Wednesday was a defensive finish. U.S. stocks declined sharply after the Fed’s forecast of fewer interest rate increases disappointed the markets, writes Gene Inger. He’s presenting at MoneyShow Orlando.

Synchronized Quantitative Tightening really has been behind monetary policy stances. and as pointed-out for some time, this means far more than the ongoing squabble as to whether the Fed passing or hiking this go-round is going to be restrictive or stimulative towards the idea of forward growth.

Reuters: US stocks tumble Wednesday on Fed tightening plans.

**

Tuesday action included crushing Micron (MU) and FedEx (FDX) after-the-close. (Someone knew something it seems, as the S&P got kicked-on-the-bell. And the futures more, as they still trade until 4:15 ET). That action affirms what kind of market jitters prevail. It is valid to say that they both undershot what the Street was looking for.

Market coverage: FedEx slashes forecast, stock price drops Tuesday.

**

A word or two about the new Wired article that discusses Luminar (not public), which is a colleague of LightPath Technologies (LPTH) This relates to the high-resolution capability that I suspect has its roots both in the algorithms and perhaps infrared high-resolution lenses from LightPath, though I can’t confirm that.

Of course, LPTH is a stock that has been under pressure due to lack of profitability caused by relocation expenses of a temporary nature, which is why we speculate about recovery next year but there are variables of course.

**

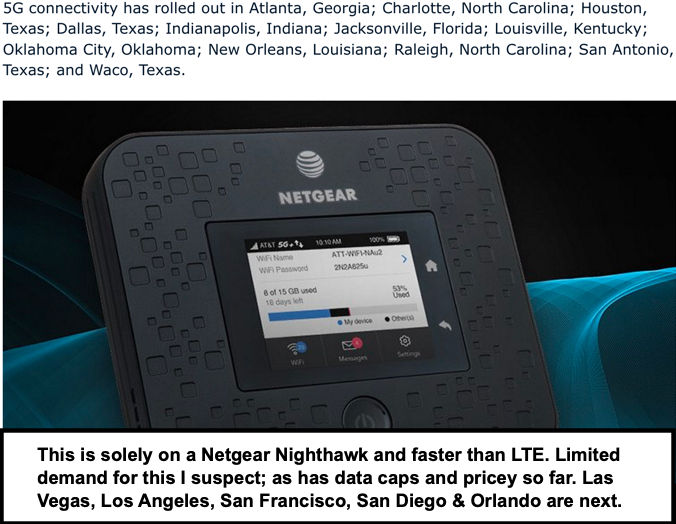

Tuesday night, you had some nervously warning that 5G cellular has more vulnerability to cyberattacks. That depends on how one distributes it as well as the software (and hardware) security issues on receiving devices of course. (Generally, iOS is more secure than Android for instance, but global distribution of Android is greater, hence more security compromise issues.)

It is the 5G networks that some are concerned about. And yes most gear for 5G is made in Europe or China, some of it using LightPath optics (from their two Chinese factories. with telecom no more than 10% of their total revenue and actually improving after languishing during the last year of 4G, which nobody wanted to invest money in upgrading infrastructure).

**

So many more things will be connected or associated with 5G that general vulnerabilities out there don’t just relate to gear suppliers but the extensive and rising utilization.

That should mean at least more opportunity for nefarious efforts to hack or penetrate networks (on a larger scale). Just like consumers who fail to have passwords for their thermostats, light switches or digital video doorbells.

So oddly many companies making the 5G equipment indeed will profit big-time, while most carriers and end-user applications will have to enhance security (and not allow systems to be activated without security) as this unfolds.

That also helps cybersecurity and related cloud business as well as security related to everything from modems to autonomous driving (AI and AR too) systems.

Actually, it’s an enormous transition time coming with lots of interesting investments, not just risks, looming on the horizon.

**

I warned about stocks like Amazon (AMZN) not just dropping but possibly being cut-in-half (or something like that) over a period of time from the highs, not from these partially-corrected levels.

So, a lot of these are in the S&P. and the market counts on Amazon and Apple (AAPL) and the Google (GOOG) of the world. they were core to this market.

A handful of others won’t hold it together. So much of my forecast 2017 rally was based on profits enhanced by taxes. But with growth outlooks changing, that’s how I came up with not just a crash call to scale-out on rallies but S&P measures of 2300-2400 while many euphorically were calling for 3000.

Candidly I said then and may find it too optimistic for the S&P, because of disintermediation and other reduced prospects.

Stay tuned.