Bits & Bytes: as with previous wireless leaps, routers and hotspots are just a probe ahead of a main force in next-generation networks. AT&T (T) will start selling Netgear (NTGR) Nighthawk 5G Mobile Hotspots (used in fixed wireless) this year, writes Gene Inger Monday.

By this time next year, without waiting for robust network deployment (to ensure reliability), most smartphone makers will release their own versions for specific carriers. (It’s not quite like the old GSM/CDMA battles but some will be tweaked to ideally run on the network it’s intended for.)

Verizon (VZ) and AT&T are starting 5G in several cities now but won’t fire them up for customers until limited service late this year. For now, those will only be accessible by the fixed wireless routers/hotspots.

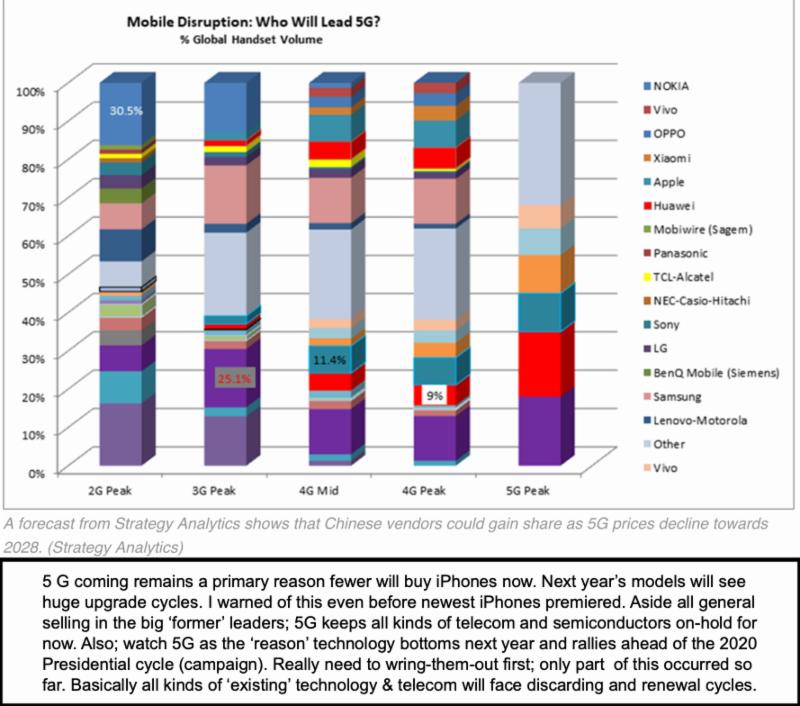

Other than the Lenovo (LNVGY) accessory, real 5G smartphones will begin hitting the market next year from Samsung, LG, OnePlus, Huawei, ZTE (ZTCOF).

Yes, all this favors China and South Korea leads in products and other manufacturers that use the Qualcomm (QCOM) 5G modem.

**

Apple (AAPL) will follow with the Intel (INTC) 5G inside.* The asterisk reflects a rumor from one good source to the effect that Apple may not enable 5G on the Fall 2019 iPhone.

I have stated for months that while Apple will do fine, the real upgrade will be when 5G joins the lineup (either premium models or across the board).

I also point out that China can make one that’s similar to a Galaxy 9 (made in Vietnam often by the way) for about $200 using Google (GOOGL) Android software.

**

I also have pointed out how China won’t allow the two most popular iPhone apps for the important realms of chat and payment. Plus, China demands access to iCloud of Chinese customers, a disincentive to spring for the higher cost of iPhones (the so-called Apple tax) by Chinese buyers.

**

Finally, I understand that Samsung Electronics (SSNLF) will release the first Galaxy 10 with 5G in South Korea in March. Then LG (LPL) follows with release of a model with 5G for Sprint (S) sometime in 2019s first half. Does that mean T-Mobile (TMUS) too?

**

I believe the Intel 8161 (a variation of the 8160 modem) supports 5G. So why would Apple delay? It sure won’t help bragging rights.

But Apple never cared a lot about that. It means Apple doesn’t want to overwhelm networks, which 100 million 5G iPhones would do.

It is possible (stay tuned) that it will be released only with one carrier supporting it. At this time a guess would be AT&T since a relationship exists starting with the very first iPhone (AT&T only that year).

If there is no 5G iPhone while others have it, Apple shares won’t be thrilled. Intel will appear to lag Qualcomm. At the same time AT&T would be compelled to promote other products as it will be fairly robust with a 5G network rolled-out pretty widely in the USA a year from now.

**

Finally, there’s a bigger battle looming in wireless that isn’t even noticed yet by most: it’s called C-V2X. It’s cellular-based and it competes with WiFi for road integration or safety controls.

Organizations that have invested in Wi-Fi technology since 2010 would prefer cellular technologies take a back seat so they can protect their investments.

However, BMW, Qualcomm and just a few leaders believe it would be a shame if the vested interests of the few prevented new technologies emerging which would benefit the many.

The fight is looming initially in Europe as the EU/EC is pushing for WiFi as a control. It’s not even compatible with cellular, whereas China and most Asian manufacturers are testing and moving to C-V2X. Compatibility and of course interactivity matters. C-V2X plays very well with 5G networks too.

In-sum: these market conditions have prevailed for months, which is why I urged a normal investor to use rallies for selling, not buying (other than scalping) for virtually this entire year, and properly so.

The major companies aren’t really growing as proclaimed, and the discretionary consumption isn’t so robust, and hasn’t been, despite arguments to the contrary by officials and pundits.

Good moves come to an end and lead to the next opportunity for those who are properly positioned (with increased liquidity).

Tailwinds are now serious headwinds, and there generally is not yet the buy-the-dips signs. Though for sure we’re watching for that to unfold in the fullness of time.