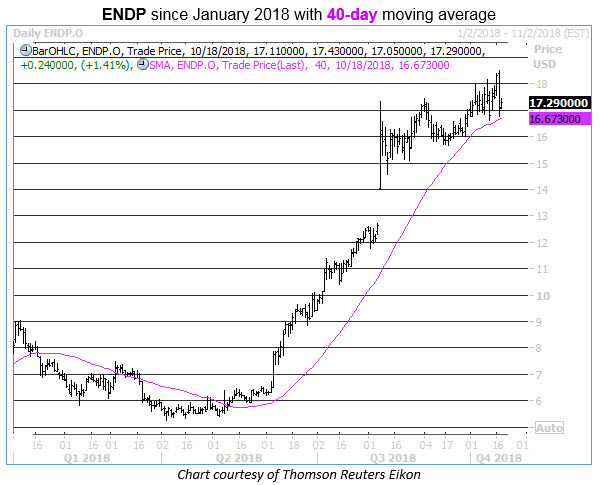

Endo International (ENDP) has been a 2018 standout performer on the charts. The Pennsylvania-based pharma name has more than doubled year-to-date, rising from its year-end 2017 close of $7.75 to its current price north of $17 per share, writes Elizabeth Harrow Thursday.

But with the stock throwing a fresh Buy signal this week -- and a surprising amount of skepticism still priced into ENDP shares – it’s not too late for bulls to join in on the uptrend.

As of Wednesday, Oct. 17, ENDP was trading within 2% of its 52-week high, at the same time that its Schaeffer’s Volatility Index (SVI) was docked in the low 18th percentile of its annual range. There has been just one other occasion since 2008 where ENDP stock has been trading so close to annual highs with short-term option implied volatility so low -- and the price action going forward was remarkable. One month after the previous signal, the shares were up 34.95%, according to Schaeffer’s Senior Quantitative Analyst Rocky White.

Following this latest signal, a combination of strong technical support and unwinding investor pessimism could propel ENDP on another impressive leg higher. The shares just pulled back to their 40-day moving average -- a former layer of resistance that now appears to have switched roles to provide support.

The company’s upcoming Q3 earnings report, scheduled for Nov. 8, could provide a key catalyst for another upside move. ENDP shares popped 28.3% after earnings on Aug. 8, and ENDP sports an average single-day move of 10.8% following its quarterly results, based on the past eight quarters of data (per Trade-Alert).

And short sellers could provide a major source of future buying pressure for ENDP. Quite a few bears have already been forced out of their losing bets, with short interest down nearly 9% over the last two reporting periods -- but short interest still accounts for a substantial 16.8% of ENDP’s float. At the equity’s average daily trading volume, that translates into 9.58 days of potential short-covering fuel.

The high-flying stock is deeply underappreciated by analysts, too. A dozen brokerage firms call ENDP a tepid Hold, compared to only five Buy ratings. Any upgrades from this group could draw buyers to the table.

Meanwhile, the stock’s low SVI rating -- which indicates that November option premiums are fairly modest, from a volatility perspective -- is backed up by a Schaeffer’s Volatility Scorecard of 91 (out of a possible 100). This high reading reveals that ENDP has regularly exceeded the volatility expectations priced into its options over the past year, making it an appealing target for option premium buyers.

As such, it’s a prime time for speculative players to consider a call trade on this pharma stock.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here