I don’t know if there are 50 of ‘em. But when it comes to investing, there are shades of grey – and that’s an important lesson I think many people forget, writes Mike Larson, who's presenting at MoneyShow Dallas Oct. 4-5.

You see, over the two decades I’ve been in this business, my outlook on the markets has been all over the map. There are times when I’ve been incredibly Bullish, like right after President Trump’s election in 2016. I advocated being essentially 100% invested based on the revised fiscal policy outlook (and regardless of anyone’s personal feelings about him).

Then there are times I’ve been incredibly Bearish, like right around the peak of the housing bubble in 2005/2006. I urged our readers and investors to get the heck out of anything related to real estate, housing, and financials -- and later, the entire stock market!

But there have been many other times where my stance was somewhere in between. Where my view was neither black nor white, but one or another shade of grey.

Take right now, for instance. I’ve had the pleasure of getting out of the office and meeting with and presenting to hundreds of investors just like you.

My next event is the MoneyShow Dallas, which runs from Oct. 3 through Oct. 5. You can attend for free by clicking this link and registering. Or you can contact the MoneyShow team directly at 1-800-970-4355.

Not long after that, I’ll be headed to the New Orleans Investment Conference. It runs from Nov. 1 to Nov. 4 in the Crescent City, and you can register to attend by clicking this link. Or if you prefer, you can call 1-800-648-8411 for more details.

At both of those events, I’m going to talk in great detail about the Everything Bubble, something I’m going to refer to as the “Uber Bubble” from here on out. After all, the word “uber” means “being a superlative example of its kind or class” and “to an extreme or excessive degree” according to Merriam-Webster. The reckless borrowing, lending, and investing behavior in many markets ... to say nothing of the extreme valuations in many asset classes ... clearly means this qualifies!

Plus, the valuation of Uber the company, the behavior of its executives, and the way investors are treating it and other radically overvalued, overhyped, and overowned public and private tech firms makes it the perfect case study of the phenomenon.

I’m convinced that the unwinding of this Uber Bubble is going to be THE driving force for markets over the next few years, with implications for stocks, bonds, real estate, and a whole host of other assets.

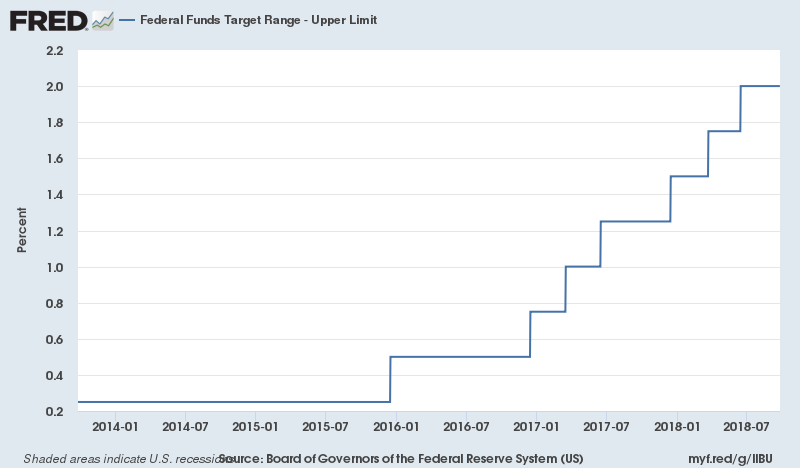

With the Federal Reserve about to hike interest rates for the eighth time, the pressure on asset markets is continuing to build, too. You can see here that the benchmark federal funds rate is about to breach the 2% mark, after spending a record eight years pegged near 0%.

That said, I’m not in “dump it all” mode ... at least not yet. I told you earlier this week about one stock that’s performing very well for subscribers to my Weiss Ratings’ Safe Money Report. I’ve also been arguing for several months that there are plenty of “Safe Money” style sectors that have been outperforming and still look attractive.

Yes, I believe you have to maintain a higher allocation to cash given the greater uncertainty and volatility in this market, as well as where we are in the economic and credit cycle. But you can still find value – as long as you’re not messing around with “Garbage IPOs”, overhyped herd-mentality stocks, and other risky investments.

So, be sure you keep your eyes peeled for new recommendations here and in my Safe Money Report. And if your travel plans permit, consider joining me for an even deeper dive into the markets in Texas and Louisiana soon.

Until next time,

Mike Larson

Check out Mike’s short video, 2 Safe Yield Stock Picks at MoneyShow San Francisco here.

Duration: 4:42.

Recorded: August 24, 2018.

Check out Mike’s short video interview, Conservative Stock Picks for 2018 at MoneyShow Las Vegas here.

Duration: 3:33

Recorded: May 14, 2018

Check out Mike’s short video interview What Investors Are Doing Wrong and How to Fix It at MoneyShow Las Vegas here:

Duration: 2:22

Recorded: May 14, 2018.