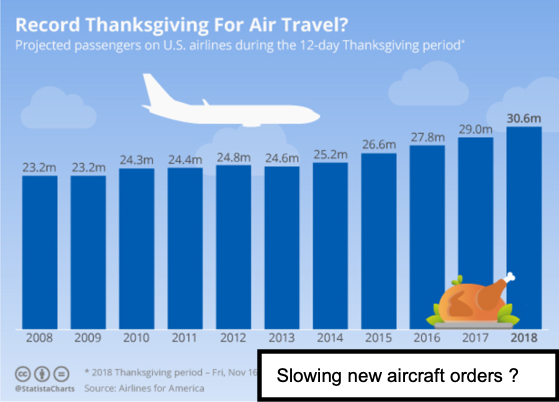

Durable orders, even aside Transportation (DJT), which means Boeing (BA), was miserable and reflects great hesitancy as regards CapEx. That indirectly ties into the corporate debt concerns which generally roll-out next year. Be wary, writes Gene Inger Wednesday.

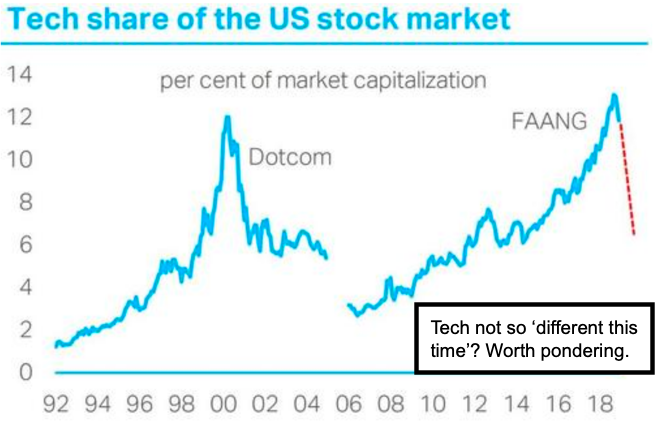

Financial media is focused on retail and short-term holiday-related features (or people not wanting to panic). When in reality, the corrections have been rolling for many months now. And hence what they don’t want to hone-in-on is the technical concern.

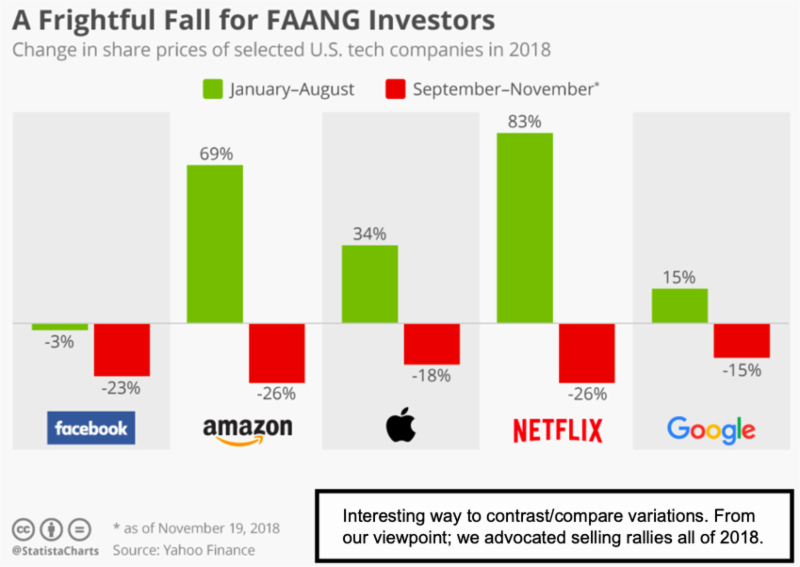

That is, the market merely trying to hold a secondary test of the end-October washout lows. That really is all this effort to bounce is about; because FAANG-led NASDAQ (FNGU) is already below that prior low and trying to rally back to that point, with prospects limited of doing better than that.

So, remain wary.

Reuters: Wall Street regains footing Wednesday as tech shares recover from two-day selloff.

**

Persistent probing postponed - panicky peddling pressures preceding what should be a capitulation.

Every rebound postpones that reckoning.

**

So long as they keep buying weakness and talking of FAANG (and others) as if there was any important low, it reduces the odds of there being such lows aside perhaps seasonal rebounds (barring a China deal).

**

Goldman Sachs (GS) turned negative on the market at the opening Tuesday. It’s a factor that combined with margin calls from the previous day to weigh on the market heavily in the early going.