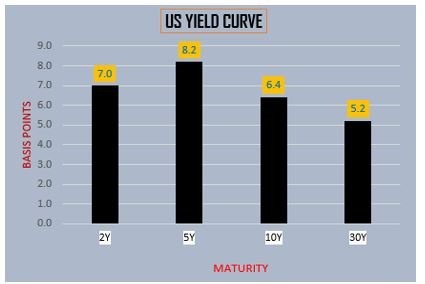

U.S. Treasuries took exception and felt the Fed would continue their hiking ways and yields rose. As you can see from this chart of the U.S. yield curve from Sept. 7 settles, shorter dated yields rose higher in comparison to their longer end counterparts:

**

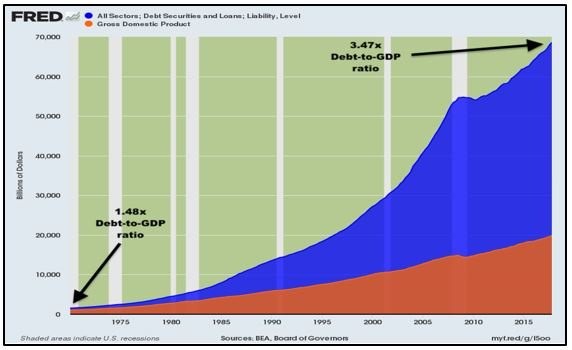

We also read a great piece from Adam Taggart via PeakProsperity.com and also found on Zhedge. Adam posted a chart that really encapsulates how America’s growth has been driven via debt and not organic savings and investment.

What is worse is that the debt/growth regime is subject to the laws of mathematics and diminishing returns. It takes increasingly more debt to generate $1 in GDP return.

Countries can get away with this for a little while, but you can guess why shorter interest rates are truly still zero. In the land of mathematics, you can’t have your debt issuing cake and eat your interest too, there are limits.

Meaning we can keep the debt train rolling, but eventually the debt service payments will overwhelm your regime, and it’s not a matter of if but when, can you say $1 trillion-dollar deficits:

**

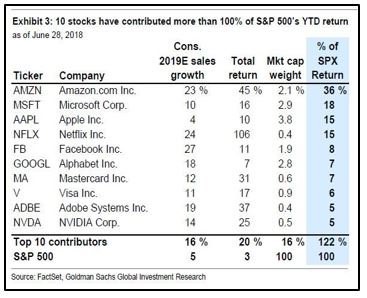

Zhedge also had a piece from Nomura posting this chart, which if it isn’t obvious by now, just a very few securities are pulling all the weight.

What happened to all that Chicago U. Efficient Market Hypothesis, is this what they had in mind? Four companies accounting for 84% of all the S&P 500 (SPX) market returns?

As this next chart points out 10 stocks have contributed to 100% of the return so far this year:

Ok, so what else did we read last week?

The WSJ had a great article on the CBOE planning to implement a “speed bump” to try and level the HFT playing field. We are a big fan of such constructs and believe that the field is plagued by predatory latency arbs.

**

TNB USA vs. NY Fed. In another interesting article, highlighted the ongoing battle between a new bank called TNB USA, run by a former NY Fed staffer no less, is suing the NY Fed for unfairly preventing them to pursue their business model.

Which isn’t a noteworthy or feat of any genius, rather the design is simple, it’s an interest rate arb, that will exploit the guaranteed IOER upper limit that is only available to those with a Fed account.

We doubt that TNB will win this case, for fear of precedent and the Federal Reserve is quite formidable to say the least, but good luck.

**

Burberry stops burning: In a lighter note, we read that none other than Burberry (BURBY) is disavowing their practice of wastefully burning excess inventory, which was reportedly valued just short of £30 million last year.

We first highlighted this practice in a note a few months back, one which certainly does not stick with the so-called green initiative. We wonder how this will affect their brand and whether or not some will opt to wait for excess supply to be discounted as opposed to paying full price.

In economics we studied this practice and in fact it is very effective at protecting brand value. We just aren’t sure if this is a change in their ways or just a temporary “saving face.”

**

Not helping Ford Motor Company (F) shares this week and which are already down some 24% this year, is a recall effecting 2 million F-150 models.

This comes at a time where Ford is eliminating most of their sedan models and opting to focus their core production fleet on trucks.

We aren’t quite sold on that move, but maybe it’s a way to hide the fact they are streamlining production and ops in order to enact much needed cost cuts.

**

Our condolences to the family of Burt Reynolds, the Hollywood Icon who died last Thursday at the age of 82. We didn’t know he had a football scholarship to play for the FSU Seminoles, but instead decided to go into acting, Smokey and the Bandit, Deliverance, The Longest Yard, #Classics.

Cheers,

Nell

Subscribe to Nell Sloane's free Unique Insights and CryptoCorner newsletters here