Of course, there are arguments as to why China should or should not bow to U.S. demands, and the inverse, writes Gene Inger. And more about FAANGs topping, iPhone screen size and pricing and how LightPath Technologies washed out then gained Friday.

And of course, the Emerging Markets are still in Submerging Market mode outlined all year long. What’s unclear in various ways, and with varying perspectives on China’s resolve, whether or not it’s justified, and whether a trade deal (if one occurs) changes that.

In an analytical sense I think most miss a point: get a fair deal and you’ll extend the market’s move. Then run right into the midterm election risk, which isn’t clear either.

Fail to get a deal and clearly, it’s a catalyst as we’d already discussed. The importance can’t be underestimated and not just in consideration of supply chain issues and so on. Neither can the fragility of the overall market, at these extended levels.

In-sum: The debated issues are pertinent. while the market is fully valued in so many areas, almost regardless of how the known challenges sort out.

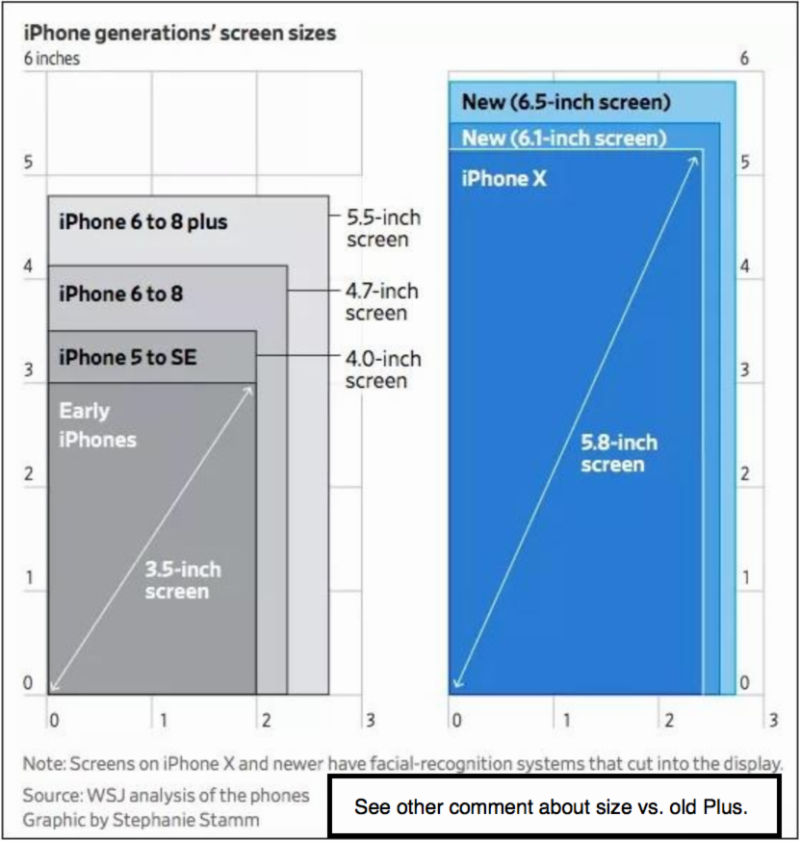

Most FANG and other stocks we warned of topped Monday: Google, (GOOG) Apple (AAPL) and Amazon (AMZN) a few of them, plus Netflix (NFLX). They topped, tested and are declining.

That’s why risk appetite is reduced, as it would be at these levels, with or without the negotiation struggle and tensions with China or others.

A stock market having moved to levels reflecting the eased regulatory environment (of course not agreeing with all the changes. But again, the market liked it, and the tax cuts (more so than reforms), is exposed to risk regardless.

**

As suspected, LightPath Technologies (LPTH) had a little washout Friday after “lighter than preliminary” earnings were reported.

We thought that would provide a spot for long-term speculative investors (not traders) to enter if patient for a quarter or two to see how business pans-out. (Primarily because of my thought that revenue from new contracts would be pushed into Q1 of 2019 that we're now in, rather than reflected in Q4 of 2018.)

Perhaps that’s why the shares not only rebounded as anticipated. But they absorbed a downgrade from Dougherty (one firm that covers it) to neutral. They observed as did I, that the infrared backlog and growth is in the backdrop looking forward.

I add to that the 5G prospects as telecom should ramp-up for them as well. So, the shares notably managed to both wash out then deliver a daily gain.