The branding is perfect: No lines, no checkouts, no registers. Retail is going people-less. Technology can replace cashiers, and companies are racing to get there first, writes Jon Markman, who’s presenting at TradersExpo on Wednesday. Consider Impinj.

The trend began with Amazon.com (AMZN). Bloomberg reported in September that the ecommerce giant might open 3,000 cashier-less “Amazon Go” convenience stores by 2021.

And Amazon has been setting trends since Jeff Bezos, founder and chief executive officer, moved his family from New York to Seattle to start the company. With outsized investments in data centers, servers and infrastructure software, he transformed an e-commerce idea into a behemoth. Then, in 2012, he arranged for the acquisition of Kiva Systems, a warehouse robotics company.

The $775 million purchase was audacious. It set retail fulfillment on its head. Suitcase-sized Kiva robots brought the product to order-pickers, saving time and ultimately boatloads of money. By 2016, Dave Clark, an Amazon executive, said the zippy orange bots saved the company roughly $22 million in every warehouse they were deployed.

In typical Amazon fashion, the company began racing to install Kivas everywhere.

Related post: Amazon’s misunderstood minimum-wage hike yields opportunity

There is an eerie similarity with its Amazon Go plans. Most of the media focus has been on artificial intelligence and privacy. But this is myopic.

Rather, Amazon is training its customers to self-serve. It is purposefully removing every friction point. More often than not, this means removing people.

The trend is growing. 7-Eleven, the Japanese-owned convenience store leader, recently began testing “pay and go” technology at 14 Dallas stores. While the trial is tiny, the Slurpee king has more than 67,000 locations, so the path is important. Patrons will be able to buy coffee, muffins, beer and beef jerky on their smartphones, avoiding lines and checkouts.

Across town, Walmart (WMT) is set to begin its cashier-free journey. The company announced in late October that a Dallas-area Sam’s Club would allow customers to scan and go, bypassing store cashiers with its smartphone app. Sam’s will even throw in one-hour pickup. No more trudging around the store.

The trend is clear. Retailers are pushing the idea that having fewer interactions with staff is a convenience, preferable even.

The jury is out on this, by the way. Apple (AAPL) is arguably the most successful retailer in the world. Its stores are teeming with cheerful sales helpers. The same is true for Sephora, the makeup selling powerhouse that has turbocharged results at its parent, LVMH Holdings.

Impinj (PI) is a small, nimble maker of ultrahigh frequency radio solutions, or RFIDs. Its digital tags, readers, gateways and enterprise management software help retailers track every item in their supply chain in real time, everywhere, including checkout.

RFID systems have been the “next big thing” for ages. For most of that time, 18 long years, Impinj has been doing the heavy lifting — gathering patents and building alliances.

Until recently, RFID tags were too costly. Or they simply offered too few benefits over the barcode system the retail industry reluctantly adopted.

But true digital is the game-changer.

To compete with Amazon, companies need inventory intelligence and customer analytics.

And with RFID doing the checkout, retailers can devote all of their human capital to service. Customers who come to stores tend to price compare less and spend more due to impulse and experiential purchases. That’s the code Apple and Sephora have cracked. They understand better retailing is about customer service, and knowledgeable humans can be very helpful.

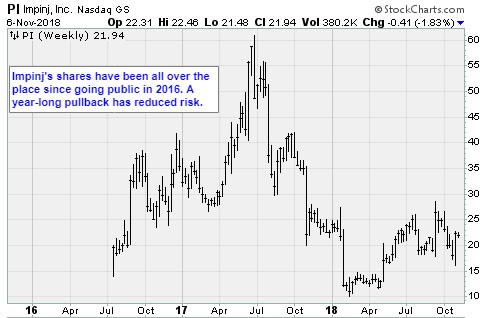

Impinj has impressive technology. It also has a long history of solid sales growth. Even in a rough retail environment, revenues grew 11.6% in 2017 to $125 million. That is still pretty small, and the company is still losing money. However, the retail industry is at the beginning of the cashier-free movement.

The market capitalization is only $457 million. Long-term speculators should consider buying the stock around current levels. Friction-free retailing is going to be a game changer for Impinj.

Best wishes,

Jon D. Markman

P.S. Bitcoin and Ethereum currently score a “C+” grade, or “Hold,” on the Weiss Cryptocurrency Ratings scale. To see which cryptocurrencies score higher marks (and a “Buy” grade from our crypto research team), check out this blog post: “4 ‘Buy’ Rated Cryptocurrencies; 5 Questions About Weiss Crypto Ratings”

Subscribe to Jon Markman’s Power Elite newsletter here

Subscribe to Jon Markman’s Tech Trend Trader here

Subscribe to Jon Markman’s Strategic Advantage here

View these MoneyShow videos featuring Jon Markman.

My sectors for a bear market: growth stocks, technology, healthcare.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:34.

How to profit now from robotics, autonomous cars, AI and the cloud.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 37:31.

Jon Markman: Stock Picks in Industrial Tech, Video Games.

At MoneyShow Dallas, Jon Markman picks in industrial tech include Lockheed Martin and Northrop Grumman. And another part of tech: video gaming: Electronic Arts, Take-Two, Activision Blizzard.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 6:15.

Jon Markman: Self-driving cars offer surprise investing ideas.

At MoneyShow Dallas, Jon Markman shares tech stock ideas with Neil George of Profitable Investing. What's ahead in self-driving cars, a lot of spin-off positives for investors. A commuter cocktail?

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 2:24.

Jon Markman's 5 tech stock picks, in a short video.

Picks: GOOG, AMZN, MSFT. Companies turning the hardware of the cloud into software: Arista Networks (ANET), Nutanix (NTNX).

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 5:13.

Jon Markman: S&P 3300, Tech, Healthcare Picks

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:33.

Jon Markman: What can end the Bull Market?

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 1:58