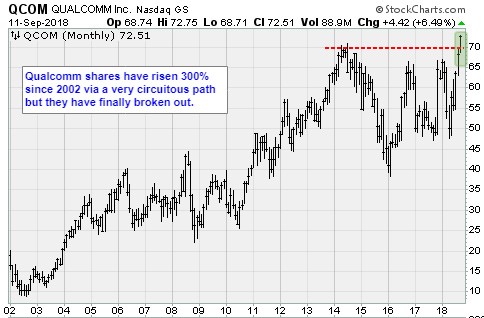

Qualcomm stock is up 13.2% this year, and 42.2% during the past 12 months. Market capitalization has risen to $102 billion. Shares now trade at 16.4 times forward earnings, not expensive given the outlook, says Jon Markman, who's presenting at MoneyShow Dallas Oct. 3-4.

China is likely to win the race to next-generation wireless technology, according to analysts. Good for them, but not so much for the United States. In fact, the negative consequences for the U.S. of losing could take decades to overcome.

Deloitte, the global consulting firm, released a research report the week of Sept. 7 about the state of fifth-generation wireless infrastructure deployment.

The takeaway: China is miles ahead. And its lead is growing.

Investors should ignore politics and focus on the implications.

The speed 5G is not merely an upgrade from 4G/LTE technology. It is orders of magnitude better.

Several telco hardware-makers have demonstrated download speeds of 10 gigabits per second. That’s a 1,000-times improvement over 4G. Latency will shrink to 1 millisecond, from the current LTE standard of 50 milliseconds. Network capacity will improve, too.

Related story: Why 5G networks will be a game-changer

This is a quantum leap. One that will unmoor infrastructure from cables and wires. It will mean connected and self-driving vehicles. It will bring true broadband to remote locations. Virtual reality and the mobile internet will blossom with fast, always-on, always-connected, real-time experiences. Factories will benefit from ubiquitous sensors and networked smart robots.

These new technologies are key to future world economic growth.

It’s no coincidence that self-driving cars and robotics are core components of Made in China 2025. The set of overarching goals is designed to push the Chinese economy away from low-cost, low-margin manufacturing. Taking the lead in forward-thinking technologies would put the communist country in the same league as Germany, Japan and the U.S.

The Chinese have spent $24 billion to build 350,000 new cell towers since 2015. As the South China Morning Post reported in June, the Ministry of Industry and Information Technology is forecasting an investment of $411 billion through 2030. For comparison, since 2015, only 30,000 towers were constructed in the U.S.

In 2016, the Economist predicted data network effects would fuel the rise of the new economy.

A decade ago, Facebook (FB) and Netflix (NFLX) benefited handsomely by growing their networks. More connections boosted the value of the network to users, leading to even more users … and more connections.

Even in the midst of privacy controversies and rising prices, users have remained captive.

The 5G networks will not be limited to connecting people consuming information. Next-generation networks will connect all sorts of things capable of exchanging data all day, every day.

Connections beget value and, in turn, more connections.

U.S. social and media networks built dominant positions by understanding these interactions. They automated and innovated processes at scale. By deploying 5G first, Deloitte analysts fear the Chinese are about to do the same with data networks. The result would be a decades-long lead in tomorrow’s technologies.

Ultimately, the Chinese are playing by a different set of rules. Authoritarianism allows state agencies to collect unprecedented amounts of personal data. Meanwhile, western democracies rail against the opaque privacy policies of Silicon Valley and Europe.

Investors should focus on the opportunity. The money will follow.

Here’s where it currently leads …

Qualcomm (QCOM) designs integrated circuits for the telecommunication industry. Since the dawn of the smartphone era, its intellectual property has dominated the sector.

The Financial Times reported in January that the San Diego company signed an agreement with a consortium of the leading Chinese smartphone makers. Their goal is to launch 5G devices in early 2019.

In August, the company settled a long-running anti-trust dispute with Taiwanese regulators. Qualcomm agreed to pay $93 million in fines. Plus, it will invest $700 million in Taiwan over the next five years.

Although the terms may seem steep, the company will maintain its controversial licensing model based on handset selling prices.

Smartphones are arguably the least interesting use case for 5G wireless technology. However, Qualcomm’s alliance with Chinese OEMs and the settling of legal skirmishes puts the company’s intellectual property in a steering role for future applications in Asia.

Eventually, connected cars, VR headsets and billions of sensors in the field will all need low-power processors, modems and antennas.

To the detriment of the U.S., China is going to win the 5G race. Qualcomm managers bet well. Now shareholders are set to win.

Best wishes,

Jon D. Markman

Subscribe to Jon Markman’s Power Elite newsletter here

Subscribe to Jon Markman’s Tech Trend Trader here

Subscribe to Jon Markman’s Strategic Advantage here

I’ll be speaking at the Money Show Dallas Oct. 3-4. It will be a great show, with all sorts of experts sharing their insights. You can find more about that incredible conference by clicking here. I hope to see you there!

Jon Markman's 5 tech stock picks, in a short video.

Picks: GOOG, AMZN, MSFT. Companies turning the hardware of the cloud into software: Arista Networks (ANET), Nutanix (NTNX).

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 5:13.