Energy stocks have taken a big hit during the recent rout in oil prices. One that has taken a bruising hit is Rowan Companies. Shares of the offshore driller down 29% from its Oct. 9 nearly two-year high of $20.87 to trade at $14.24 Monday, writes Karee Venema.

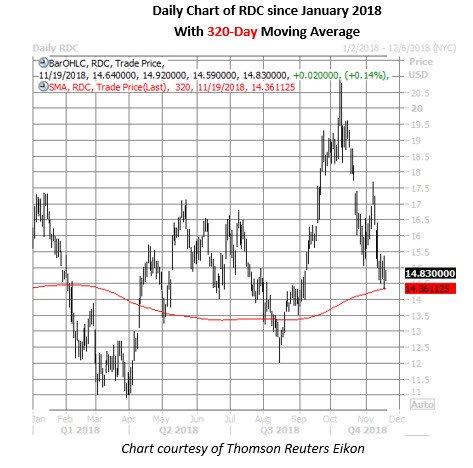

However, Texas-based RDC is now trading near a trendline that’s marked attractive entry points in the past, suggesting it could be time to buy the dip on the oil stock.

Specifically, Rowan stock is trading within one standard deviation of its 320-day moving average after trading above it 60% of the time over the past two months -- and in eight of the last 10 trading days.

According to Schaeffer’s Senior Quantitative Analyst Rocky White, there have been four other times since 2015 this signal has flashed, translating into an average one-month gain of 10.9%.

On the sentiment front, short interest has been cut in half since topping out at a year-to-date peak of 19.8 million shares in mid-April. The 9.34 million RDC shares currently sold short represent 7.5% of the stock’s available float, or 2.4 times the average daily pace of trading.

Analysts, meanwhile, are mixed toward the oil stock. While eight of 14 maintain Hold or Strong Sell, the average 12-month price target of $19.78 is a 33.2% premium to current trading levels.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here.

Todd Salamone of Schaeffer’s Investment Research: How to trade options like the pros in a webinar here.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 49:23.