Housing data has remained gloomy, with single-family housing starts down 13% in November on a year-over-year basis, while building permits dropped 2%. Consider call options on home builder TOL, writes Elizabeth Harrow Thursday.

Not surprisingly, the National Association of Home Builders/Wells Fargo Homebuilder Sentiment Index also cratered, falling 4 points this month to 56 -- its lowest reading since May 2015.

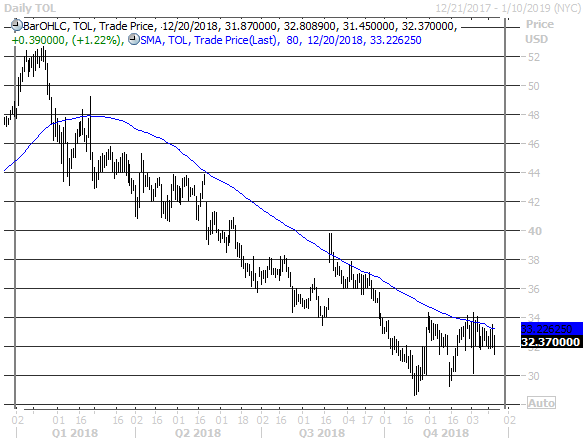

Against this dismal fundamental backdrop, the downtrend that has taken shape on the daily chart of Toll Brothers (TOL) in 2018 is nearly textbook in nature.

The stock is down 32.6% year-to-date, and since late January, TOL's steady decline has been highlighted by the firm resistance of its 80-day moving average. And prospective bears should note that the equity's recent rally up to this trendline provides a prime opportunity to speculate on TOL's next leg lower.

Specifically, Schaeffer's Senior Quantitative Analyst Rocky White reports that TOL has risen to trade within one standard deviation of its 80-day moving average after a prolonged period below it, and there have been seven prior such signals over the past three years. Following those previous tests of resistance at the 80-day trendline, TOL's average return 21 days later was a loss of 3.32%, with only 17% of the returns positive.

Despite the broadly negative price action in Toll Brothers shares, options traders have loaded up on call options. Trade-Alert tallies total call open interest of 29,499 contracts, which registers in the 91st percentile of its annual range -- a heavier-than-usual supply of bullishly oriented options. Meanwhile, total put open interest of 34,356 contracts arrives in the tamer 77th annual percentile.

Meanwhile, very few shorts are betting on additional downside, either. Following a slim 1.1% increase during the most recent reporting period, short interest accounts for a relatively modest 5.5% of TOL's float, or just 2 times its average daily trading volume. With plenty of room for these bearish bets to grow, increased short-selling activity could help to push TOL lower in the weeks ahead.

Unsurprisingly, very few analysts recommend buying Toll Brothers stock -- but then again, very few recommend selling it, either. The shares have garnered seven Hold ratings, along with two Strong Buy ratings and one Strong Sell. With an average 12-month price target of $38 -- a price point that acted as resistance earlier this year and is now 17.7% above TOL's current perch – there’s still room for downgrades or price-target cuts to spark additional selling pressure.

Those looking to capitalize on another downside move in TOL may want to target the stock's weekly 1/25 option series, which carries a slightly lower 38.25% at-the-money implied volatility level relative to the 39.39% level in the standard January 2019 monthly series.

TOL since December 2017 with 80-day moving average

Chart courtesy of Thomson Reuters Eikon

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here

Todd Salamone of Schaeffer’s Investment Research: How to trade options like the pros in a webinar here.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 49:23.