In this week’s Macro Theme, we review “Slowing Dragon,” which is the macro theme we’ve been using since March to short Chinese equities. The iShares China Large Cap ETF (FXI) recently had a nice two-week, +9.5% countertrend rally, writes Landon Whaley Wednesday.

This is a typical dead cat bounce experienced by entrenched bear markets.

The bearish Gravitational developments in China over the last six weeks continue to present us with opportunities on the short side of FXI.

Fundamental Gravity says what?

Two chief variables impact the risk and return of asset prices: economic conditions and how central banks respond to those conditions. Together, these variables drive what we call an economy’s Fundamental Gravity.

Since our last update, we’ve received several months of Chinese data showing more of the same slowing growth we’ve been calling out since last November.

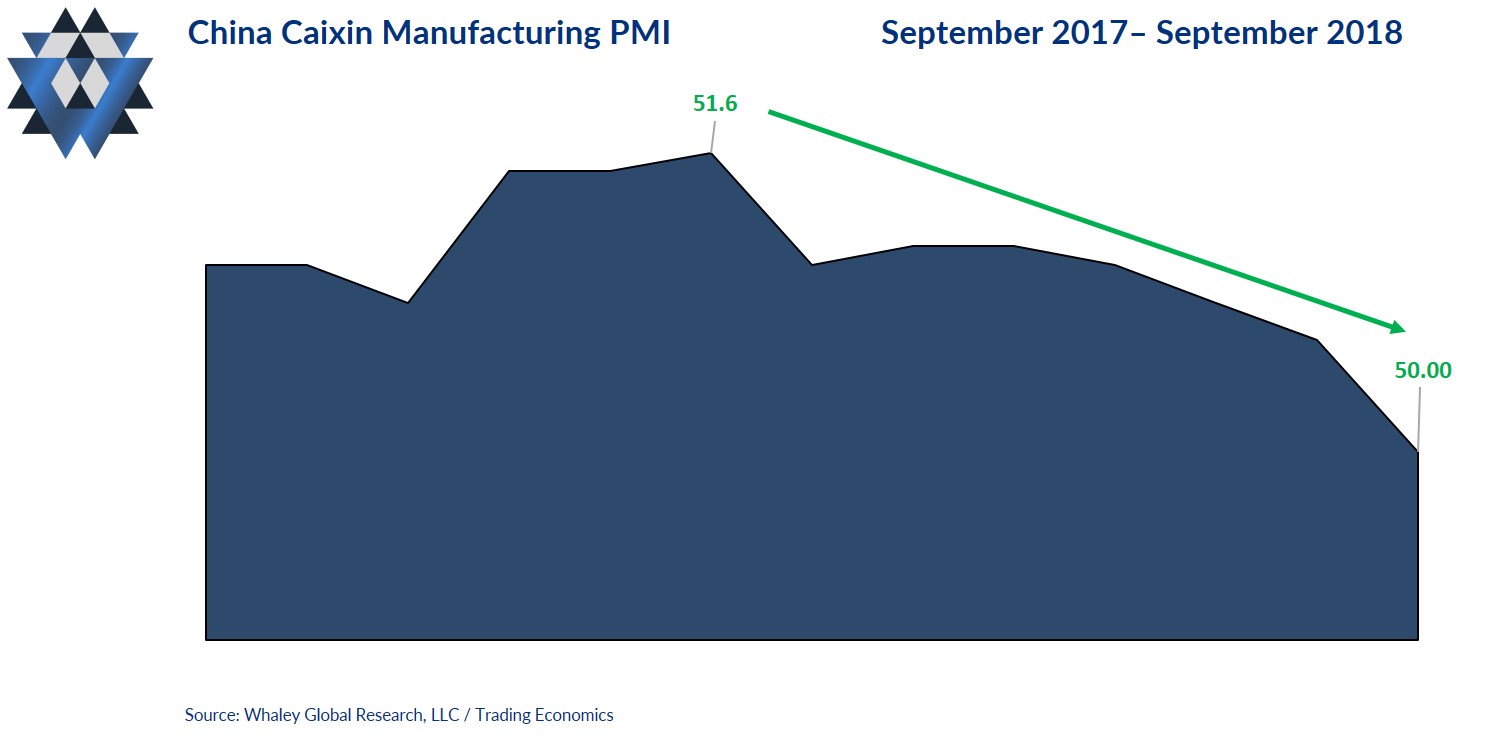

The latest reading of the Caixin Manufacturing PMI came in at a flat 50.0, which is the threshold between expansion (>50) and contraction (<49.9). September was the fourth consecutive month of slowing and the fifth in the last seven. Things were ugly beneath the hood as the export orders sub-index fell at the fastest pace in over two years.

The government’s own manufacturing PMI painted a similar picture, slowing to 50.8 in September from August’s 51.3. This marked the third month of “official” slowing data in the last four. Here again, it wasn’t just the headline number that confirmed the downward trajectory of growth: all the major sub-indexes showed growth at a slower pace in September.

The production index fell, and both the new export order and imports indices fell and are now at the lowest levels since February 2016. The employment index fell, as did the suppliers' delivery times index. Why do we care about this last index? Because longer suppliers' delivery times indicate weaker domestic demand.

Bottom line is that China is getting hit from all sides with a bearish combo platter of waning demand, both foreign and domestic.

And just in case the data doesn’t do it for you, The New York Times reported that a government directive sent to journalists in China on September 28 named economic topics to be “managed.” The list of items the government wants censored managed is amazing: worse-than-expected data that could show the economy is slowing, local government debt risks, the impact of the trade war with the United States, signs of declining consumer confidence, and the risks of stagflation (rising prices coupled with slowing economic growth).

The bottom line is that the economic data confirms that China is in a Fundamental Gravity #3 environment, and the government’s attempts to obfuscate this reality is just further evidence of the bearish trajectory of growth.

Chinese equities don’t care for an FG3 environment: FXI typically averages a -4.4% quarterly return, with an average quarterly drawdown of -16.5%. In addition, it posts negative three-month returns 67% of the time.

The Fundamental Gravity bottom line is that the economic data confirms that China is in a Fundamental Gravity #3 environment, and the government’s attempts to obfuscate this reality is just further evidence of the bearish trajectory of growth. Chinese equities don’t care for an FG3 environment: FXI typically averages a -4.4% quarterly return, with an average quarterly drawdown of -16.5%. In addition, it posts negative three-month returns 67% of the time.

Slowing Dragon and Shorting FXI Part 2

This Friday, October 12, we will release part 2 of this commentary, which is where we will dig in to the other two critical forces, or gravities, that are currently impacting Chinese equities: Quantitative and Behavioral. We will also provide a detailed game plan for trading FXI.

If you can’t wait the 48 hours to get the complete picture for this macro theme and the accompanying trade details, please email us at ClientServices@WhaleyGlobalResearch.com with the subject line “Slowing Dragon – Part 2.”

We will provide you with the complete macro theme breakdown as well as sign you up to participate in an eight-week free trial of our research offering, which consists of three weekly reports: Gravitational Edge, The 358, and The Weekender.