This decline today is perhaps the culmination of a series of selling on rallies for months. While interim rallies are likely, “circling the wagons” is the after-the-fact reaction by many traders, writes Gene Inger Wednesday.

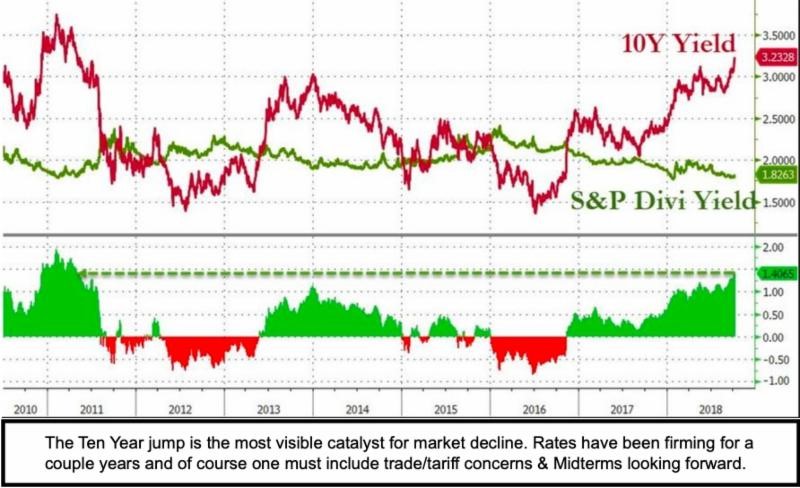

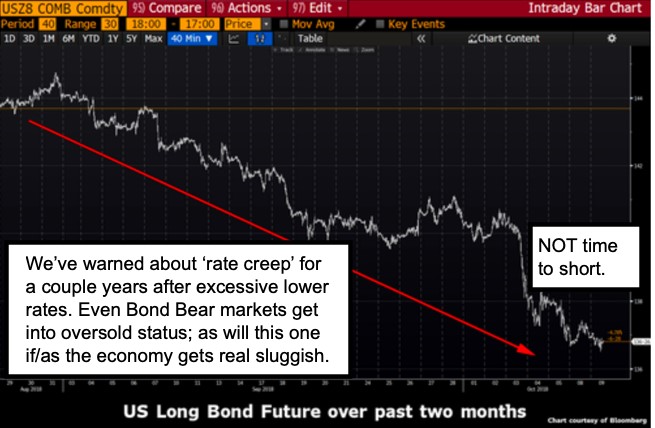

This market has been flirting with breaking supports after the Bond market reopened and while it’s a process, the overall downside should persist.

The 10-year Auction at 1 pm EDT today was of interest, to say the least. Chinese are a large holder and they probably won’t be a big seller; but not a big buyer. This is a topic I broached very recently, due to the spike in rates beyond what the Fed’s Funds hike in itself warranted.

Reuters: S&P 500 index falls 2% Wednesday as U.S. bond yields soar. Investors shun risk.

Regardless, all rallies should be ephemeral and continue to express concern about midterms too.

**

Lowered earnings guidance has been noted before relative to many of the major companies, especially those impacted by higher import costs. It is not so simple as issuing material warnings (from major companies). But they can also relate to supply chain issues besides labor costs and as noted, a bit of 'carry-cost' to maintain higher inventories than normal.

Hence for a slew of competitive companies, they likely have been building inventory at a faster clip, to avoid both tariffs and any supply-chain delivery issues, which for some of them aren’t usually key this time of year ahead of the holidays, given just-in-time inventory modern distribution modes.

**

You might see a reduction in rate pressures but also a slower economy and growth environment, such as the IMF’s forecast for the next year.

Of course, we all know that’s contingent on a China trade deal or not and perhaps how the midterms go. That latter issue alone has traders holding their “breadth” so to speak and is in line with our overall expression of concern we thought the market would have in October ahead of time.

This year is different for these obvious reasons, making it tough to dissect, or breakout, the longer-term implications of the material earnings warning series we’re starting to increasingly hear.