State of the market—U.S. stock indexes suffer their worst decline since February. Our model indicates that we should ride this out, writes Marvin Appel Thursday.

The S&P 500 SPDR ETF (SPY) lost 3.3% on Oct. 10 and as of this writing is down another 2% intra-day on Oct. 11. This brings SPY more than 6% below its Sept. 20 peak.

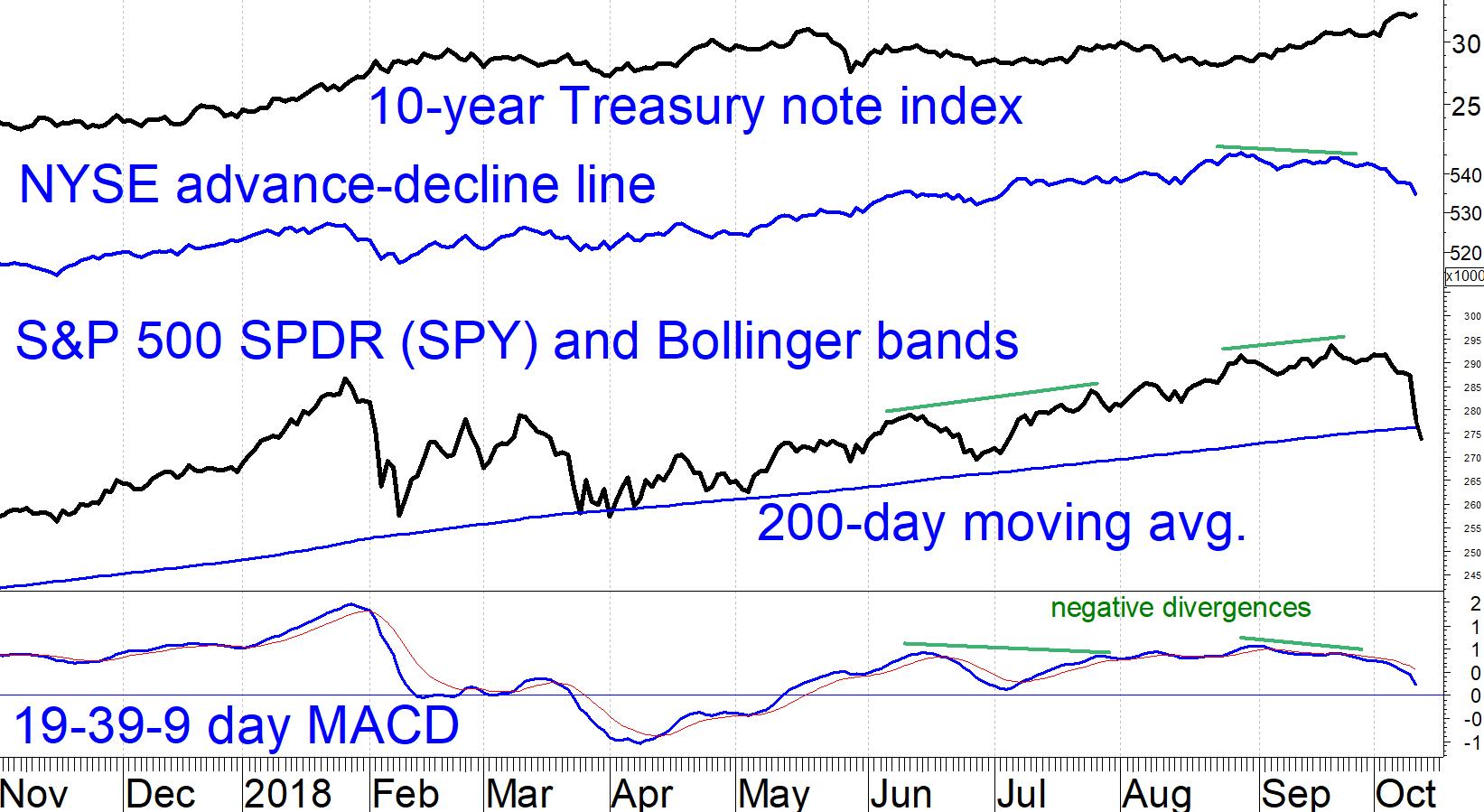

According to many commentators, this week’s sharp decline was triggered by the recent jump in interest rates which brought the yield on 10-year Treasury notes from 3.06 to 3.22% in just four days. This is the highest level of long-term interest rates since 2011. However, paradoxically, yields have stabilized during the stock market rout.

The chart below shows that the January-February market correction had a similar relation to the timing of interest rates to the current retracement: In both instances rates started climbing briskly one month before the beginning of a sharp correction.

This week’s decline brings SPY below its 200-day moving average. I expect it to find support shortly.

Our timing model, currently on a Buy, indicates that we should ride out the current market turbulence.

During Buy readings, the worst historical drawdown in the S&P 500 Index (SPX) has been 10%-11%, suggesting that even under a bad case scenario the current decline should be about 2/3 behind us.

If the current decline violates historical norms by extending beyond 11% then we will reduce our clients’ equity market exposure even in the presence of a Buy signal.

As always, we will remain vigilant and will update our newsletter subscribers promptly if our market outlook changes.

—Marvin Appel

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.

View a video interview with Marvin Appel and Dan Gramza on 2018 investing opportunities here.

Recorded: July 25, 2018 at TradersExpo Chicago.

Duration: 6:30.

View a video interview with Marvin Appel and John Bollinger on Bollinger Bands, when they are most useful for traders and about systematic investing pioneered by Dr. Appel and his father Gerald Appel here.

Recorded: July 25, 2018 at TradersExpo Chicago.

Duration: 4:31.