Our research team highlighted the recent breakdown in the Transportation Index (TRAN) as a very strong sign that the global economy and U.S. economy may be starting to show early signs of weakness, writes Chris Vermeulen of The Technical Traders.

The Transportation Index typically leads the markets by about 3 to 6 months (on average). When we see a big breakdown in the Transportation Index, as we've seen recently, it immediately raises red flags that one or more component of the global markets may be crashing. At this point in the seasonal cycle, one could expect the Transportation Index to rotate lower a bit.

Our concern is that global economic factors may be driving China and other markets into much deeper corrections – which could cause the U.S. and other world markets to correct a bit further.

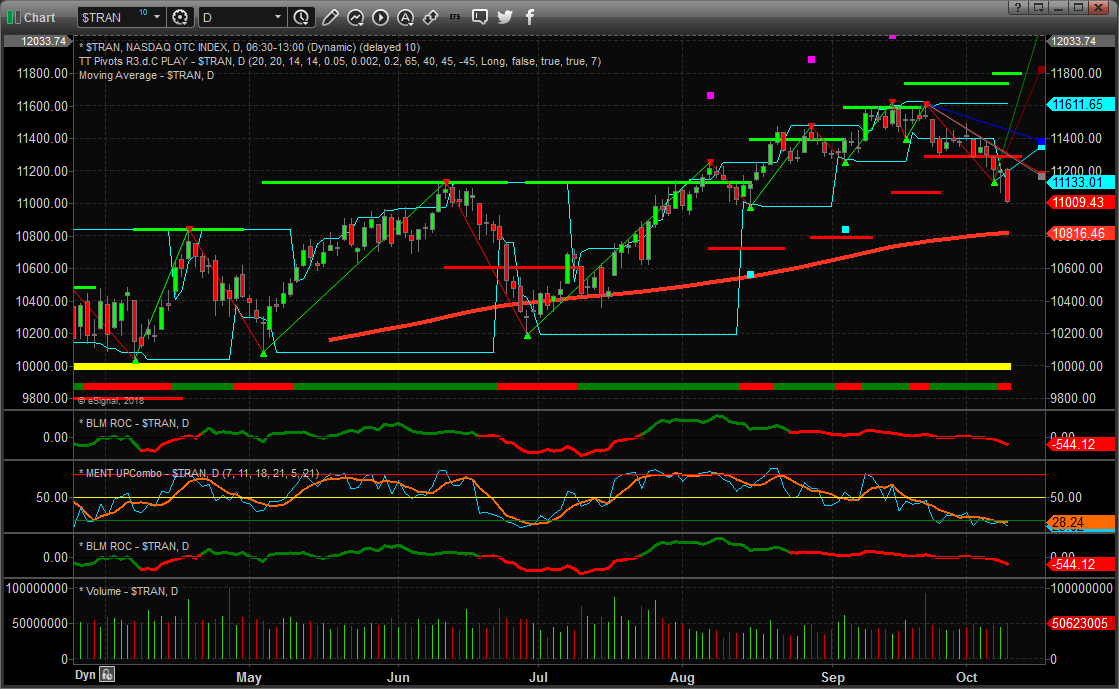

The recent price rotation is shown near the right side of this Daily Transportation Index clearly shows the recent downtrend and the current breakdown in price. This price breakdown cleared recent support near 11,290 and is currently resting near another support level near 10,980. Any further breakdown of the Transportation Index below the 10,980 level would suggest we could be looking at a very deep -10% to -15% price move.

Our research team will continue to monitor the Transportation Index, and all the other major U.S. and foreign markets, for additional signs of strength or weakness in the future. Right now, be prepared for what may become further price weakness in the U.S. indices as this breakdown in the Transportation Index suggests.

Visit www.TheTechnicalTraders.com to learn more about our services for skilled traders and to see how we can help you navigate these markets.