A year ago, the idea that bitcoin (BTC-USD) and cryptocurrencies were going to change the world was becoming the consensus opinion. Today, not so much. Microsoft (MSFT) was an early convert to blockchain, a play for investors and traders, writes Jon Markman.

The digital currency fell to $3625 Nov. 25, bouncing to $4300 Nov. 28, off its high near $20,000 in January. Other cryptos are collapsing, too.

There is a catalyst. People who follow digital tokens blame the hard fork of bitcoin Cash. The smaller, namesake cryptocurrency is itself a fork of bitcoin proper. But last week, its developers and miners could not agree on the future of the digital token. So, they decided to split into two competing cryptos, bitcoin ABC and bitcoin Satoshi’s Vision (SV).

If that seems like an inherently bad idea, it is. Bitcoin is an open source project. Developers are free to duplicate the base code and create cryptocurrencies at will. And they have. As of November 2018, there are 2,502 cryptocurrencies, according to a list compiled at Investing.com. The cumulative market capitalization of these tokens is $142 billion, although it had been much higher.

**

Watch Jon Markman’s presentation: How to crush the post-IPO trade for emerging Tech companies here. My top 7 picks now.

Recorded: TradersExpo Las Vegas, Nov. 14, 2018.

Duration: 51:17

**

Forgive me. I’m burying the lede. The problem with bitcoin, and cryptocurrency in general, is not forking. It’s that developers should not be able to create currency, at all.

I began writing in January that cryptocurrencies were where the internet was in the dot-com era, and in February that most of these thousands of cryptos were headed to zero. At the time, it was not a popular position. I prefaced my view on two things every potential investor needs to understand about “me too” digital coins: There is no use case, and worse, it’s unlikely they will ever represent a store of value.

Keep in mind, many things can represent a store of value. Collectibles like art, baseball cards and signed memorabilia immediately come to mind. Cryptocurrencies, at least the vast majority of them, will never be that.

Bill Harris, a former chief executive officer at PayPal (PYPL), made headlines in August when he wrote at Recode: “OK, I’ll say it: bitcoin is a scam.”

Harris argues bitcoin is a pump-and-dump scheme, where promoters push up the value of dubious investments with hype and relentless advocacy. As the price surges and enthusiasm is greatest, they dump everything, leaving unsuspecting investors holding worthless securities.

Admittedly, I have made this case about so-called alternative coins. Investing in an Initial Coin Offering is like speculating in a highly promoted junior gold mining company where the prospect of finding actual gold is nil. There will be price volatility and plenty of promises made. But in the end, the investment is worthless. And it was always going to be worthless.

But Harris is conflating bitcoin with alternative coins. That is a mistake, I believe.

A pure digital currency is a good idea. It takes power away from central authority. The problem is oversupply. There are currently too many coins and too many charlatans.

This will pass. The Securities and Exchange Commission will round up the fraudsters. Their fake investment premises will lead to a great reckoning. Most ICOs will go to zero because they will be unable to pass the test of legitimate government oversight.

That could leave bitcoin as one of the last digital coins standing. When that happens, my guess is it will ultimately be more valuable than it is today. However, there is plenty of pain ahead as pump-and-dump schemes are uncovered, and most coins collapse — souring the mood for all their peers.

The play for stock investors is blockchain, bitcoin’s cryptographic infrastructure …

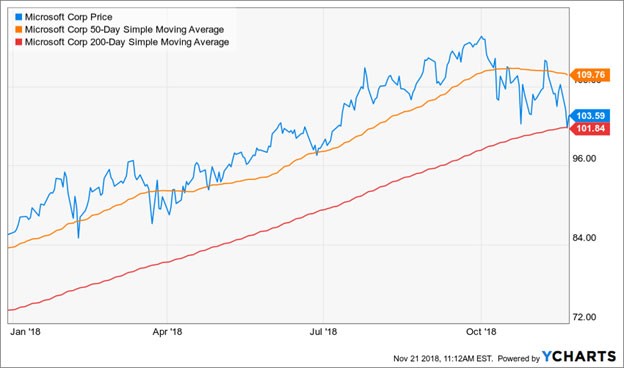

The markets shed their 2018 gains early this week. But not Microsoft, which is still up 21.5% year-to-date as it builds blockchain services into its offerings.

Ultimately, this digital ledger system is going to find its way into global supply chains and financial services because it systematically removes middling trusted agents for verification.

Blockchain will make legions of accountants, lawyers and back office personnel redundant.

IDC, a global information technology research firm, sees blockchain as part of a larger digital transformation. The shift could be worth $7 trillion by 2022.

Microsoft (MSFT) was an early convert to the power of blockchain. It began working with financial services start-ups in 2016. More recently, the Redmond, Wash., software giant has been touting the scalability of its Azure cloud computing platform to run ledger systems. The company is even working on a blockchain-as-a-service tool.

Shares trade at 20x forward earnings. The market capitalization has come down to $780 billion in the last leg of the tech wreck, then it recovered and surpassed Apple (AAPL) Nov. 27. The stock would be a great pickup in the low $90s. It was $110 Wednesday.

Related: Apple Trumped, then Microsoft flies by. Time to discount iPhones, writes Gene Inger.

Related: Microsoft's stock market value pulls ahead of Apple's Nov. 28, Reuters reports.

Best wishes,

Jon D. Markman

P.S. Speaking of investing in collectibles, investors can now take a stake in priceless artwork, real estate and other illiquid assets, thanks to the blockchain technology that underlies cryptocurrencies. Read about this “tokenization” of assets into more-affordable increments here.

View these MoneyShow videos featuring Jon Markman.

My sectors for a bear market: growth stocks, technology, healthcare.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:34.

How to profit now from robotics, autonomous cars, AI and the cloud.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 37:31.

Jon Markman: Stock Picks in Industrial Tech, Video Games.

At MoneyShow Dallas, Jon Markman picks in industrial tech include Lockheed Martin and Northrop Grumman. And another part of tech: video gaming: Electronic Arts, Take-Two, Activision Blizzard.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 6:15.

Jon Markman: Self-driving cars offer surprise investing ideas.

At MoneyShow Dallas, Jon Markman shares tech stock ideas with Neil George of Profitable Investing. What's ahead in self-driving cars, a lot of spin-off positives for investors. A commuter cocktail?

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 2:24.

Jon Markman's 5 tech stock picks, in a short video.

Picks: GOOG, AMZN, MSFT. Companies turning the hardware of the cloud into software: Arista Networks (ANET), Nutanix (NTNX).

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 5:13.

Jon Markman: S&P 3300, Tech, Healthcare Picks

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:33.

Jon Markman: What can end the Bull Market?

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 1:58