Content delivery specialist Akamai Technologies (AKAM) has been trending lower since its June peak around the $83 level. The stock has generally found support in 2018 around the site of its year-to-date breakeven mark of $65.04, writes Elizabeth Harrow Thursday.

Widespread market volatility in February and October pushed AKAM shares as far south as the $61 level.

Now, based on a reliable technical sell signal -- and a surprising lack of bearish sentiment toward the struggling tech stock -- it looks as though AKAM is on the verge of another leg lower.

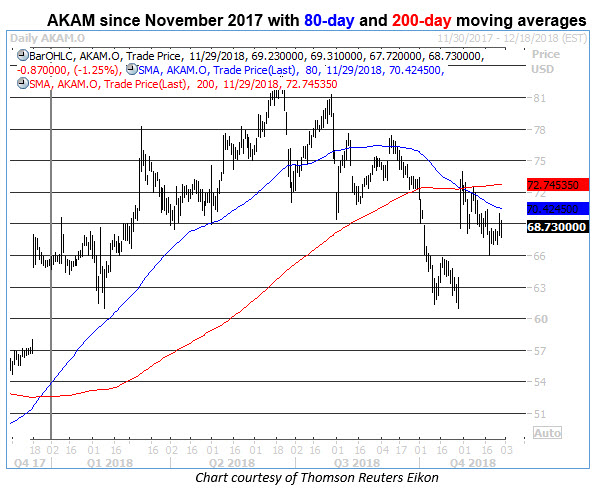

Specifically, AKAM just rallied up to within one standard deviation of its 80-day moving average, following a prolonged period of trading below this trendline (defined as 60% of the time over the past two months, and eight of the last 10 sessions).

According to Schaeffer's Senior Quantitative Analyst Rocky White, there have been eight previous 80-day sell signals for AKAM over the last three years. Following those prior instances, the stock was down 2.3% five days later, on average. By the 21-day mark after a signal, AKAM's average return had widened to a loss of 4.9%, with only 43% of the returns positive.

The 80-day moving average served as support for Akamai stock earlier this year, but more recently emerged as a steeply descending technical ceiling. Likewise, AKAM fell sharply in October after a close below its 200-day moving average, and the stock's attempt to reclaim this benchmark trendline was firmly rejected in early November.

As the stock teeters on thin technical ice, AKAM looks particularly vulnerable to bearish analyst notes. There are eight Strong Buy ratings on the stock, compared to five Hold ratings and zero Sell ratings. This upbeat configuration leaves plenty of room for future downgrades, which could spark fresh selling pressure on the shares.

Options traders, like analysts, are surprisingly optimistic toward the declining tech name. Trade-Alert data shows total call open interest on AKAM at 42,235 contracts, in the average 54th annual percentile; meanwhile, put open interest is in the extremely low 9th percentile of its annual range, with only 18,245 contracts in open interest. In other words, it seems that very few options traders are betting on AKAM to extend the bout of technical weakness that’s shaved about 17% off its value in the last five months.

Traders looking to capitalize on AKAM’s latest short-term sell signal may want to consider the stock’s December-dated options.

The equity’s Schaeffer's Volatility Index (SVI) stands at 30%, which arrives in the modest 20th percentile of its annual range. This means that front-month options have priced in lower implied volatility expectations only 20% of the time during the past year -- allowing put option buyers to maximize their leverage on a downside move in the stock price over the coming weeks.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here

Todd Salamone of Schaeffer’s Investment Research: How to trade options like the pros in a webinar here.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 49:23.